Lazard Investor Presentation Deck

INVESTOR PRESENTATION

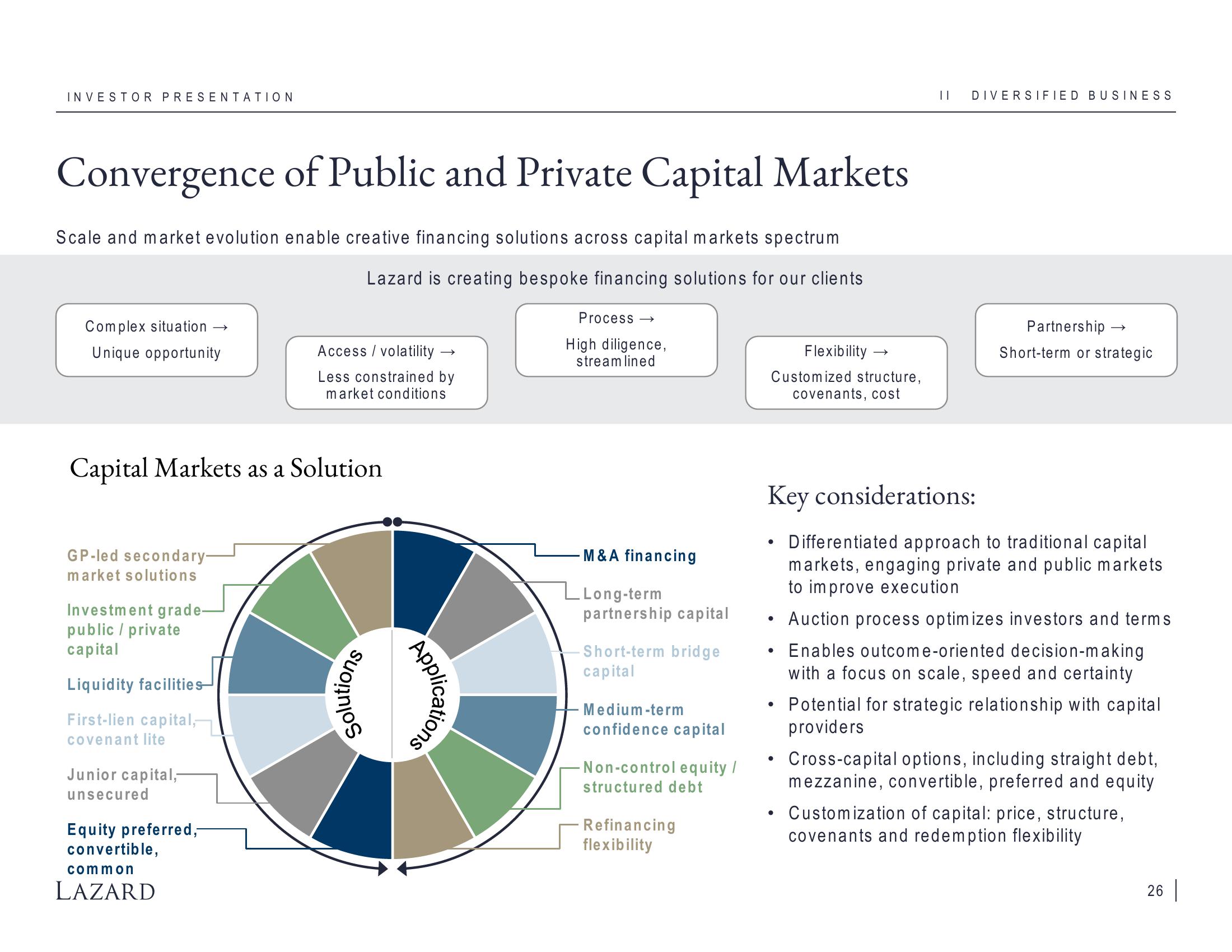

Convergence of Public and Private Capital Markets

Scale and market evolution enable creative financing solutions across capital markets spectrum

Lazard is creating bespoke financing solutions for our clients

Complex situation →

Unique opportunity

Capital Markets as a Solution

GP-led secondary-

market solutions

Investment grade-

public/private

capital

Liquidity facilities

First-lien capital,-

covenant lite

Junior capital,-

unsecured

Access / volatility →

Less constrained by

market conditions

Equity preferred,-

convertible,

common

LAZARD

Solutions

Applications

Process →

High diligence,

streamlined

M&A financing

Long-term

partnership capital

Short-term bridge

capital

Medium-term

confidence capital

- Non-control equity /

structured debt

Refinancing

flexibility

Flexibility

Customized structure,

covenants, cost

Key considerations:

●

●

●

[] DIVERSIFIED BUSINESS

●

Partnership →

Short-term or strategic

Differentiated approach to traditional capital

markets, engaging private and public markets

to improve execution

Auction process optimizes investors and terms

Enables outcome-oriented decision-making

with a focus on scale, speed and certainty

• Potential for strategic relationship with capital

providers

Cross-capital options, including straight debt,

mezzanine, convertible, preferred and equity

Customization of capital: price, structure,

covenants and redemption flexibility

26View entire presentation