MoneyLion Results Presentation Deck

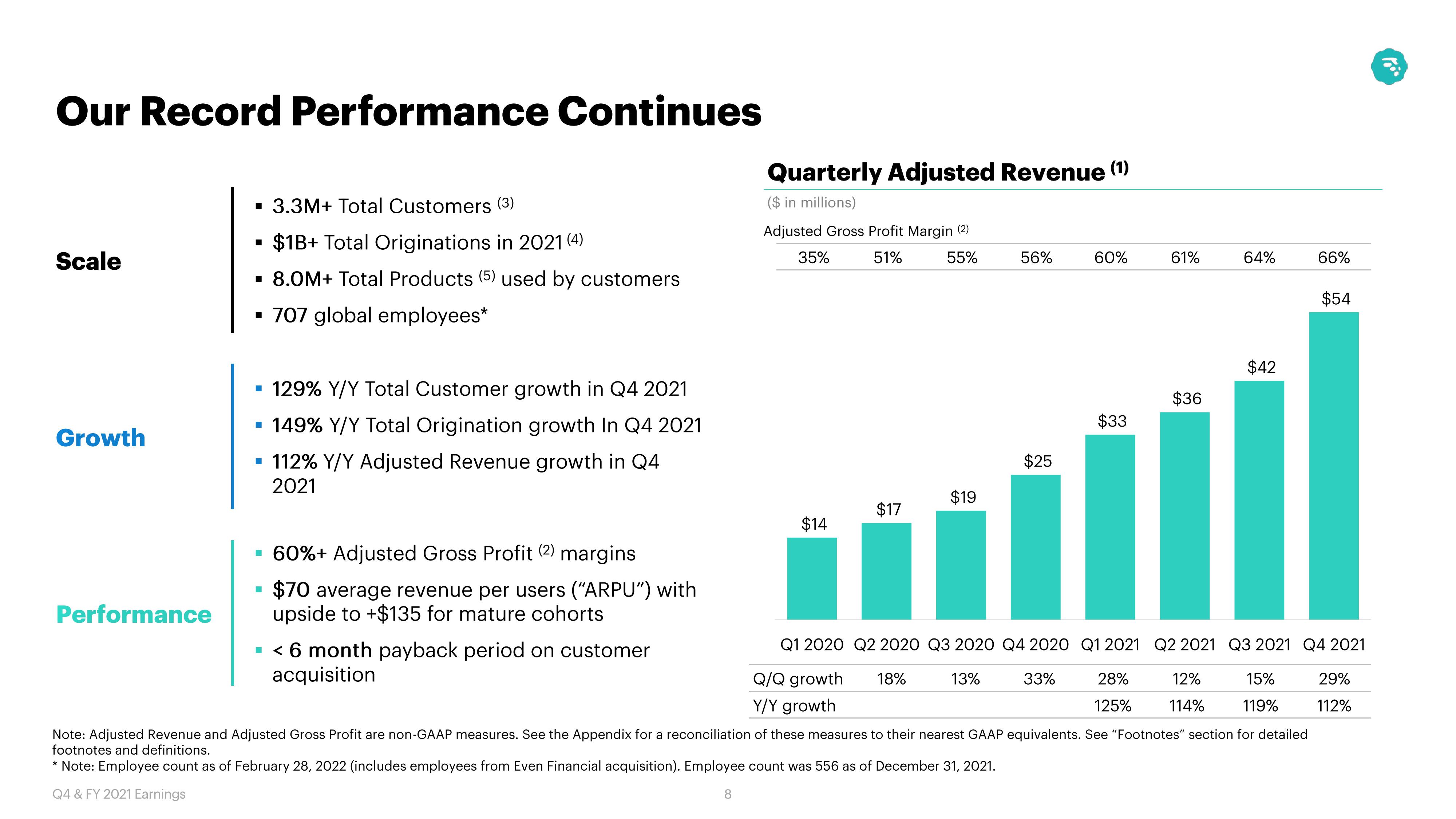

Our Record Performance Continues

Scale

Growth

Performance

▪ 3.3M+ Total Customers (3)

■

O $1B+ Total Originations in 2021 (4)

▪ 8.0M+ Total Products (5) used by customers

▪ 707 global employees*

▪ 129% Y/Y Total Customer growth in Q4 2021

▪ 149% Y/Y Total Origination growth In Q4 2021

▪ 112% Y/Y Adjusted Revenue growth in Q4

2021

▪ 60%+ Adjusted Gross Profit (2) margins

$70 average revenue per users ("ARPU") with

upside to +$135 for mature cohorts

■

Quarterly Adjusted Revenue (1)

($ in millions)

▪ < 6 month payback period on customer

acquisition

Adjusted Gross Profit Margin (2)

35%

51%

55%

$14

$17

$19

56%

13%

$25

60%

33%

$33

61%

$36

Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021

Q/Q growth 18%

28%

Y/Y growth

125%

Note: Adjusted Revenue and Adjusted Gross Profit are non-GAAP measures. See the Appendix for a reconciliation of these measures to their nearest GAAP equivalents. See "Footnotes" section for detailed

footnotes and definitions.

* Note: Employee count as of February 28, 2022 (includes employees from Even Financial acquisition). Employee count was 556 as of December 31, 2021.

Q4 & FY 2021 Earnings

8

64%

$42

12%

114%

66%

Q2 2021 Q3 2021 Q4 2021

15%

119%

$54

29%

112%View entire presentation