Blackwells Capital Activist Presentation Deck

CASE STUDIES - ASHLAND GLOBAL / AMBER ROAD

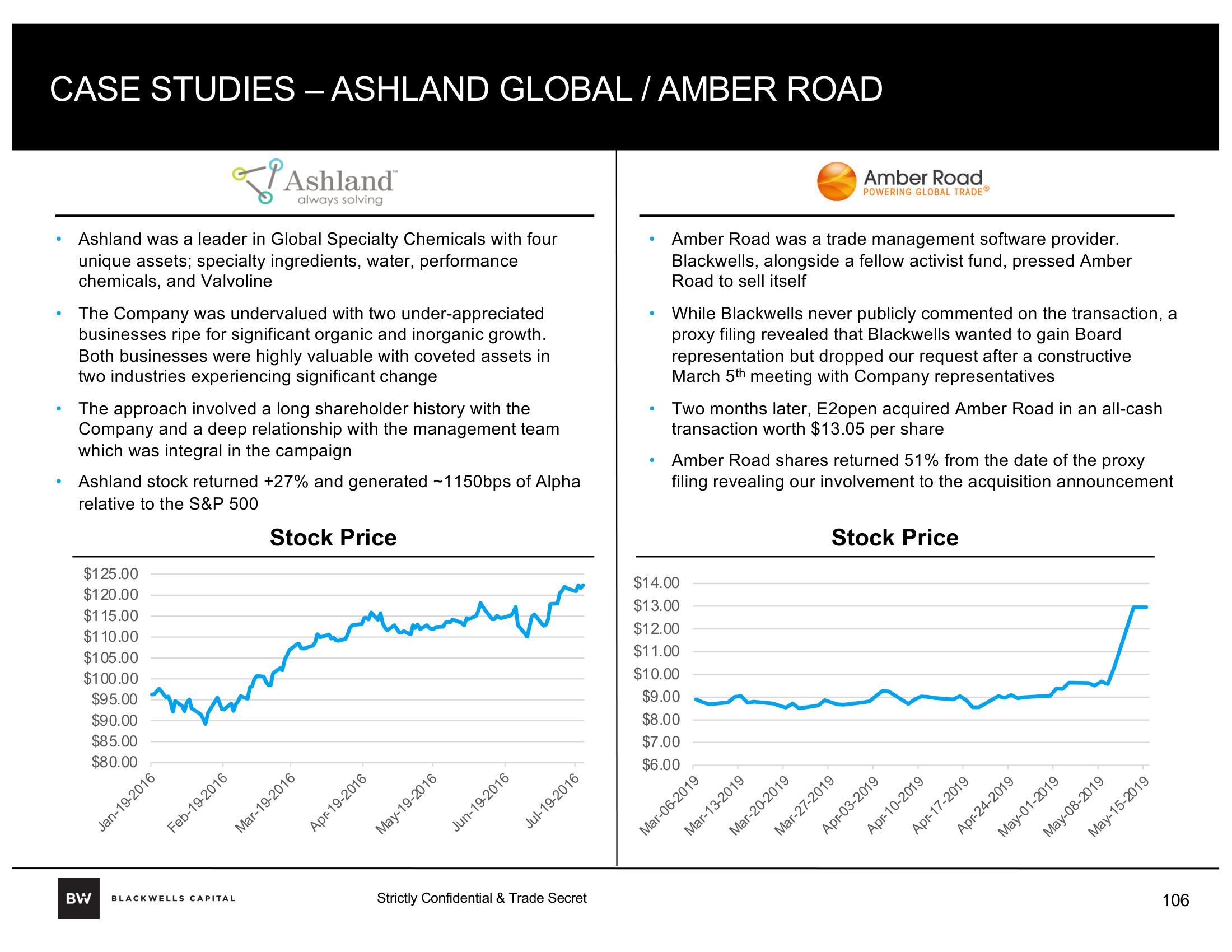

Ashland was a leader Global Specialty Chemicals with four

unique assets; specialty ingredients, water, performance

chemicals, and Valvoline

The Company was undervalued with two under-appreciated

businesses ripe for significant organic and inorganic growth.

Both businesses were highly valuable with coveted assets in

two industries experiencing significant change

The approach involved a long shareholder history with the

Company and a deep relationship with the management team

which was integral in the campaign

Ashland stock returned +27% and generated ~1150bps of Alpha

relative to the S&P 500

$125.00

$120.00

$115.00

$110.00

$105.00

$100.00

$95.00

$90.00

$85.00

$80.00

Ashland™

always solving

BW

Jan-19-2016

Feb-19-2016

BLACKWELLS CAPITAL

Stock Price

Mar-19-2016

Apr-19-2016

www.m

May-19-2016

Jun-19-2016

Jul-19-2016

Strictly Confidential & Trade Secret

●

●

Amber Road was a trade management software provider.

Blackwells, alongside a fellow activist fund, pressed Amber

Road to sell itself

While Blackwells never publicly commented on the transaction, a

proxy filing revealed that Blackwells wanted to gain Board

representation but dropped our request after a constructive

March 5th meeting with Company representatives

Two months later, E2open acquired Amber Road in an all-cash

transaction worth $13.05 per share

Amber Road shares returned 51% from the date of the proxy

filing revealing our involvement to the acquisition announcement

$14.00

$13.00

$12.00

$11.00

$10.00

$9.00

$8.00

$7.00

$6.00

Amber Road

POWERING GLOBAL TRADEⓇ

Mar-13-2019

Mar-06-2019

Mar-20-2019

Stock Price

Mar-27-2019

Apr-03-2019

Apr-10-2019

Apr-17-2019

Apr-24-2019

May-01-2019

May-08-2019

May-15-2019

106View entire presentation