BlackRock Global Long/Short Credit Absolute Return Credit

Demystifying Absolute Return

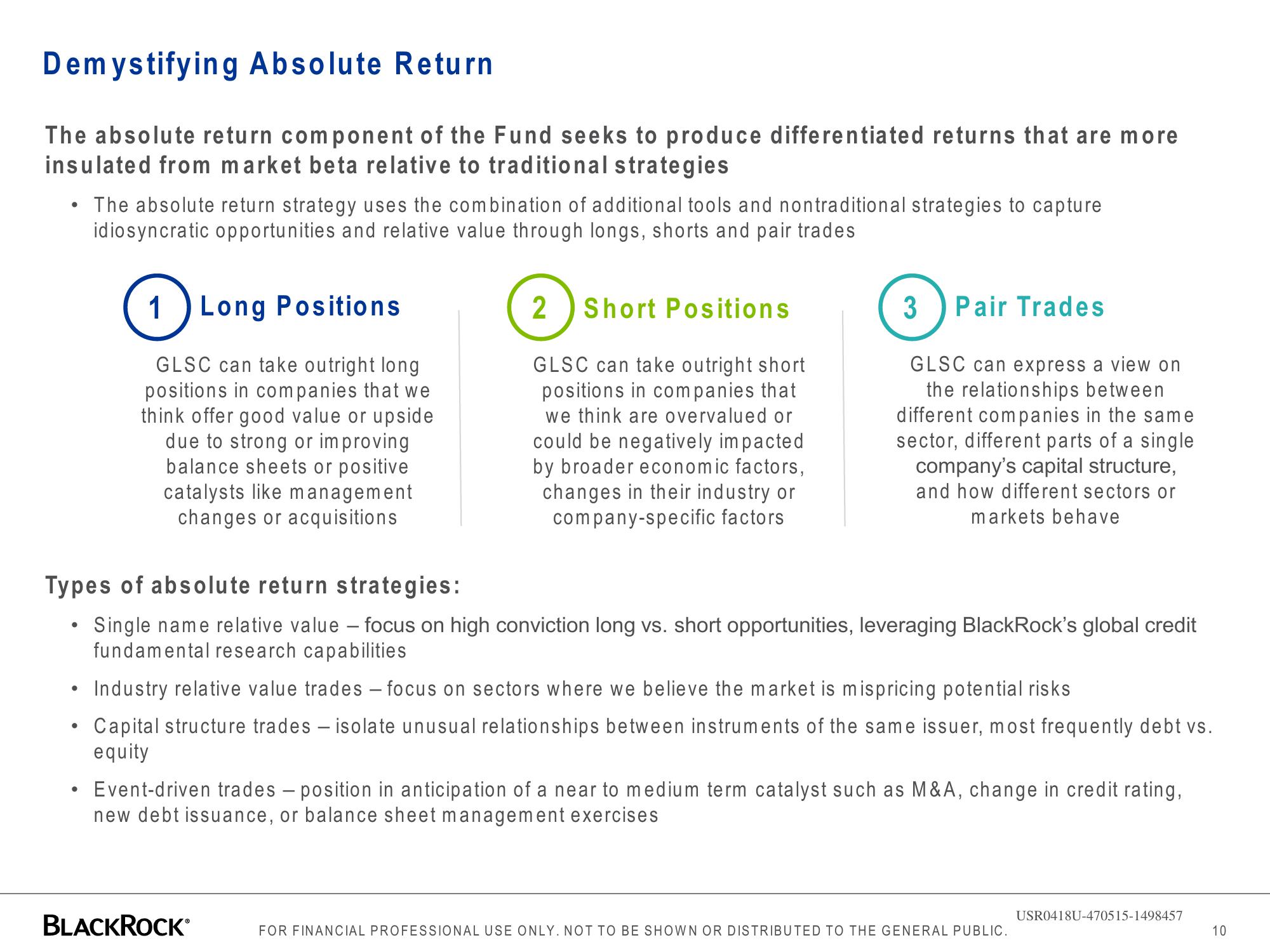

The absolute return component of the Fund seeks to produce differentiated returns that are more

insulated from market beta relative to traditional strategies

●

●

The absolute return strategy uses the combination of additional tools and nontraditional strategies to capture

idiosyncratic opportunities and relative value through longs, shorts and pair trades

●

1 Long Positions

GLSC can take outright long

positions in companies that we

think offer good value or upside

due to strong or improving

balance sheets or positive

catalysts like management

changes or acquisitions

Types of absolute return strategies:

Single name relative value - focus on high conviction long vs. short opportunities, leveraging BlackRock's global credit

fundamental research capabilities

●

2 Short Positions

GLSC can take outright short

positions in companies that

we think are overvalued or

could be negatively impacted

by broader economic factors,

changes in their industry or

company-specific factors

• Industry relative value trades - focus on sectors where we believe the market is mispricing potential risks

Capital structure trades - isolate unusual relationships between instruments of the same issuer, most frequently debt vs.

equity

3 Pair Trades

GLSC can express a view on

the relationships between

different companies in the same

sector, different parts of a single

company's capital structure,

and how different sectors or

markets behave

BLACKROCK*

Event-driven trades - position in anticipation of a near to medium term catalyst such as M&A, change in credit rating,

new debt issuance, or balance sheet management exercises

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

USR0418U-470515-1498457

10View entire presentation