Third Quarter 2022 Earnings Conference Call

Average loans & leases HFI

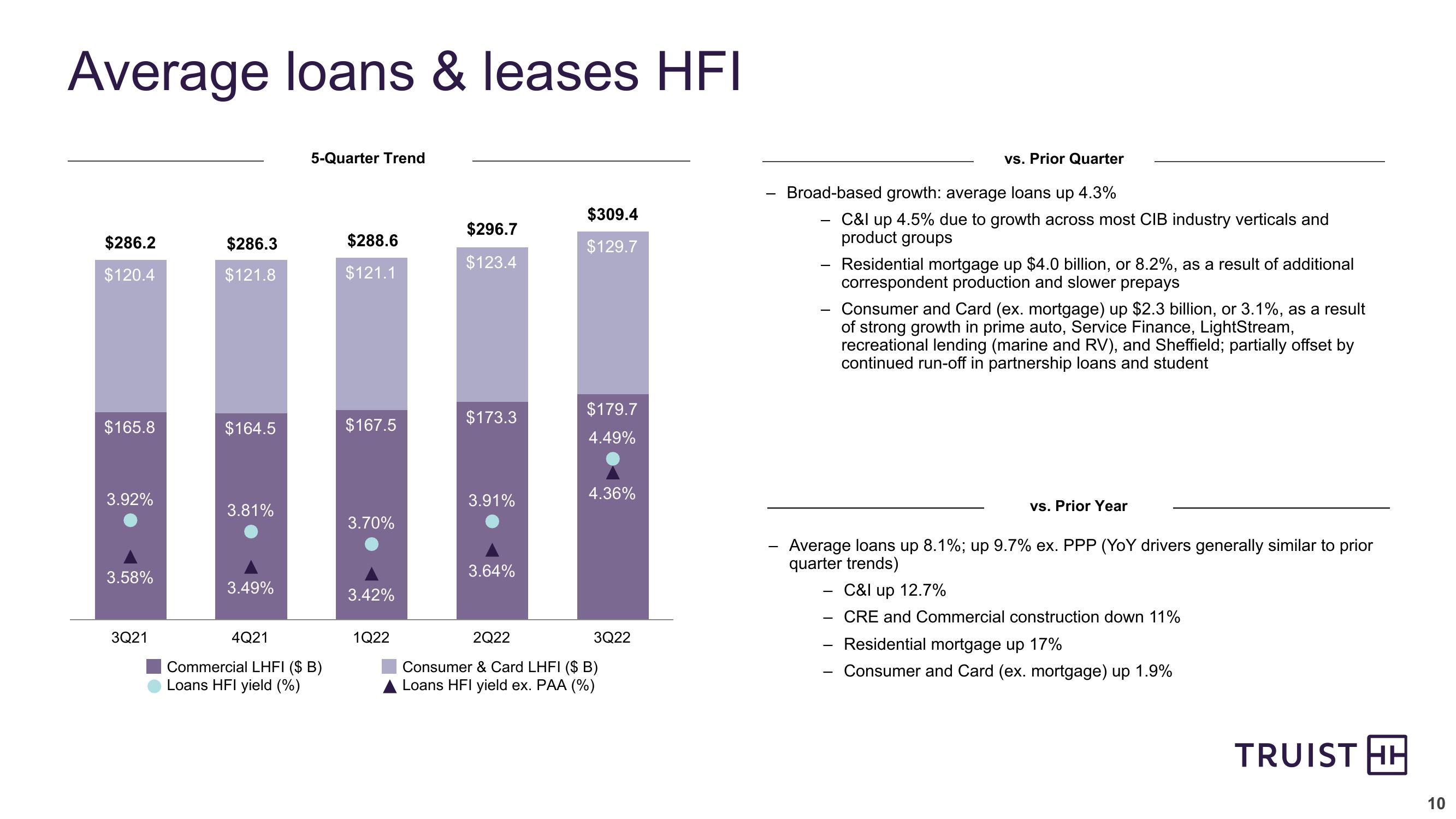

5-Quarter Trend

$309.4

$296.7

$286.2

$286.3

$288.6

$129.7

$123.4

$120.4

$121.8

$121.1

$173.3

$165.8

$164.5

$167.5

$179.7

4.49%

4.36%

3.92%

3.91%

3.81%

3.70%

3.64%

3.58%

3.49%

3.42%

3Q21

4Q21

Commercial LHFI ($ B)

Loans HFI yield (%)

1Q22

2Q22

Consumer & Card LHFI ($ B)

Loans HFI yield ex. PAA (%)

vs. Prior Quarter

Broad-based growth: average loans up 4.3%

-

C&I up 4.5% due to growth across most CIB industry verticals and

product groups

Residential mortgage up $4.0 billion, or 8.2%, as a result of additional

correspondent production and slower prepays

Consumer and Card (ex. mortgage) up $2.3 billion, or 3.1%, as a result

of strong growth in prime auto, Service Finance, LightStream,

recreational lending (marine and RV), and Sheffield; partially offset by

continued run-off in partnership loans and student

vs. Prior Year

Average loans up 8.1%; up 9.7% ex. PPP (YoY drivers generally similar to prior

quarter trends)

-

C&I up 12.7%

3Q22

-

-

-

CRE and Commercial construction down 11%

Residential mortgage up 17%

Consumer and Card (ex. mortgage) up 1.9%

TRUIST HH

10View entire presentation