Fort Capital Investment Banking Pitch Book

Sensitivity Analysis

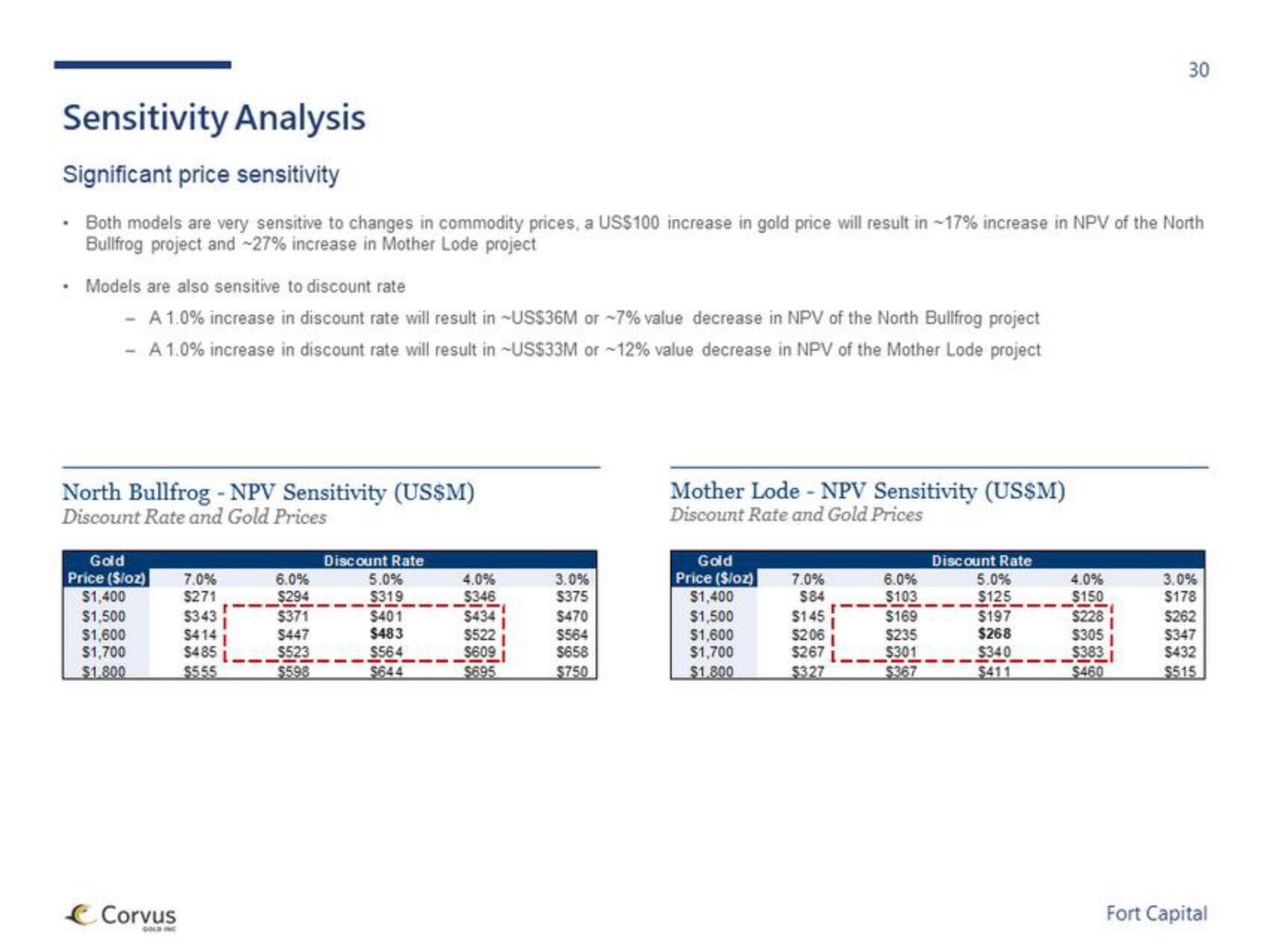

Significant price sensitivity

• Both models are very sensitive to changes in commodity prices, a US$100 increase in gold price will result in ~17% increase in NPV of the North

Bullfrog project and -27% increase in Mother Lode project

Models are also sensitive to discount rate

A 1.0% increase in discount rate will result in US$36M or -7% value decrease in NPV of the North Bullfrog project

A 1.0% increase in discount rate will result in -US$33M or -12% value decrease in NPV of the Mother Lode project

-

North Bullfrog - NPV Sensitivity (US$M)

Discount Rate and Gold Prices

Gold

Price ($/oz) 7.0%

$271

$1,400

$1,500

$1,600

$1,700

$1.800

Corvus

$343

$414

$485

$5.55

T

6.0%

$294

$371

$447

$523

$598

Discount Rate

5.0%

$319

--

$401

$483

$564

$644

4.0%

$346

--

$434

$522

$609

$695

I

3.0%

$375

$470

$564

$658

$750

Mother Lode - NPV Sensitivity (US$M)

Discount Rate and Gold Prices

Gold

Price ($/oz)

$1,400

$1,500

$1,600

$1,700

$1.800

7.0%

$84

$145

$206

$267

$327

I

I

6.0%

$103

$169

$235

$301

$367

Discount Rate

5.0%

$125

11

$197

$268

$340

$411

4.0%

$150

C

$228

--

30

$305

$383

$460

3.0%

$178

$262

$347

$432

$515

Fort CapitalView entire presentation