Blackwells Capital Activist Presentation Deck

■

■

■

■

D

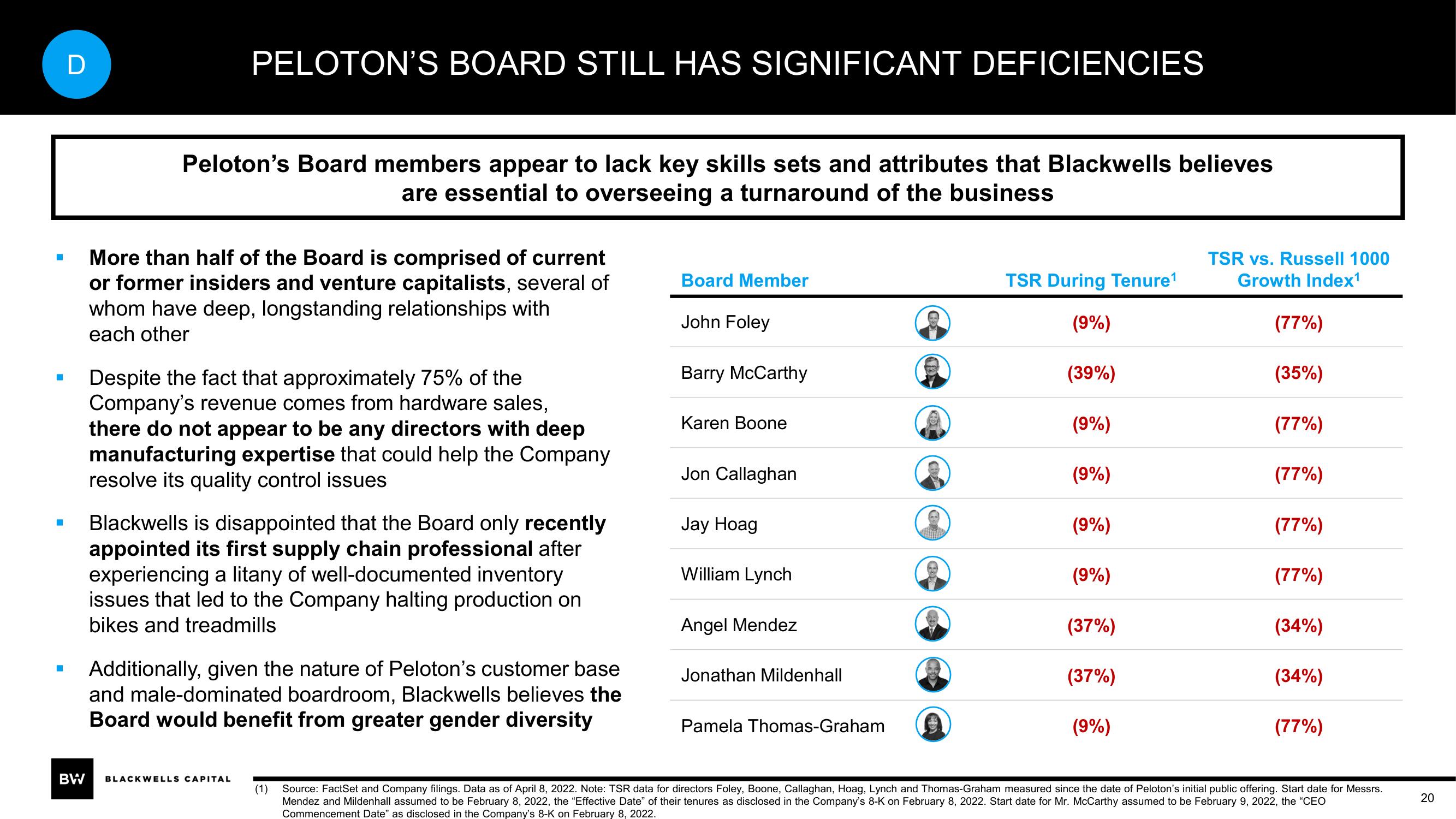

PELOTON'S BOARD STILL HAS SIGNIFICANT DEFICIENCIES

Peloton's Board members appear to lack key skills sets and attributes that Blackwells believes

are essential to overseeing a turnaround of the business

More than half of the Board is comprised of current

or former insiders and venture capitalists, several of

whom have deep, longstanding relationships with

each other

Despite the fact that approximately 75% of the

Company's revenue comes from hardware sales,

there do not appear to be any directors with deep

manufacturing expertise that could help the Company

resolve its quality control issues

Blackwells is disappointed that the Board only recently

appointed its first supply chain professional after

experiencing a litany of well-documented inventory

issues that led to the Company halting production on

bikes and treadmills

Additionally, given the nature of Peloton's customer base

and male-dominated boardroom, Blackwells believes the

Board would benefit from greater gender diversity

BW BLACKWELLS CAPITAL

Board Member

John Foley

Barry McCarthy

Karen Boone

Jon Callaghan

Jay Hoag

William Lynch

Angel Mendez

Jonathan Mildenhall

Pamela Thomas-Graham

TSR During Tenure¹

(9%)

(39%)

(9%)

(9%)

(9%)

(9%)

(37%)

(37%)

(9%)

TSR vs. Russell 1000

Growth Index¹

(77%)

(35%)

(77%)

(77%)

(77%)

(77%)

(34%)

(34%)

(77%)

(1) Source: FactSet and Company filings. Data as of April 8, 2022. Note: TSR data for directors Foley, Boone, Callaghan, Hoag, Lynch and Thomas-Graham measured since the date of Peloton's initial public offering. Start date for Messrs.

Mendez and Mildenhall assumed to be February 8, 2022, the "Effective Date" of their tenures as disclosed in the Company's 8-K on February 8, 2022. Start date for Mr. McCarthy assumed to be February 9, 2022, the "CEO

Commencement Date" as disclosed in the Company's 8-K on February 8, 2022.

20View entire presentation