Crocs Investor Presentation Deck

crocs™

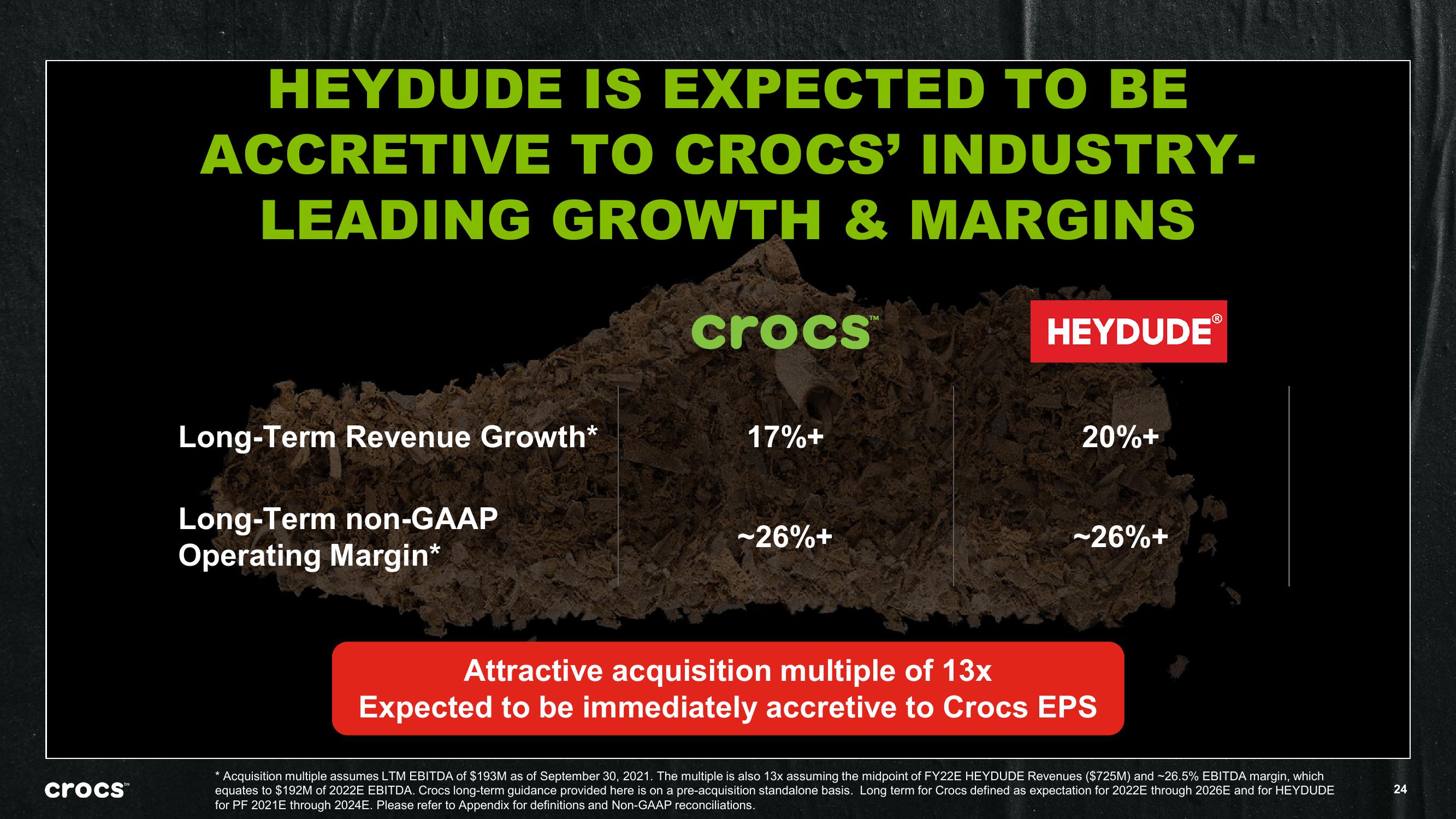

HEYDUDE

ACCRETIVE

IS EXPECTED TO BE

TO CROCS' INDUSTRY-

LEADING GROWTH & MARGINS

Long-Term Revenue Growth*

Long-Term non-GAAP

Operating Margin*

crocs™

17%+

-26%+

HEYDUDE

20%+

-26%+

Attractive acquisition multiple of 13x

Expected to be immediately accretive to Crocs EPS

Ⓡ

Acquisition multiple assumes LTM EBITDA of $193M as of September 30, 2021. The multiple is also 13x assuming the midpoint of FY22E HEYDUDE Revenues ($725M) and -26.5% EBITDA margin, which

equates to $192M of 2022E EBITDA. Crocs long-term guidance provided here is on a pre-acquisition standalone basis. Long term for Crocs defined as expectation for 2022E through 2026E and for HEYDUDE

for PF 2021E through 2024E. Please refer to Appendix for definitions and Non-GAAP reconciliations.

24View entire presentation