TPG Results Presentation Deck

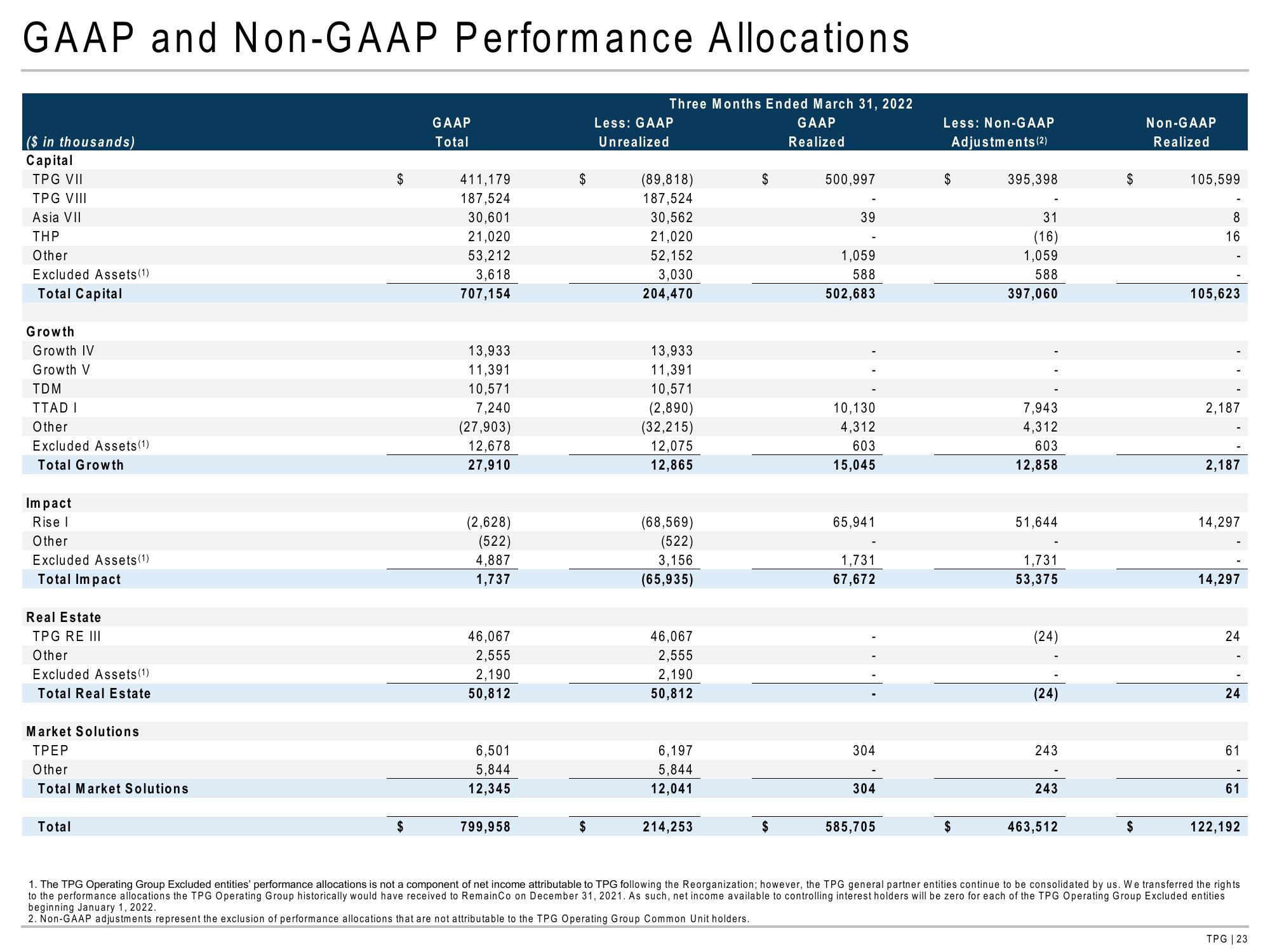

GAAP and Non-GAAP Performance Allocations

Three Months Ended March 31, 2022

GAAP

Realized

($ in thousands)

Capital

TPG VII

TPG VIII

Asia VII

THP

Other

Excluded Assets (1)

Total Capital

Growth

Growth IV

Growth V

TDM

TTAD I

Other

Excluded Assets (1)

Total Growth

Impact

Rise I

Other

Excluded Assets (1)

Total Impact

Real Estate

TPG RE III

Other

Excluded Assets (1)

Total Real Estate

Market Solutions

TPEP

Other

Total Market Solutions

Total

$

$

GAAP

Total

411,179

187,524

30,601

21,020

53,212

3,618

707,154

13,933

11,391

10,571

7,240

(27,903)

12,678

27,910

(2,628)

(522)

4,887

1,737

46,067

2,555

2,190

50,812

6,501

5,844

12,345

799,958

$

$

Less: GAAP

Unrealized

(89,818)

187,524

30,562

21,020

52,152

3,030

204,470

13,933

11,391

10,571

(2,890)

(32,215)

12,075

12,865

(68,569)

(522)

3,156

(65,935)

46,067

2,555

2,190

50,812

6,197

5,844

12,041

214,253

$

$

500,997

39

1,059

588

502,683

10,130

4,312

603

15,045

65,941

1,731

67,672

304

304

585,705

Less: Non-GAAP

Adjustments (2)

$

395,398

31

(16)

1,059

588

397,060

7,943

4,312

603

12,858

51,644

1,731

53,375

(24)

(24)

243

243

463,512

$

$

Non-GAAP

Realized

105,599

8

16

105,623

2,187

2,187

14,297

14,297

24

24

61

61

122,192

1. The TPG Operating Group Excluded entities' performance allocations is not a component of net income attributable to TPG following the Reorganization; however, the TPG general partner entities continue to be consolidated by us. We transferred the rights

to the performance allocations the TPG Operating Group historically would have received to RemainCo on December 31, 2021. As such, net income available to controlling interest holders will be zero for each of the TPG Operating Group Excluded entities

beginning January 1, 2022.

2. Non-GAAP adjustments represent the exclusion of performance allocations that are not attributable to the TPG Operating Group Common Unit holders.

TPG | 23View entire presentation