Q2 2018 Fixed Income Investor Conference Call

AT1/Tier2

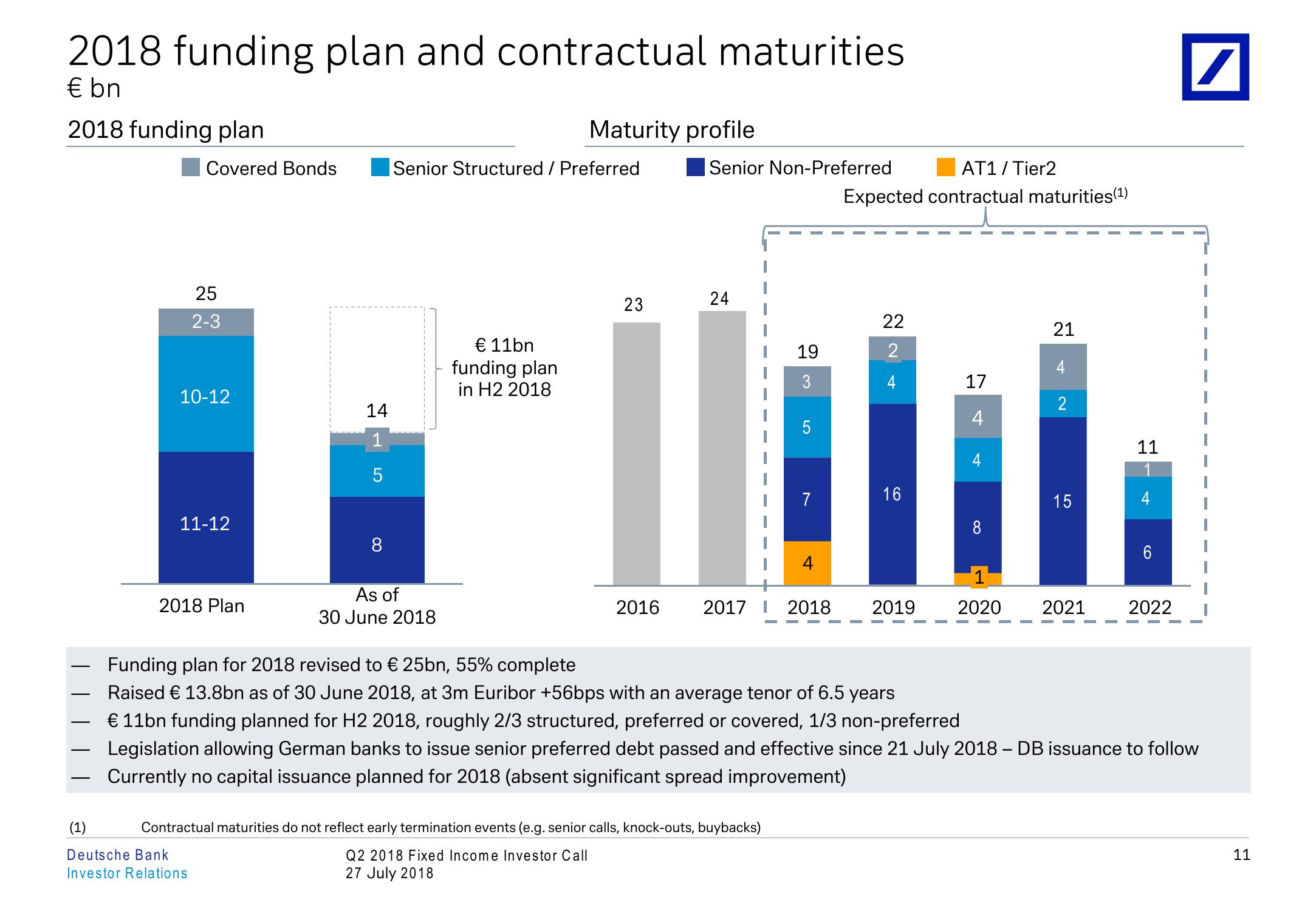

Expected contractual maturities(1)

2018 funding plan and contractual maturities

€ bn

2018 funding plan

Maturity profile

Covered Bonds

Senior Structured / Preferred

Senior Non-Preferred

25

2-3

10-12

14

1

5

€ 11bn

funding plan

in H2 2018

23

11-12

8

As of

2018 Plan

30 June 2018

Funding plan for 2018 revised to € 25bn, 55% complete

-

(1)

24

24

22

21

19

2

4

<t

3

4

17

2

4

LO

5

11

7

16

+

15

4

CO

1

2016

2017 I

2018

2019

2020

2021

2022

Raised € 13.8bn as of 30 June 2018, at 3m Euribor +56bps with an average tenor of 6.5 years

€ 11bn funding planned for H2 2018, roughly 2/3 structured, preferred or covered, 1/3 non-preferred

Legislation allowing German banks to issue senior preferred debt passed and effective since 21 July 2018 - DB issuance to follow

Currently no capital issuance planned for 2018 (absent significant spread improvement)

Contractual maturities do not reflect early termination events (e.g. senior calls, knock-outs, buybacks)

Q2 2018 Fixed Income Investor Call

Deutsche Bank

Investor Relations

27 July 2018

11View entire presentation