OppFi Investor Presentation Deck

36

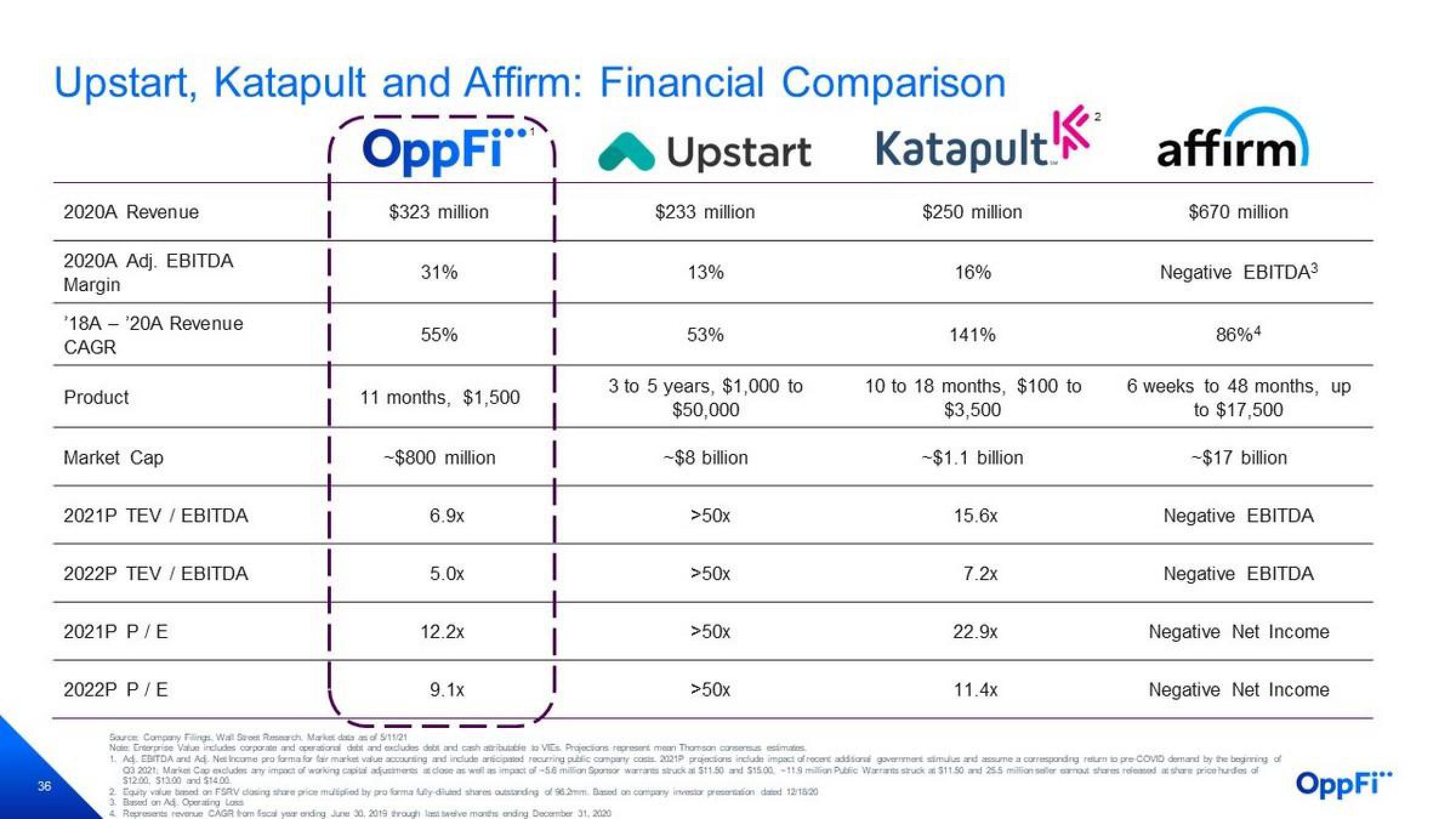

Upstart, Katapult and Affirm: Financial Comparison

OppFi***

$323 million

2020A Revenue

2020A Adj. EBITDA

Margin

¹18A¹20A Revenue

CAGR

Product

Market Cap

2021P TEV / EBITDA

2022P TEV / EBITDA

2021P P/E

2022P P/E

1

1

+

1

31%

55%

11 months, $1,500

-$800 million

6.9x

5.0x

12.2x

9.1x

Upstart Katapult affirm

$233 million

13%

53%

3 to 5 years, $1,000 to

$50,000

-$8 billion

>50x

>50x

>50x

>50x

$250 million

2. Equity value based on FSRV clasing share price multiplied by pro forma luty diuled share outstanding of 962mm. Based on company investor presentation dated 12/1820

3. Based on Adj. Operating Loss

4 Represents revenue CAGR from fiscal you anding June 30, 2019 through betwelve months onding December 31, 2020

16%

141%

10 to 18 months, $100 to

$3,500

-$1.1 billion

15.6x

7.2x

22.9x

11.4x

$670 million

Negative EBITDA³

86%4

6 weeks to 48 months, up

to $17,500

-$17 billion

Negative EBITDA

Negative EBITDA

Negative Net Income

Negative Net Income

Source Company Flings. Wall Scout Research, Market

5/11/21

Nain: Enterprise Value includes corporate and operational debit and excludes dobt and cash asributable to VIES Projections represent mean Thomson consensus eximinos

1. Ad. EBTDA and Ad. Net Income pro form for for market value accounting and include anticipated recurring public company cos 2021 projections include impact of recent addisonal government simulues and assume a corresponding return to pre COVD demand by the beginning of

00 2021, Market Cap excludes any impact of working capita aqusiness a dose as well as impact of 56 million Sponsor warrants struck at $11.50 and $15.00 -11.9 million Public Warrants stuck $11.50 and 25.5 million eller amous share med at the pricehudies of

$12:00, $10.00

OppFi"View entire presentation