UBS Shareholder Engagement Presentation Deck

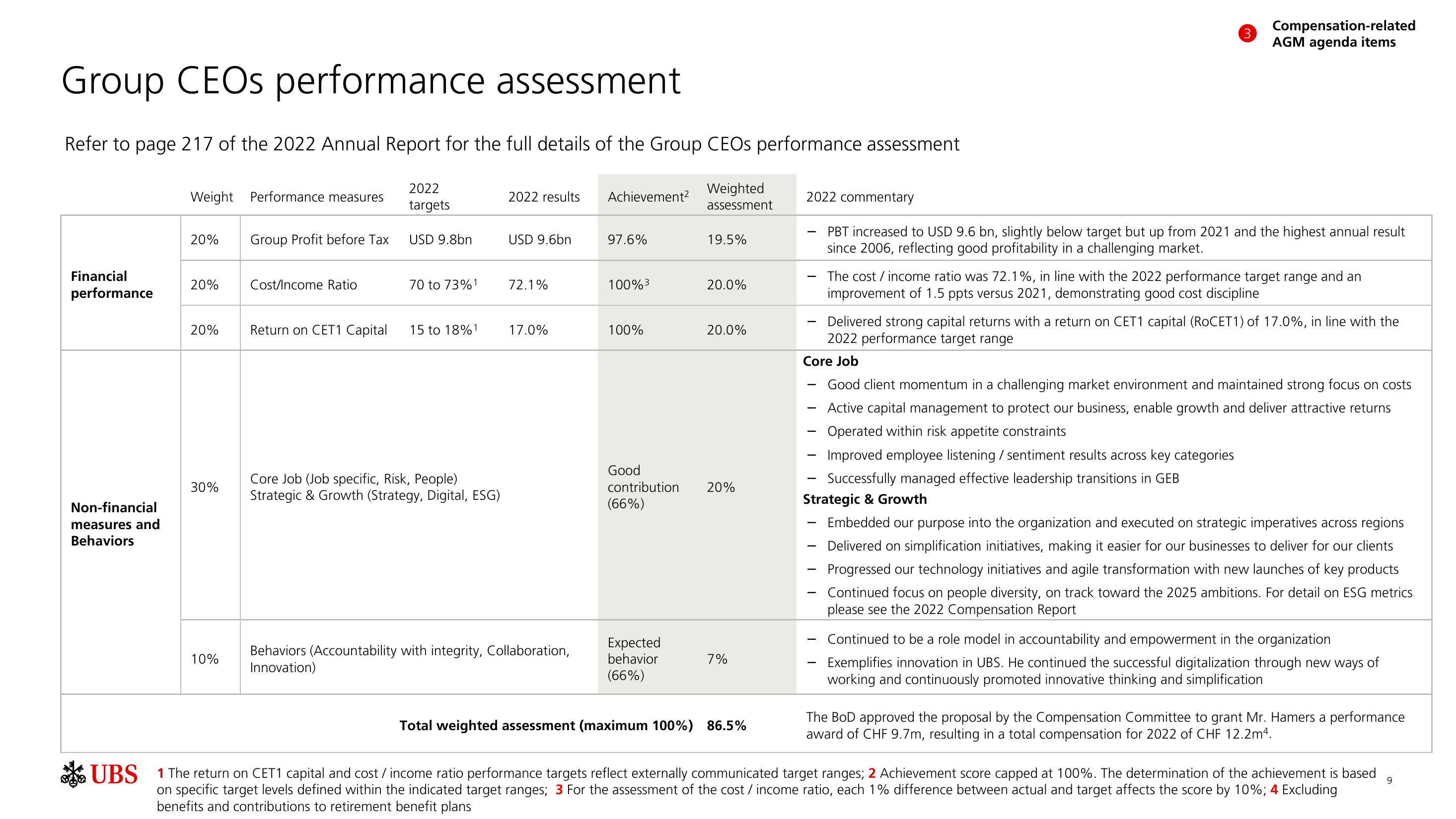

Group CEOs performance assessment

Refer to page 217 of the 2022 Annual Report for the full details of the Group CEOs performance assessment

2022

targets

Weighted

assessment

Financial

performance

Non-financial

measures and

Behaviors

Weight Performance measures

20%

20%

20%

30%

10%

Group Profit before Tax

Cost/Income Ratio

Return on CET1 Capital

USD 9.8bn

70 to 73%¹

15 to 18%1

Core Job (Job specific, Risk, People)

Strategic & Growth (Strategy, Digital, ESG)

2022 results

USD 9.6bn

72.1%

17.0%

Behaviors (Accountability with integrity, Collaboration,

Innovation)

Achievement²

97.6%

100%³

100%

Good

contribution

(66%)

Expected

behavior

(66%)

19.5%

20.0%

20.0%

20%

7%

Total weighted assessment (maximum 100%) 86.5%

-

2022 commentary

PBT increased to USD 9.6 bn, slightly below target but up from 2021 and the highest annual result

since 2006, reflecting good profitability in a challenging market.

3

Compensation-related

AGM agenda items

Delivered strong capital returns with a return on CET1 capital (RoCET1) of 17.0%, in line with the

2022 performance target range

Core Job

-

The cost / income ratio was 72.1%, in line with the 2022 performance target range and an

improvement of 1.5 ppts versus 2021, demonstrating good cost discipline

Good client momentum in a challenging market environment and maintained strong focus on costs

Active capital management to protect our business, enable growth and deliver attractive returns

Operated within risk appetite constraints

- Improved employee listening / sentiment results across key categories

Successfully managed effective leadership transitions in GEB

Strategic & Growth

-

- Embedded our purpose into the organization and executed on strategic imperatives across regions

- Delivered on simplification initiatives, making it easier for our businesses to deliver for our clients

- Progressed our technology initiatives and agile transformation with new launches of key products

Continued focus on people diversity, on track toward the 2025 ambitions. For detail on ESG metrics

please see the 2022 Compensation Report

Continued to be a role model in accountability and empowerment in the organization

Exemplifies innovation in UBS. He continued the successful digitalization through new ways of

working and continuously promoted innovative thinking and simplification

The BoD approved the proposal by the Compensation Committee to grant Mr. Hamers a performance

award of CHF 9.7m, resulting in a total compensation for 2022 of CHF 12.2m4.

UBS 1 The return on CET1 capital and cost / income ratio performance targets reflect externally communicated target ranges; 2 Achievement score capped at 100%. The determination of the achievement is based

on specific target levels defined within the indicated target ranges; 3 For the assessment of the cost / income ratio, each 1% difference between actual and target affects the score by 10%; 4 Excluding

benefits and contributions to retirement benefit plans

9View entire presentation