XP Inc Results Presentation Deck

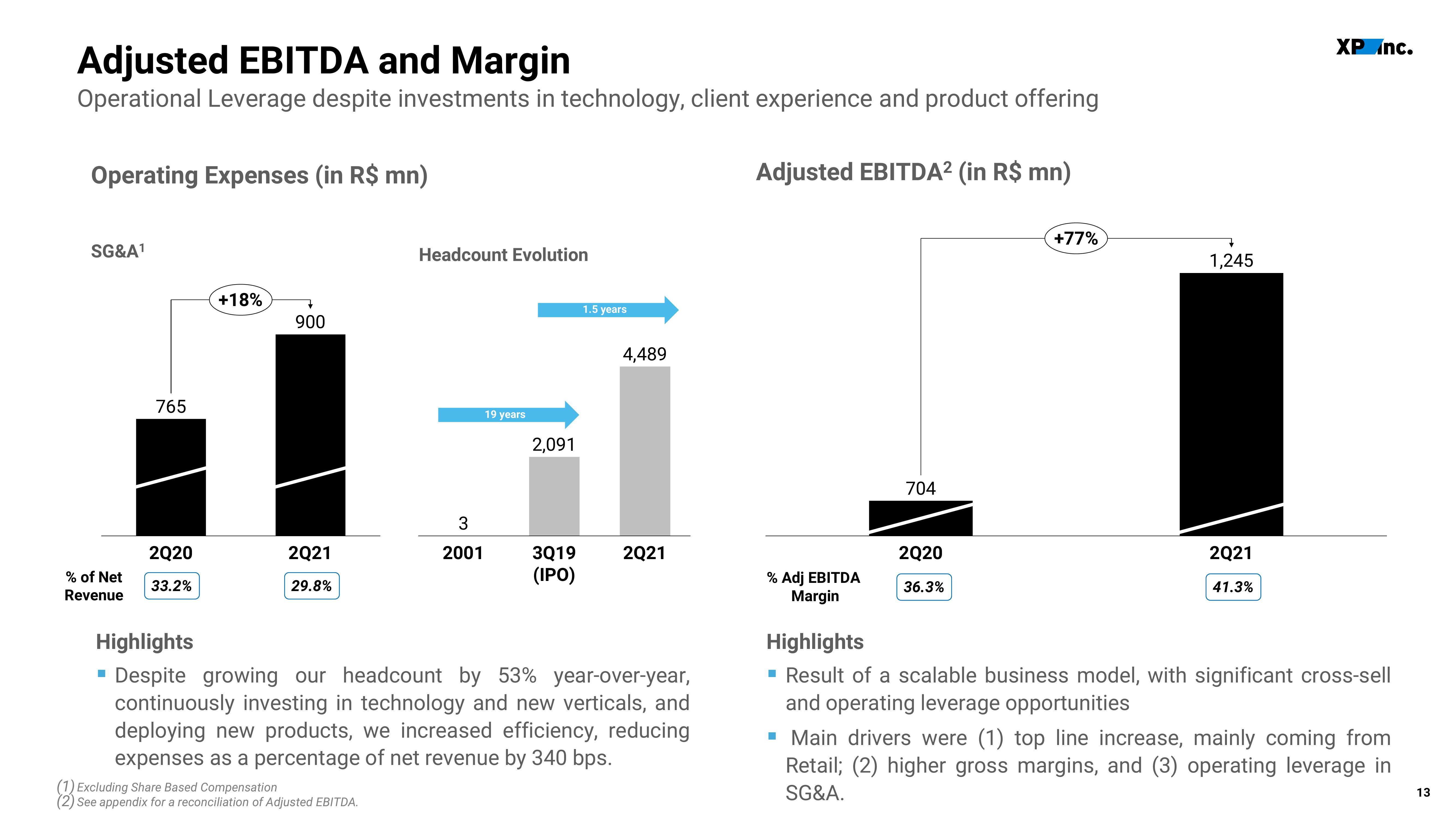

Adjusted EBITDA and Margin

Operational Leverage despite investments in technology, client experience and product offering

Operating Expenses (in R$ mn)

SG&A¹

% of Net

Revenue

765

■

2Q20

33.2%

+18%

900

2Q21

29.8%

Headcount Evolution

(2)

See appendix for a reconciliation of Adjusted EBITDA.

3

2001

19 years

2,091

3Q19

(IPO)

1.5 years

4,489

Highlights

Despite growing our headcount by 53% year-over-year,

continuously investing in technology and new verticals, and

deploying new products, we increased efficiency, reducing

expenses as a percentage of net revenue by 340 bps.

2Q21

Adjusted EBITDA² (in R$ mn)

% Adj EBITDA

Margin

704

2Q20

36.3%

+77%

1,245

2Q21

41.3%

XP Inc.

Highlights

▪ Result of a scalable business model, with significant cross-sell

and operating leverage opportunities

▪ Main drivers were (1) top line increase, mainly coming from

Retail; (2) higher gross margins, and (3) operating leverage in

SG&A.

13View entire presentation