AMD Results Presentation Deck

APPENDICES

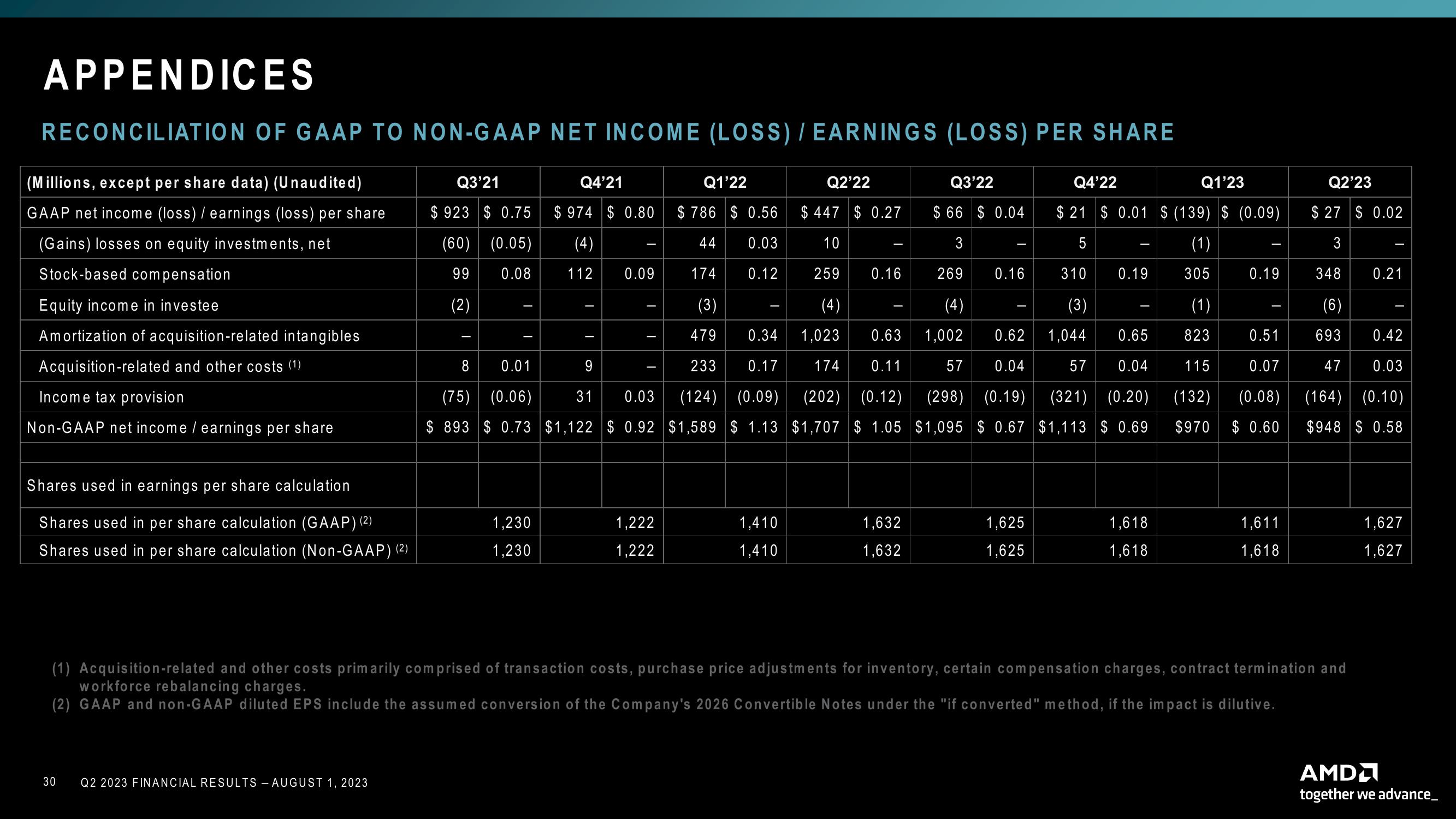

RECONCILIATION OF GAAP TO NON-GAAP NET INCOME (LOSS) / EARNINGS (LOSS) PER SHARE

(Millions, except per share data) (Unaudited)

GAAP net income (loss) / earnings (loss) per share

(Gains) losses on equity investments, net

Stock-based compensation

Equity income in investee

Amortization of acquisition-related intangibles

Acquisition-related and other costs (1)

Income tax provision

Non-GAAP net income / earnings per share

Shares used in earnings per share calculation

Shares used in per share calculation (GAAP) (2)

Shares used in per share calculation (Non-GAAP) (2)

30

Q2'22

$66 $0.04

$447 $ 0.27

10

3

259 0.16 269

(4)

(4)

1,023 0.63 1,002

174 0.11 57 0.04

0.51

0.34

0.17

8

0.01

9

0.07

(75) (0.06)

31 0.03 (124) (0.09) (202) (0.12) (298) (0.19) (321) (0.20) (132)

(0.08)

$ 893 $ 0.73 $1,122 $ 0.92 $1,589 $ 1.13 $1,707 $ 1.05 $1,095 $ 0.67 $1,113 $0.69 $970 $ 0.60

Q2 2023 FINANCIAL RESULTS - AUGUST 1, 2023

Q3'21

$923 $0.75

(60)| (0.05)

99 0.08

(2)

-

1,230

1,230

Q4'21

$974 $ 0.80

(4)

112 0.09

I

I

1,222

1,222

Q1'22

$786 $ 0.56

44 0.03

0.12

174

(3)

479

233

-

1,410

1,410

1,632

1,632

Q3'22

Q4'22

Q1'23

$ 21 $ 0.01 $ (139) $ (0.09)

5

(1)

305

310

(3)

0.62 1,044

-

0.16

1,625

1,625

0.19

0.65

57 0.04

1,618

1,618

(1)

823

115

-

0.19

1,611

1,618

Q2'23

(1) Acquisition-related and other costs primarily comprised of transaction costs, purchase price adjustments for inventory, certain compensation charges, contract termination and

workforce rebalancing charges.

(2) GAAP and non-GAAP diluted EPS include the assumed conversion of the Company's 2026 Convertible Notes under the "if converted" method, if the impact is dilutive.

$27 $0.02

3

348

(6)

693

0.42

47 0.03

(164) (0.10)

$948 $ 0.58

I

0.21

1,627

1,627

AMD

together we advance_View entire presentation