Carlyle Investor Day Presentation Deck

Endnotes

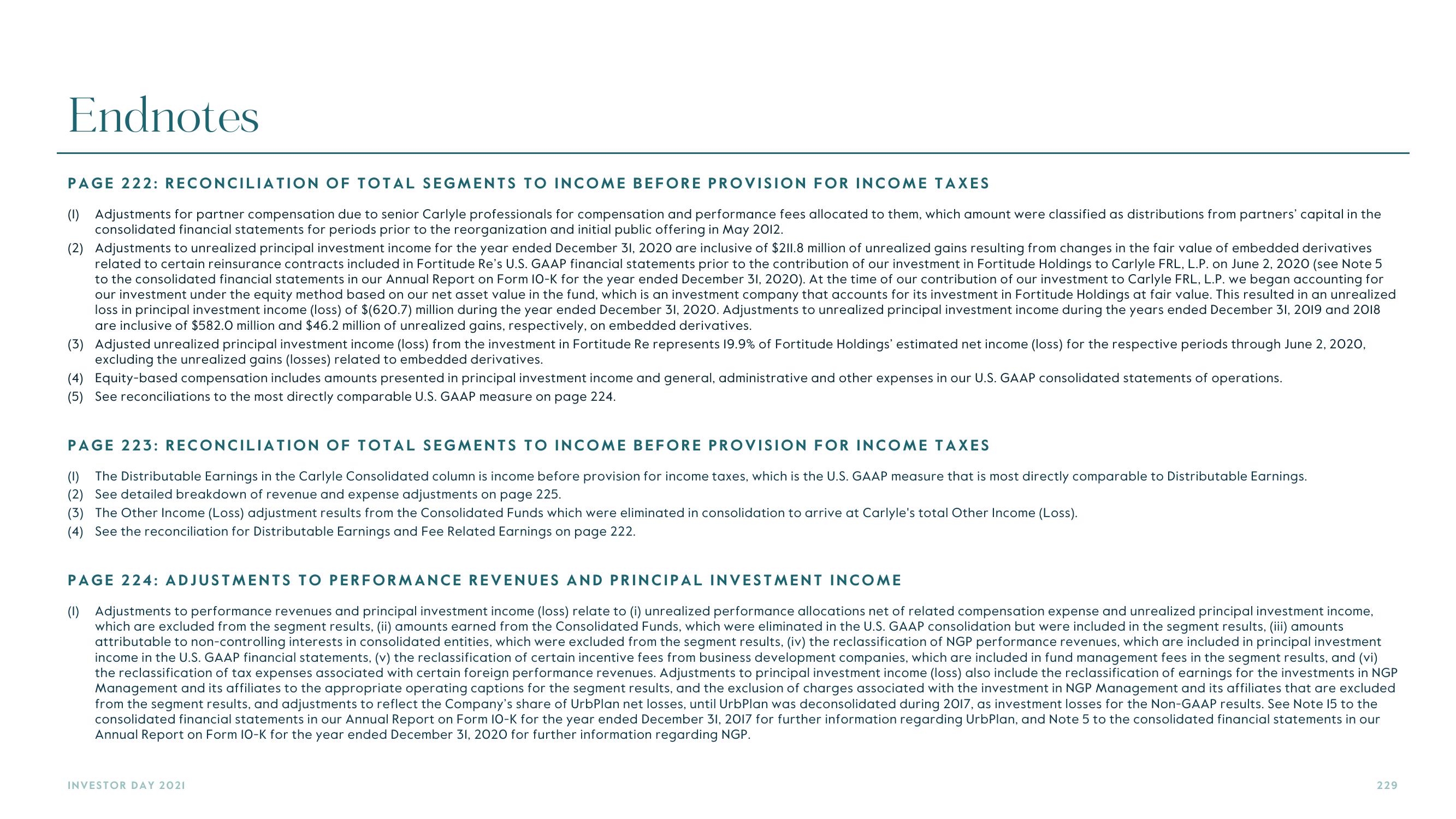

PAGE 222: RECONCILIATION OF TOTAL SEGMENTS TO INCOME BEFORE PROVISION FOR INCOME TAXES

(1) Adjustments for partner compensation due to senior Carlyle professionals for compensation and performance fees allocated to them, which amount were classified as distributions from partners' capital in the

consolidated financial statements for periods prior to the reorganization and initial public offering in May 2012.

