CURO Group Holdings Credit Presentation Deck

■

M

■

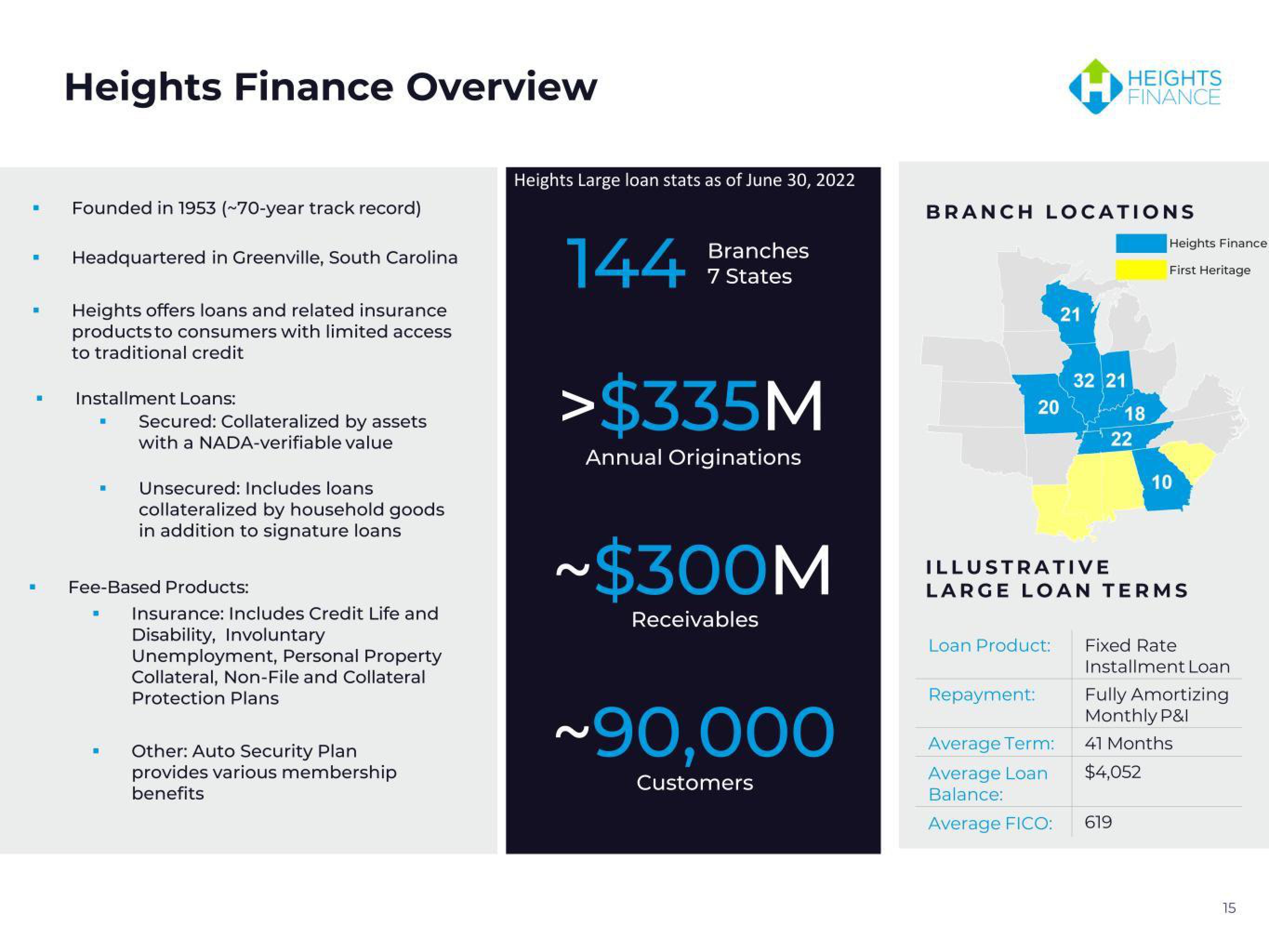

Heights Finance Overview

Founded in 1953 (~70-year track record)

Headquartered in Greenville, South Carolina

Heights offers loans and related insurance

products to consumers with limited access

to traditional credit

Installment Loans:

■

m

Secured: Collateralized by assets

with a NADA-verifiable value

Fee-Based Products:

.

Unsecured: Includes loans

collateralized by household goods

in addition to signature loans

Insurance: Includes Credit Life and

Disability, Involuntary

Unemployment, Personal Property

Collateral, Non-File and Collateral

Protection Plans

Other: Auto Security Plan

provides various membership

benefits

Heights Large loan stats as of June 30, 2022

144

Branches

7 States

>$335M

Annual Originations

$300M

Receivables

~90,000

Customers

BRANCH LOCATIONS

20

21

ILLUSTRATIVE

Repayment:

32 21

Average Term:

Average Loan

Balance:

Average FICO:

HEIGHTS

FINANCE

18

22

LARGE LOAN TERMS

Heights Finance

First Heritage

Loan Product: Fixed Rate

10

619

Installment Loan

Fully Amortizing

Monthly P&I

41 Months

$4,052

15View entire presentation