Affirm Results Presentation Deck

Income Statement Reconciliations

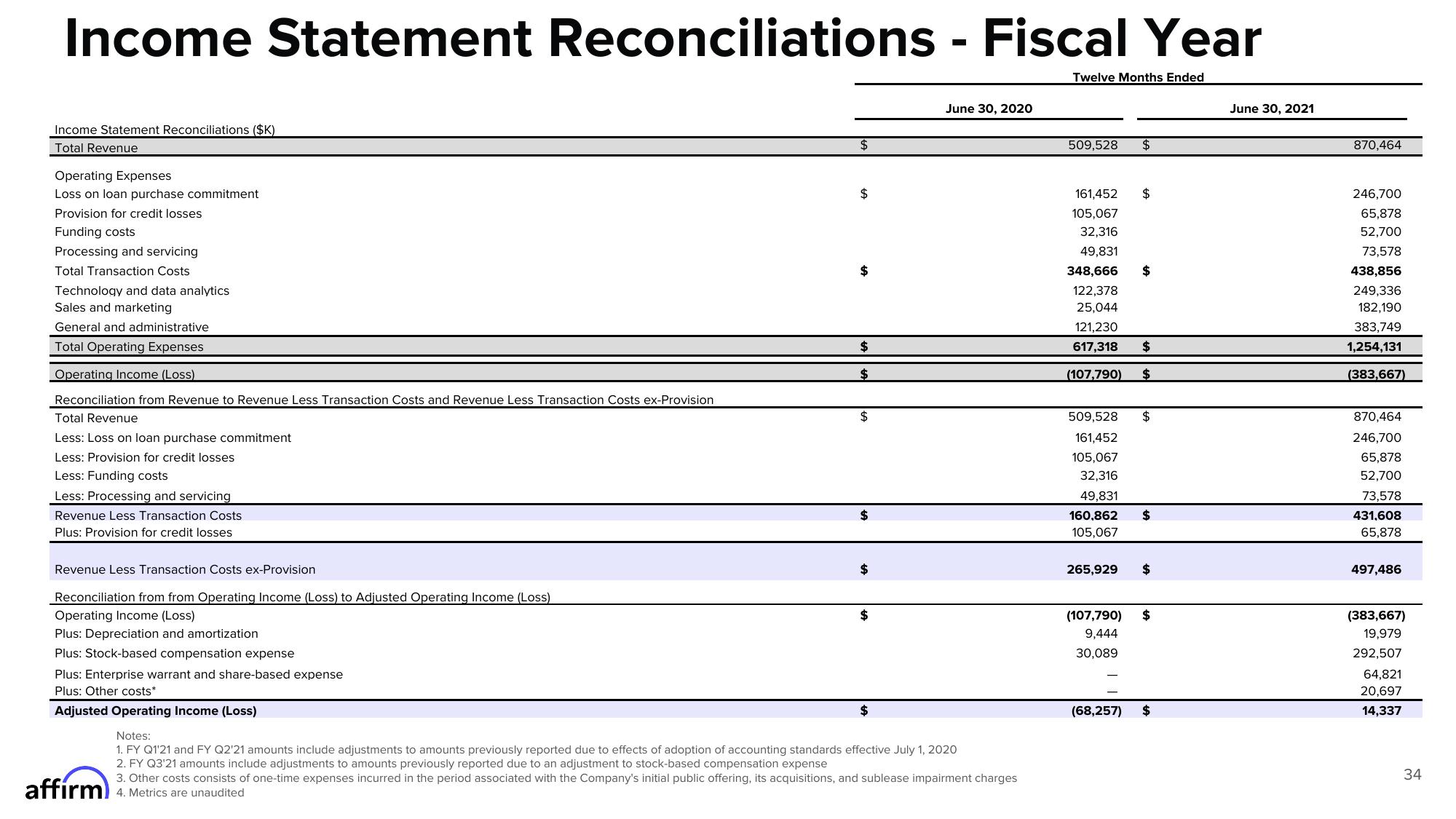

Income Statement Reconciliations ($K)

Total Revenue

Operating Expenses

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Total Operating Expenses

Operating Income (Loss)

Reconciliation from Revenue to Revenue Less Transaction Costs and Revenue Less Transaction Costs ex-Provision

Total Revenue

Less: Loss on loan purchase commitment

Less: Provision for credit losses

Less: Funding costs

Less: Processing and servicing

Revenue Less Transaction Costs

Plus: Provision for credit losses

Revenue Less Transaction Costs ex-Provision

Reconciliation from from Operating Income (Loss) to Adjusted Operating Income (Loss)

Operating Income (Loss)

Plus: Depreciation and amortization

Plus: Stock-based compensation expense

Plus: Enterprise warrant and share-based expense

Plus: Other costs*

Adjusted Operating Income (Loss)

$

$

$

$

$

$

$

$

$

$

Fiscal Year

June 30, 2020

Notes:

1. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020

2. FY Q3'21 amounts include adjustments to amounts previously reported due to an adjustment to stock-based compensation expense

3. Other costs consists of one-time expenses incurred in the period associated with the Company's initial public offering, its acquisitions, and sublease impairment charges

affirm) 4. Metrics are unaudited

Twelve Months Ended

509,528 $

161,452

105,067

32,316

49,831

348,666

122,378

25,044

121,230

617,318

$

(107,790) $

509,528

161,452

105,067

32,316

49,831

160,862

105,067

265,929

(107,790)

9,444

30,089

(68,257)

$

$

$

$

$

$

$

June 30, 2021

870,464

246,700

65,878

52,700

73,578

438,856

249,336

182,190

383,749

1,254,131

(383,667)

870,464

246,700

65,878

52,700

73,578

431,608

65,878

497,486

(383,667)

19,979

292,507

64,821

20,697

14,337

34View entire presentation