CorpAcq SPAC Presentation Deck

2C

1

2

3

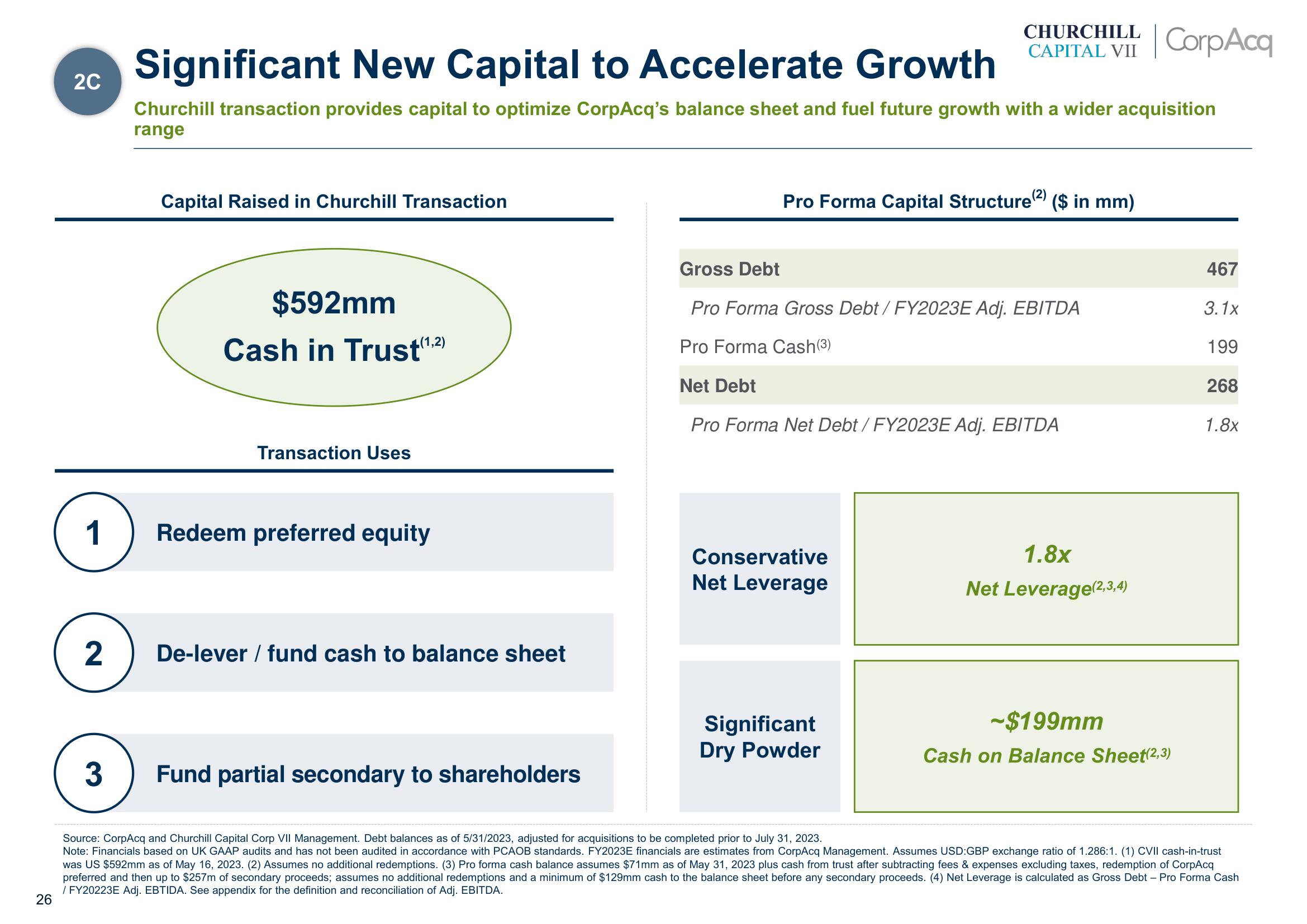

Significant New Capital to Accelerate Growth

Churchill transaction provides capital to optimize CorpAcq's balance sheet and fuel future growth with a wider acquisition

range

Capital Raised in Churchill Transaction

$592mm

Cash in Trust

Transaction Uses

(1,2)

Redeem preferred equity

De-lever/fund cash to balance sheet

Fund partial secondary to shareholders

CHURCHILL

CAPITAL VII CorpAcq

Pro Forma Capital Structure) ($ in mm)

Gross Debt

Pro Forma Gross Debt / FY2023E Adj. EBITDA

Pro Forma Cash(3)

Net Debt

Pro Forma Net Debt / FY2023E Adj. EBITDA

Conservative

Net Leverage

Significant

Dry Powder

1.8x

Net Leverage(2,3,4)

~$199mm

Cash on Balance Sheet(2,3)

467

3.1x

199

268

1.8x

Source: CorpAcq and Churchill Capital Corp VII Management. Debt balances as of 5/31/2023, adjusted for acquisitions to be completed prior to July 31, 2023.

Note: Financials based on UK GAAP audits and has not been audited in accordance with PCAOB standards. FY2023E financials are estimates from CorpAcq Management. Assumes USD:GBP exchange ratio of 1.286:1. (1) CVII cash-in-trust

was US $592mm as of May 16, 2023. (2) Assumes no additional redemptions. (3) Pro forma cash balance assumes $71mm as of May 31, 2023 plus cash from trust after subtracting fees & expenses excluding taxes, redemption of CorpAcq

preferred and then up to $257m of secondary proceeds; assumes no additional redemptions and a minimum of $129mm cash to the balance sheet before any secondary proceeds. (4) Net Leverage is calculated as Gross Debt - Pro Forma Cash

/ FY20223E Adj. EBTIDA. See appendix for the definition and reconciliation of Adj. EBITDA.

26View entire presentation