First Busey Results Presentation Deck

4Q23 Earnings Investor Presentation

Exp.

Focused Control on Expenses

Noninterest Expense

Noninterest Exp.

Unfunded

Provision

$ in millions

Acq./Restructuring

1

Intangible Amort.

NMTC Amort.

Adj. Core Exp.(¹)

$73.7

55.8%

2022 Q4

Expenses ex-Acq.

Adj. Core Efficiency Ratio ¹

$73.7

- $0.5

$2.4

$2.8

$1.7

$67.2

$70.4

55.6%

2023 Q1

$70.4

- $0.6

$0.0

$2.7

$2.2

First Busey Corporation | Ticker: BUSE

$66.1

$69.2

58.6%

2023 Q2

Acq./Restructuring Exp.

$69.2

$0.3

$0.0

$2.7

$2.3

$64.0

$70.9

60.2%

2023 Q3

$70.9

$0.0

$0.1

$2.6

$2.3

$66.0

$75.0

60.1%

2023 Q4

$75.0

$0.8

$4.2

$2.5

$2.3

$65.2

I

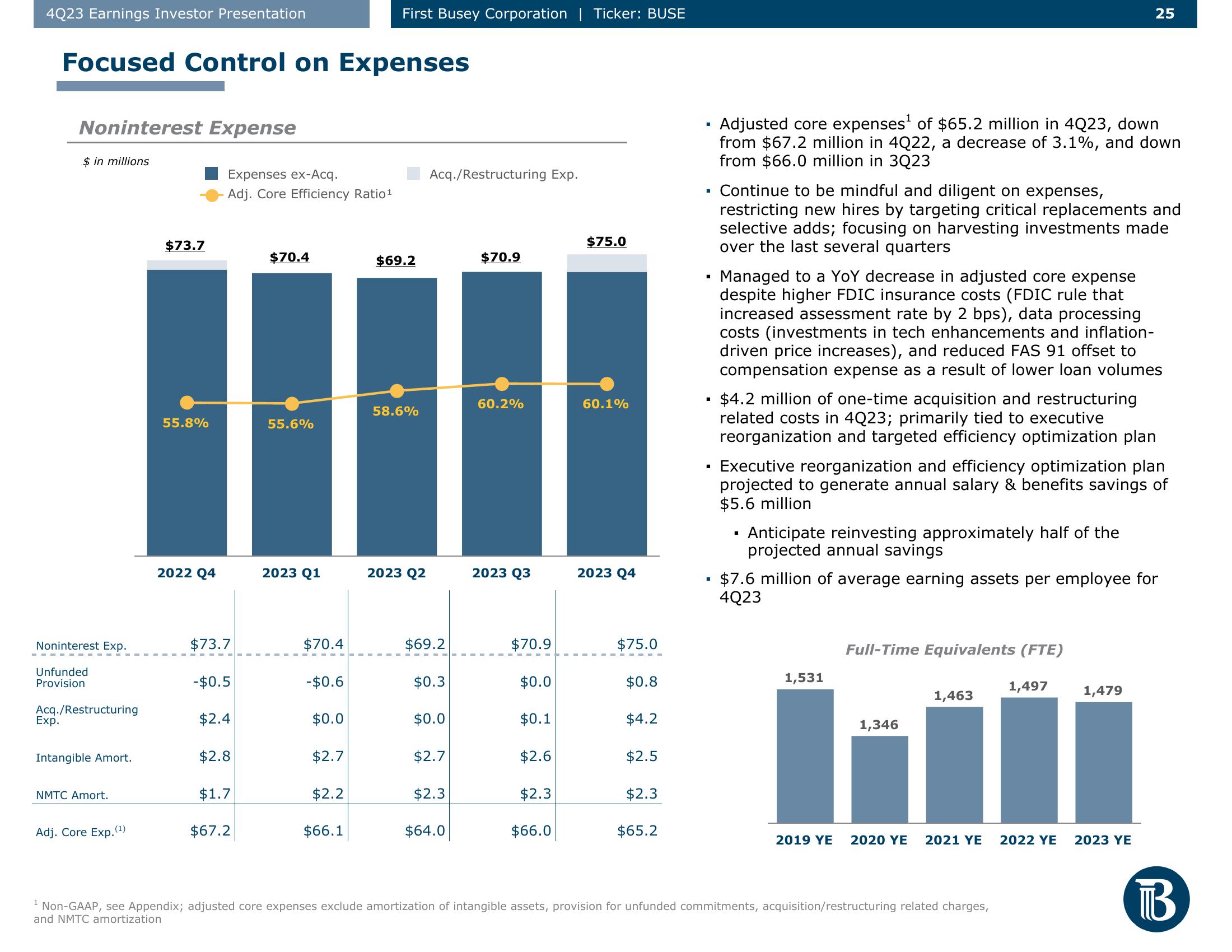

Adjusted core expenses¹ of $65.2 million in 4Q23, down

from $67.2 million in 4Q22, a decrease of 3.1%, and down

from $66.0 million in 3Q23

Continue to be mindful and diligent on expenses,

restricting new hires by targeting critical replacements and

selective adds; focusing on harvesting investments made

over the last several quarters

Managed to a YoY decrease in adjusted core expense

despite higher FDIC insurance costs (FDIC rule that

increased assessment rate by 2 bps), data processing

costs (investments in tech enhancements and inflation-

driven price increases), and reduced FAS 91 offset to

compensation expense as a result of lower loan volumes

$4.2 million of one-time acquisition and restructuring

related costs in 4Q23; primarily tied to executive

reorganization and targeted efficiency optimization plan

Executive reorganization and efficiency optimization plan

projected to generate annual salary & benefits savings of

$5.6 million

■

Anticipate reinvesting approximately half of the

projected annual savings

$7.6 million of average earning assets per employee for

4Q23

1,531

Full-Time Equivalents (FTE)

1,346

25

1,463

2019 YE 2020 YE 2021 YE

Non-GAAP, see Appendix; adjusted core expenses exclude amortization of intangible assets, provision for unfunded commitments, acquisition/restructuring related charges,

and NMTC amortization

1,497

1,479

2022 YE 2023 YE

BView entire presentation