Freyr SPAC Presentation Deck

Transaction Overview

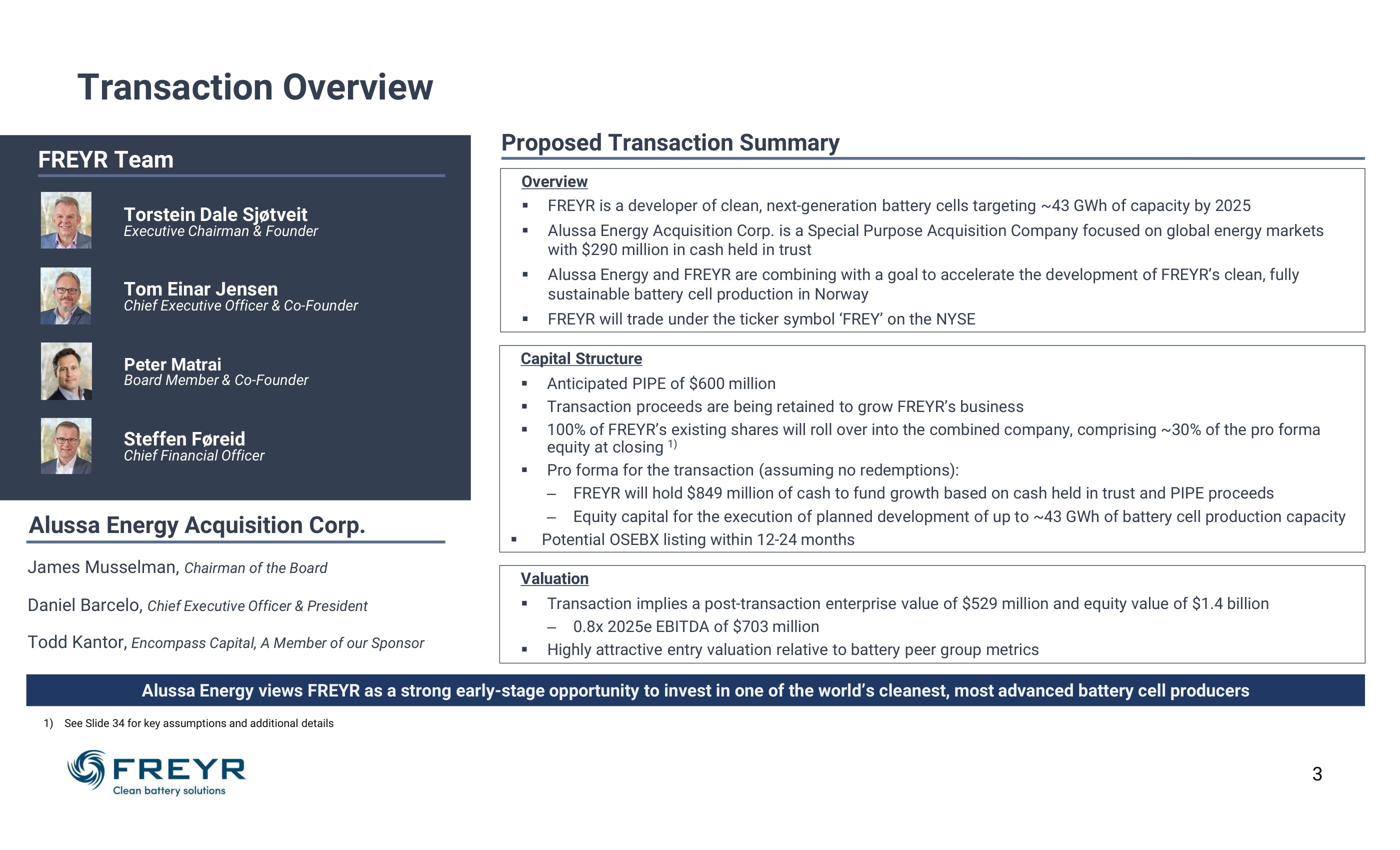

FREYR Team

Torstein Dale Sjøtveit

Executive Chairman & Founder

Tom Einar Jensen

Chief Executive Officer & Co-Founder

Peter Matrai

Board Member & Co-Founder

Steffen Føreid

Chief Financial Officer

Alussa Energy Acquisition Corp.

James Musselman, Chairman of the Board

Daniel Barcelo, Chief Executive Officer & President

Todd Kantor, Encompass Capital, A Member of our Sponsor

Proposed Transaction Summary

Overview

FREYR is a developer of clean, next-generation battery cells targeting ~43 GWh of capacity by 2025

Alussa Energy Acquisition Corp. is a Special Purpose Acquisition Company focused on global energy markets

with $290 million in cash held in trust

FREYR

Clean battery solutions

-

■

■

Capital Structure

■

Alussa Energy and FREYR are combining with a goal to accelerate the development of FREYR's clean, fully

sustainable battery cell production in Norway

FREYR will trade under the ticker symbol 'FREY' on the NYSE

■

I

Anticipated PIPE of $600 million

Transaction proceeds are being retained to grow FREYR's business

100% of FREYR's existing shares will roll over into the combined company, comprising ~30% of the pro forma

equity at closing ¹)

Pro forma for the transaction (assuming no redemptions):

FREYR will hold $849 million of cash to fund growth based on cash held in trust and PIPE proceeds

Valuation

Equity capital for the execution of planned development of up to ~43 GWh of battery cell production capacity

Potential OSEBX listing within 12-24 months

Transaction implies a post-transaction enterprise value of $529 million and equity value of $1.4 billion

0.8x 2025e EBITDA of $703 million

Highly attractive entry valuation relative to battery peer group metrics

Alussa Energy views FREYR as a strong early-stage opportunity to invest in one of the world's cleanest, most advanced battery cell producers

1) See Slide 34 for key assumptions and additional details

3View entire presentation