(2) Adjustments to unrealized principal investment income for the year ended December 31, 2020 are inclusive of $211.8 million of unrealized gains resulting from changes in the fair value of embedded derivatives

related to certain reinsurance contracts included in Fortitude Re's U.S. GAAP financial statements prior to the contribution of our investment in Fortitude Holdings to Carlyle FRL, L.P. on June 2, 2020 (see Note 5

to the consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2020). At the time of our contribution of our investment to Carlyle FRL, L.P. we began accounting for

our investment under the equity method based on our net asset value in the fund, which is an investment company that accounts for its investment in Fortitude Holdings at fair value. This resulted in an unrealized

loss in principal investment income (loss) of $(620.7) million during the year ended December 31, 2020. Adjustments to unrealized principal investment income during the years ended December 31, 2019 and 2018

are inclusive of $582.0 million and $46.2 million of unrealized gains, respectively, on embedded derivatives.

(3) Adjusted unrealized principal investment income (loss) from the investment in Fortitude Re represents 19.9% of Fortitude Holdings' estimated net income (loss) for the respective periods through June 2, 2020,

excluding the unrealized gains (losses) related to embedded derivatives.

(4) Equity-based compensation includes amounts presented in principal investment income and general, administrative and other expenses in our U.S. GAAP consolidated statements of operations.

(5) See reconciliations to the most directly comparable U.S. GAAP measure on page 224.

PAGE 223: RECONCILIATION OF TOTAL SEGMENTS TO INCOME BEFORE PROVISION FOR INCOME TAXES

(1) The Distributable Earnings in the Carlyle Consolidated column is income before provision for income taxes, which is the U.S. GAAP measure that is most directly comparable to Distributable Earnings.

(2) See detailed breakdown of revenue and expense adjustments on page 225.

(3) The Other Income (Loss) adjustment results from the Consolidated Funds which were eliminated in consolidation to arrive at Carlyle's total Other Income (Loss).

(4) See the reconciliation for Distributable Earnings and Fee Related Earnings on page 222.

PAGE 224: ADJUSTMENTS TO PERFORMANCE REVENUES AND PRINCIPAL INVESTMENT INCOME

(1) Adjustments to performance revenues and principal investment income (loss) relate to (i) unrealized performance allocations net of related compensation expense and unrealized principal investment income,

which are excluded from the segment results, (ii) amounts earned from the Consolidated Funds, which were eliminated in the U.S. GAAP consolidation but were included in the segment results, (iii) amounts

attributable to non-controlling interests in consolidated entities, which were excluded from the segment results, (iv) the reclassification of NGP performance revenues, which are included in principal investment

income in the U.S. GAAP financial statements, (v) the reclassification of certain incentive fees from business development companies, which are included in fund management fees in the segment results, and (vi)

the reclassification of tax expenses associated with certain foreign performance revenues. Adjustments to principal investment income (loss) also include the reclassification of earnings for the investments in NGP

Management and its affiliates to the appropriate operating captions for the segment results, and the exclusion of charges associated with the investment in NGP Management and its affiliates that are excluded

from the segment results, and adjustments to reflect the Company's share of UrbPlan net losses, until UrbPlan was deconsolidated during 2017, as investment losses for the Non-GAAP results. See Note 15 to the

consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2017 for further information regarding UrbPlan, and Note 5 to the consolidated financial statements in our

Annual Report on Form 10-K for the year ended December 31, 2020 for further information regarding NGP.

INVESTOR DAY 2021

229View entire presentation