Kinnevik Results Presentation Deck

Intro

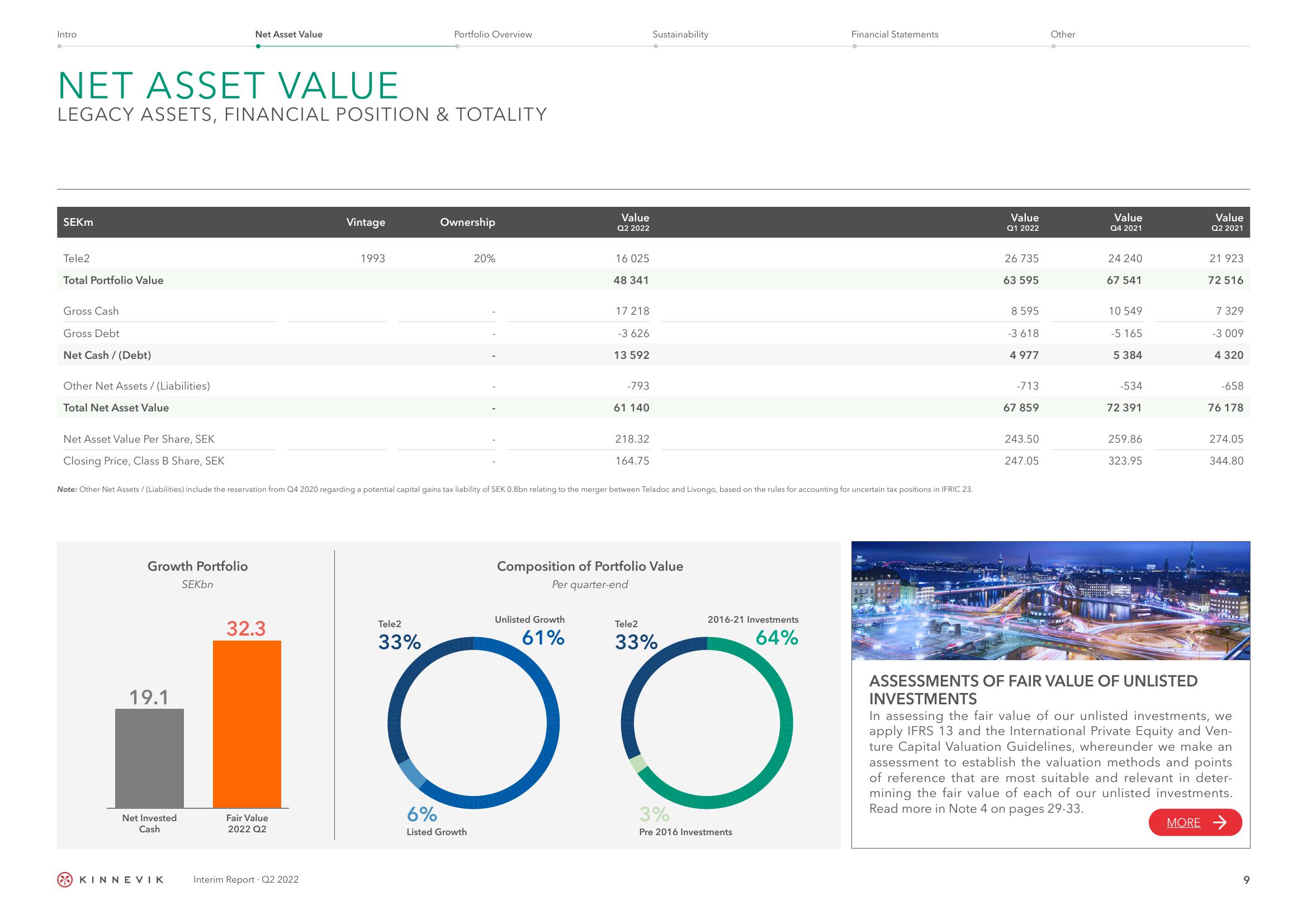

SEKM

NET ASSET VALUE

LEGACY ASSETS, FINANCIAL POSITION & TOTALITY

Tele2

Total Portfolio Value

Gross Cash

Gross Debt

Net Cash / (Debt)

Other Net Assets/(Liabilities)

Total Net Asset Value

Net Asset Value Per Share, SEK

Closing Price, Class B Share, SEK

Note:

Growth Portfolio

19.1

Net Invested

Cash

Net Asset Value

KINNEVIK

SEKbn

32.3

Fair Value

2022 Q2

Vintage

Interim Report Q2 2022

1993

Portfolio Overview

Tele2

33%

Ownership

tAssets/(Liabilities) include the reservation from Q4 2020 regarding a potential capital gains tax liability of SEK 0.8bn relating to the merger between Teladoc and Livongo, based on the rules for accounting for uncertain tax positions in IFRIC 23.

20%

6%

Listed Growth

Value

Q2 2022

16 025

48 341

Unlisted Growth

61%

)

17 218

-3 626

13 592

-793

61 140

218.32

164.75

Sustainability

Composition of Portfolio Value

Per quarter-end

Tele2

33%

2016-21 Investments

64%

Financial Statements

3%

Pre 2016 Investments

Value

Q1 2022

26 735

63 595

8 595

-3

618

4 977

-713

67 859

243.50

247.05

Other

Value

Q4 2021

24 240

67 541

10 549

-5 165

5 384

-534

72 391

259.86

323.95

ASSESSMENTS OF FAIR VALUE OF UNLISTED

INVESTMENTS

Value

Q2 2021

21

72 516

7 329

-3 009

4 320

-658

76 178

274.05

344.80

In assessing the fair value of our unlisted investments, we

apply IFRS 13 and the International Private Equity and Ven-

ture Capital Valuation Guidelines, whereunder we make an

assessment to establish the valuation methods and points

of reference that are most suitable and relevant in deter-

mining the fair value of each of our unlisted investments.

Read more in Note 4 on pages 29-33.

MORE →

9View entire presentation