Q3 Fiscal 2019

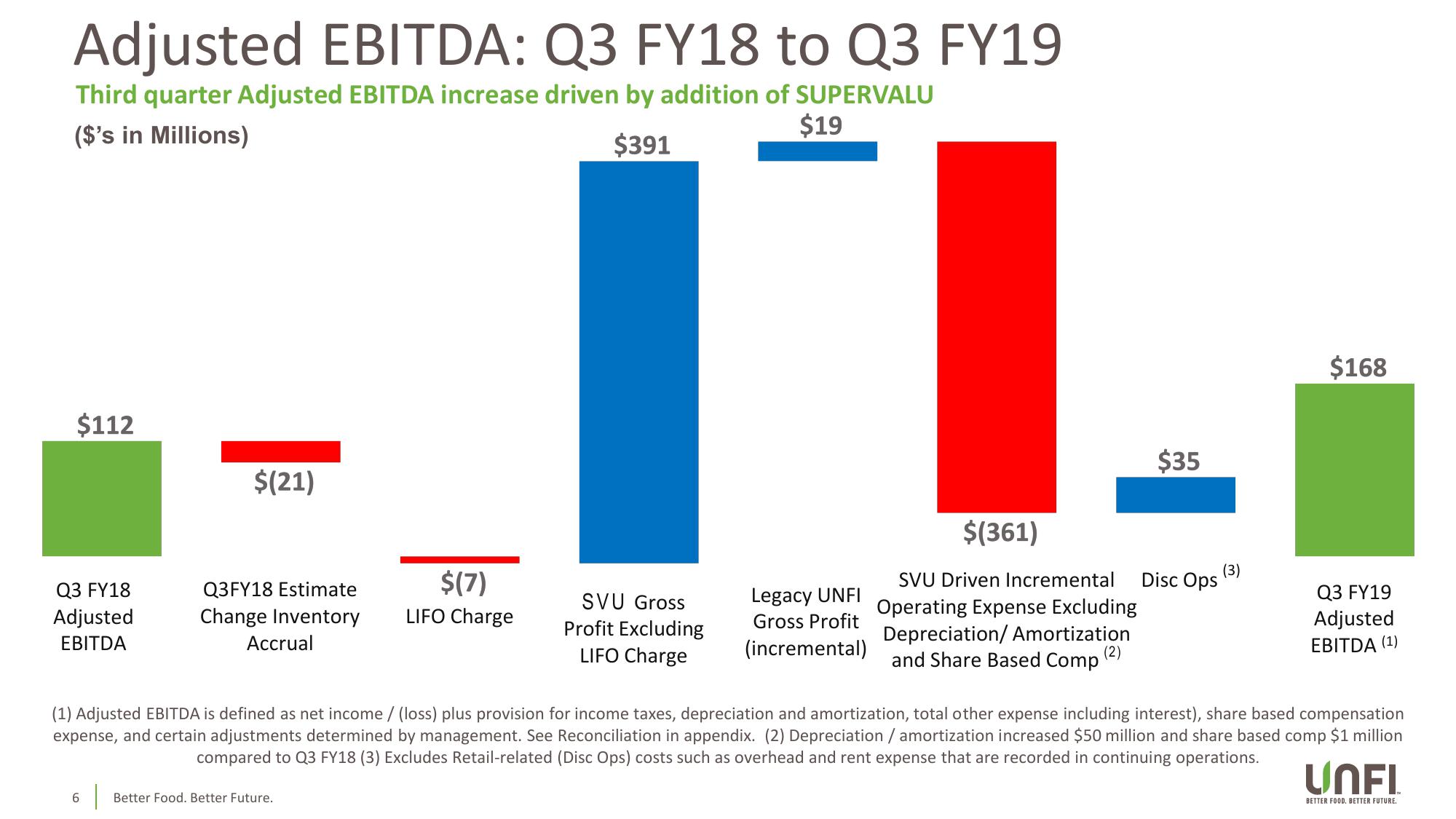

Adjusted EBITDA: Q3 FY18 to Q3 FY19

Third quarter Adjusted EBITDA increase driven by addition of SUPERVALU

($'s in Millions)

$19

$391

$112

Q3 FY18

Adjusted

EBITDA

$(21)

Q3FY18 Estimate

Change Inventory

Accrual

$(7)

LIFO Charge

6

T Better Food. Better Future.

SVU Gross

Profit Excluding

LIFO Charge

Legacy UNFI

Gross Profit

(incremental)

$(361)

SVU Driven Incremental

Operating Expense Excluding

Depreciation/ Amortization

and Share Based Comp (2)

$35

Disc Ops

(3)

$168

Q3 FY19

Adjusted

EBITDA (¹)

(1) Adjusted EBITDA is defined as net income / (loss) plus provision for income taxes, depreciation and amortization, total other expense including interest), share based compensation

expense, and certain adjustments determined by management. See Reconciliation in appendix. (2) Depreciation / amortization increased $50 million and share based comp $1 million

compared to Q3 FY18 (3) Excludes Retail-related (Disc Ops) costs such as overhead and rent expense that are recorded in continuing operations.

UNFL

BETTER FOOD. BETTER FUTURE.View entire presentation