Evercore Investment Banking Pitch Book

For

Reference Only

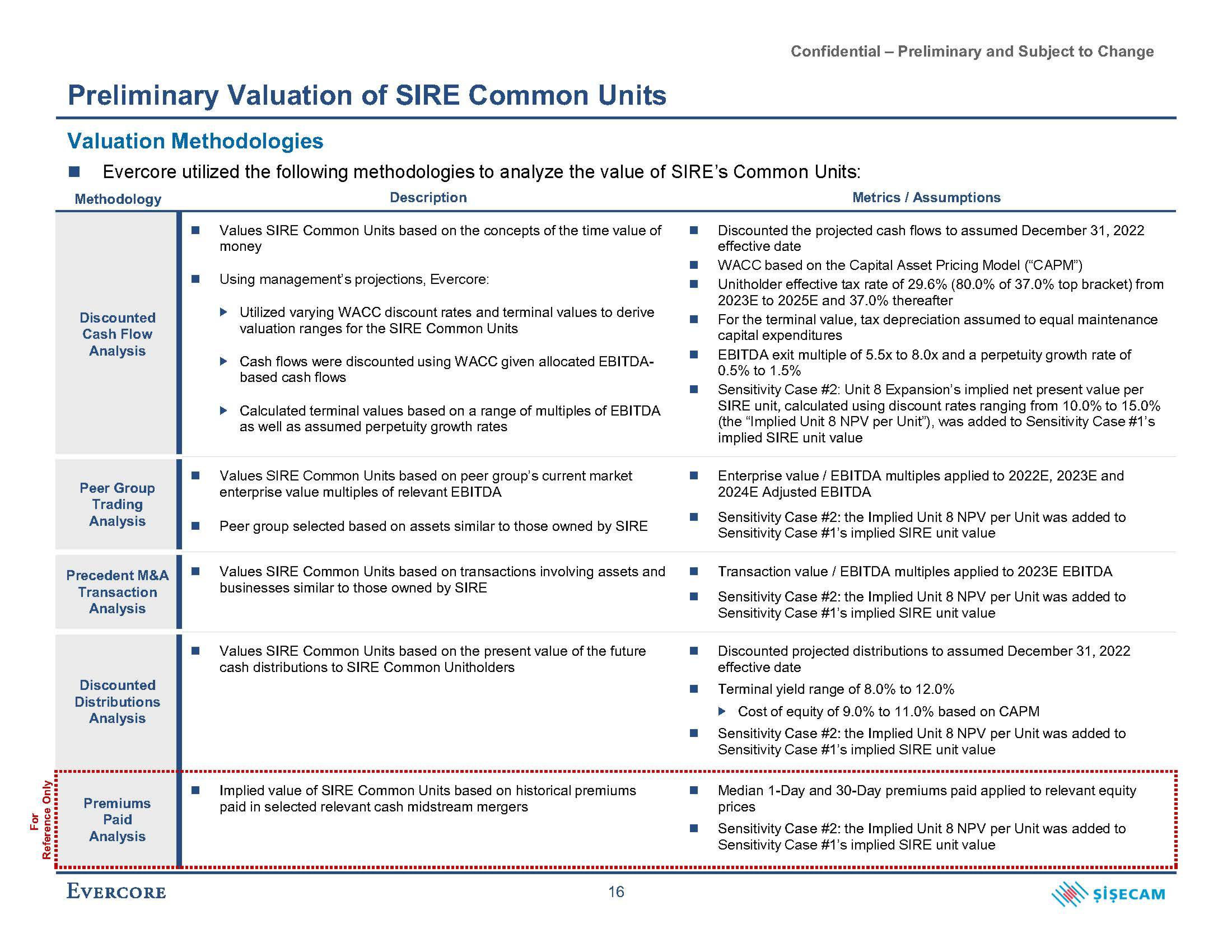

Preliminary Valuation of SIRE Common Units

Valuation Methodologies

Evercore utilized the following methodologies to analyze the value of SIRE's Common Units:

Methodology

Description

Discounted

Cash Flow

Analysis

Peer Group

Trading

Analysis

Precedent M&A

Transaction

Analysis

Discounted

Distributions

Analysis

Premiums

Paid

Analysis

EVERCORE

■ Values SIRE Common Units based on the concepts of the time value of

money

■ Using management's projections, Evercore:

► Utilized varying WACC discount rates and terminal values to derive

valuation ranges for the SIRE Common Units

■

► Cash flows were discounted using WACC given allocated EBITDA-

based cash flows

Values SIRE Common Units based on peer group's current market

enterprise value multiples of relevant EBITDA

■ Peer group selected based on assets similar to those owned by SIRE

■

► Calculated terminal values based on a range of multiples of EBITDA

as well as assumed perpetuity growth rates

Values SIRE Common Units based on transactions involving assets and

businesses similar to those owned by SIRE

Values SIRE Common Units based on the present value of the future

cash distributions to SIRE Common Unitholders

■ Implied value of SIRE Common Units based on historical premiums

paid in selected relevant cash midstream mergers

16

■

■

■

■

■

■

■

■

■

■

■

Confidential - Preliminary and Subject to Change

■

Metrics / Assumptions

Discounted the projected cash flows to assumed December 31, 2022

effective date

WACC based on the Capital Asset Pricing Model ("CAPM")

Unitholder effective tax rate of 29.6% (80.0% of 37.0% top bracket) from

2023E to 2025E and 37.0% thereafter

For the terminal value, tax depreciation assumed to equal maintenance

capital expenditures

EBITDA exit multiple of 5.5x to 8.0x and a perpetuity growth rate of

0.5% to 1.5%

Sensitivity Case #2: Unit 8 Expansion's implied net present value per

SIRE unit, calculated using discount rates ranging from 10.0% to 15.0%

(the "Implied Unit 8 NPV per Unit'"), was added to Sensitivity Case #1's

implied SIRE unit value

Enterprise value / EBITDA multiples applied to 2022E, 2023E and

2024E Adjusted EBITDA

Sensitivity Case #2: the Implied Unit 8 NPV per Unit was added to

Sensitivity Case #1's implied SIRE unit value

Transaction value / EBITDA multiples applied to 2023E EBITDA

Sensitivity Case #2: the Implied Unit 8 NPV per Unit was added to

Sensitivity Case #1's implied SIRE unit value

Discounted projected distributions to assumed December 31, 2022

effective date

Terminal yield range of 8.0% to 12.0%

Cost of equity of 9.0% to 11.0% based on CAPM

Sensitivity Case #2: the Implied Unit 8 NPV per Unit was added to

Sensitivity Case #1's implied SIRE unit value

Median 1-Day and 30-Day premiums paid applied to relevant equity

prices

Sensitivity Case #2: the Implied Unit 8 NPV per Unit was added to

Sensitivity Case #1's implied SIRE unit value

ŞİŞECAMView entire presentation