Cyxtera SPAC Presentation Deck

Cyxtera as a

Public Company

Key Benefits of the Transaction

Significant Leverage Reduction-Pro forma financial net leverage

halved to 2.8x

Substantial Incremental Liquidity-Availability increased to $395MM,

including cash and revolver. Additionally, SVAC may invest an

incremental $75MM under an optional share purchase agreement

Improved Cash Flow-Lower debt-service payments and higher

interest coverage

Enhanced Commercial Execution-Go to Market efforts greatly

supported by Public profile (publicity from announcement positively

impacting pipeline)

Cyxtera

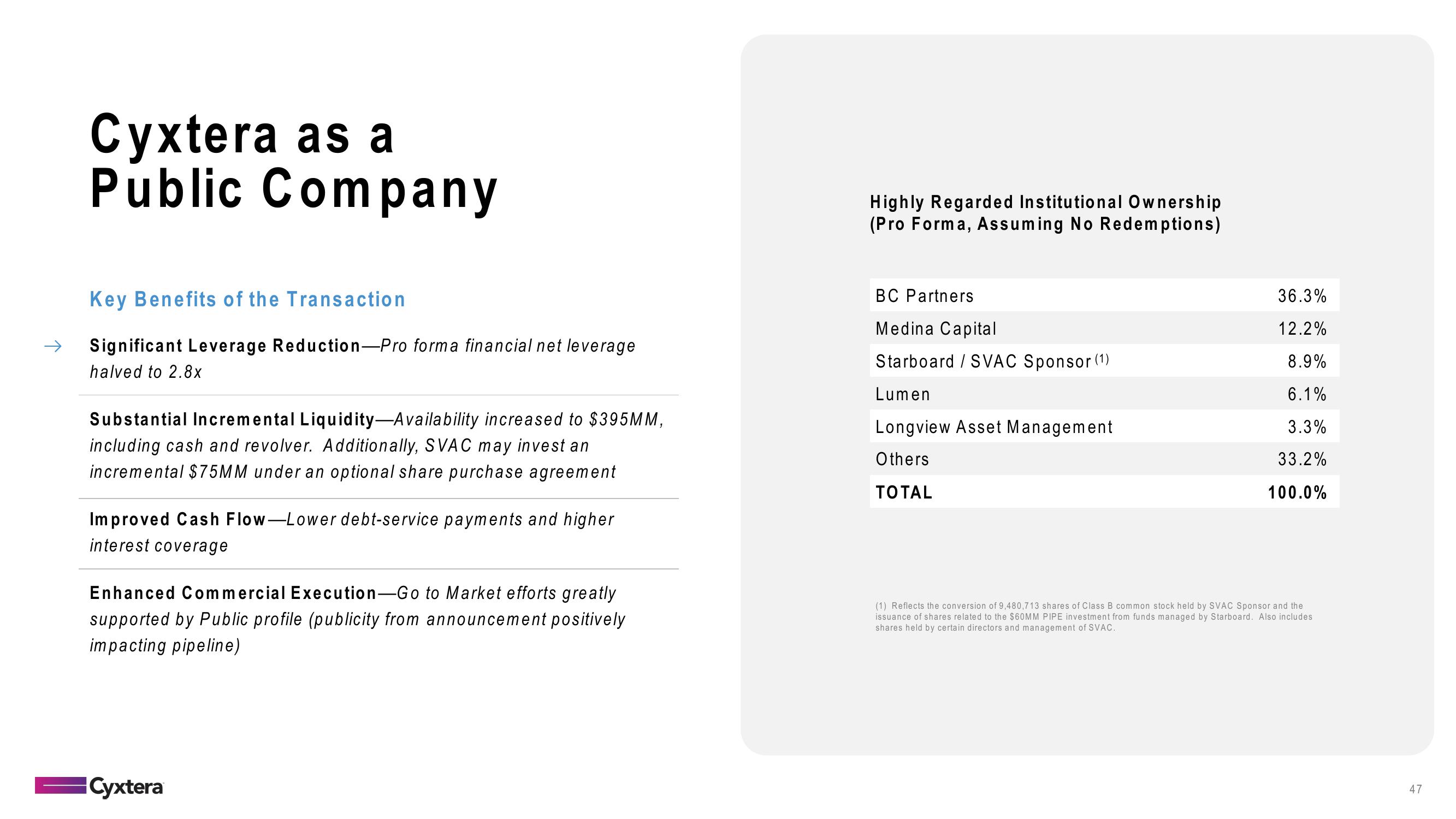

Highly Regarded Institutional Ownership

(Pro Forma, Assuming No Redemptions)

BC Partners

Medina Capital

Starboard/SVAC Sponsor (1)

Lumen

Longview Asset Management

Others

TOTAL

36.3%

12.2%

8.9%

6.1%

3.3%

33.2%

100.0%

(1) Reflects the conversion of 9,480,713 shares of Class B common stock held by SVAC Sponsor and the

issuance of shares related to the $60MM PIPE investment from funds managed by Starboard. Also includes

shares held by certain directors and management of SVAC.

47View entire presentation