DiDi IPO Presentation Deck

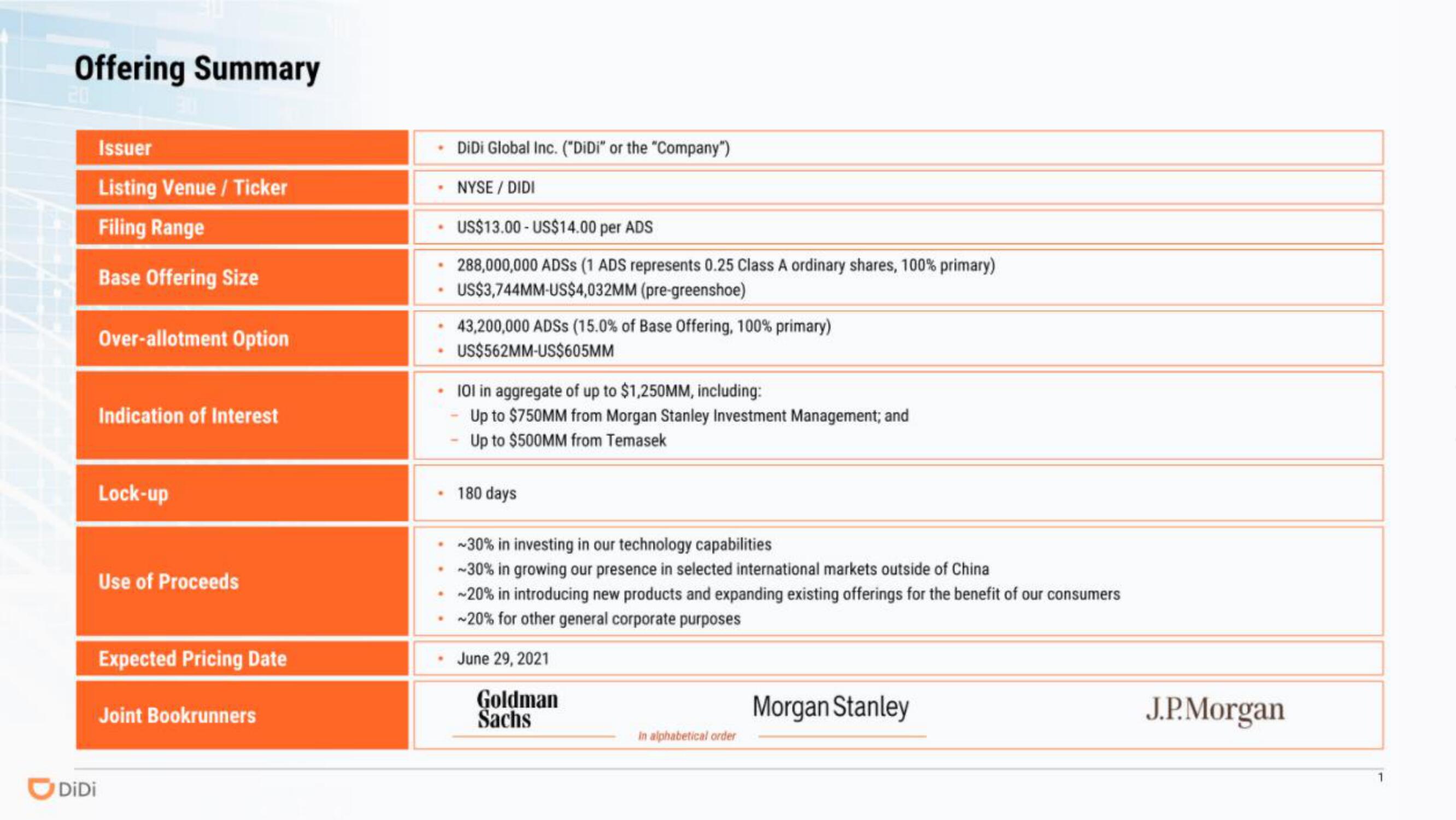

Offering Summary

20

Issuer

Listing Venue / Ticker

Filing Range

Base Offering Size

DiDi

Over-allotment Option

Indication of Interest

Lock-up

Use of Proceeds

Expected Pricing Date

Joint Bookrunners

• DiDi Global Inc. ("DiDi" or the "Company")

NYSE / DIDI

• US$13.00-US$14.00 per ADS

288,000,000 ADSS (1 ADS represents 0.25 Class A ordinary shares, 100% primary)

US$3,744MM-US$4,032MM (pre-greenshoe)

.

43,200,000 ADSs (15.0% of Base Offering, 100% primary)

• US$562MM-US$605MM

.

101 in aggregate of up to $1,250MM, including:

- Up to $750MM from Morgan Stanley Investment Management; and

Up to $500MM from Temasek

~30% in investing in our technology capabilities

~30% in growing our presence in selected international markets outside of China

~20% in introducing new products and expanding existing offerings for the benefit of our consumers

•

~20% for other general corporate purposes

June 29, 2021

Goldman

Sachs

•

180 days

in alphabetical order

Morgan Stanley

J.P. MorganView entire presentation