UBS Fixed Income Presentation Deck

Legal structure and capital position

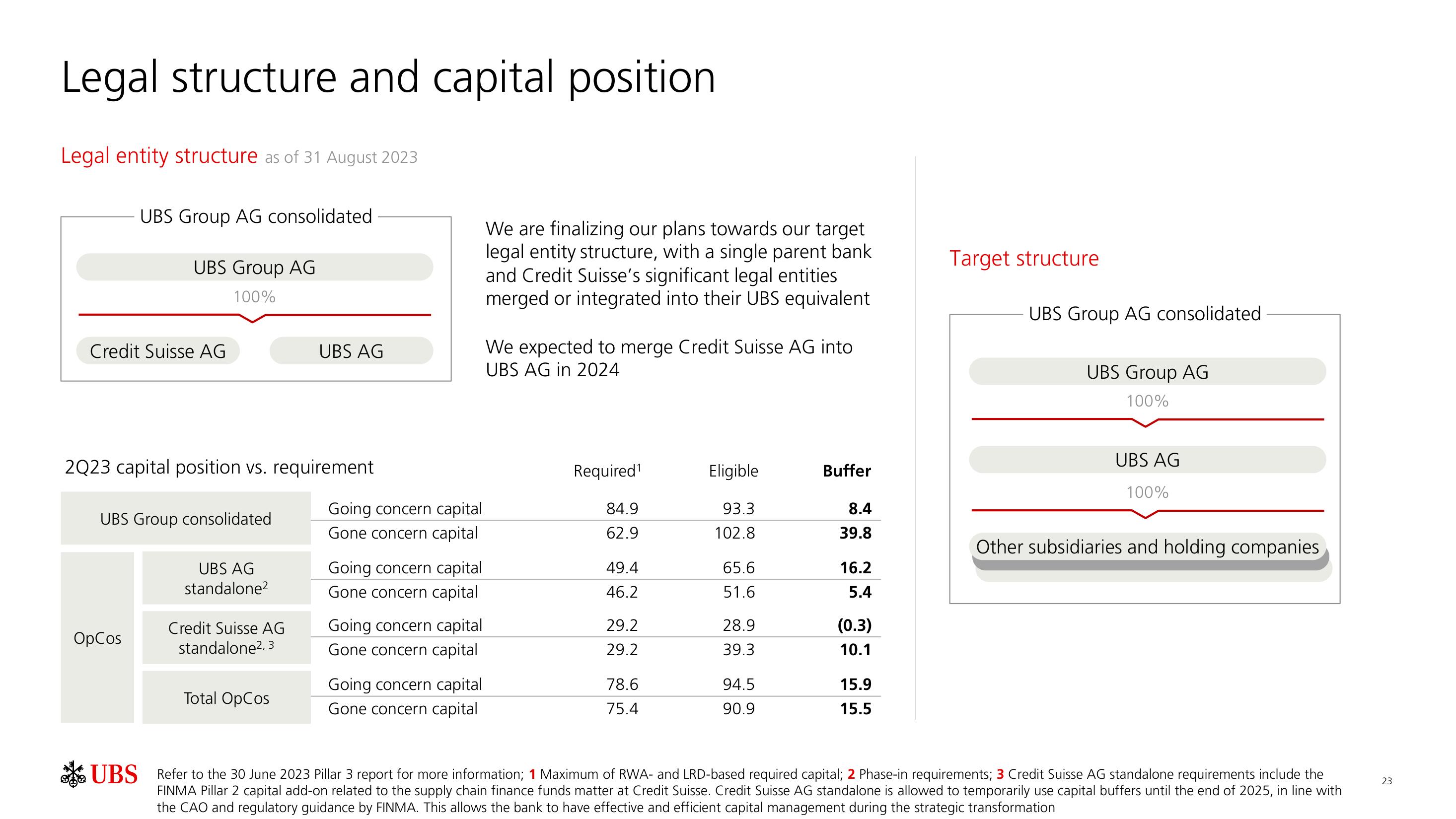

Legal entity structure as of 31 August 2023

UBS Group AG consolidated

Credit Suisse AG

UBS Group AG

100%

OpCos

2Q23 capital position vs. requirement

UBS Group consolidated

UBS

UBS AG

standalone²

Credit Suisse AG

standalone2, 3

UBS AG

Total OpCos

Going concern capital

Gone concern capital

Going concern capital

Gone concern capital

Going concern capital

Gone concern capital

Going concern capital

Gone concern capital

We are finalizing our plans towards our target

legal entity structure, with a single parent bank

and Credit Suisse's significant legal entities

merged or integrated into their UBS equivalent

We expected to merge Credit Suisse AG into

UBS AG in 2024

Required ¹

84.9

62.9

49.4

46.2

29.2

29.2

78.6

75.4

Eligible

93.3

102.8

65.6

51.6

28.9

39.3

94.5

90.9

Buffer

8.4

39.8

16.2

5.4

(0.3)

10.1

15.9

15.5

Target structure

UBS Group AG consolidated

UBS Group AG

100%

UBS AG

100%

Other subsidiaries and holding companies

Refer to the 30 June 2023 Pillar 3 report for more information; 1 Maximum of RWA- and LRD-based required capital; 2 Phase-in requirements; 3 Credit Suisse AG standalone requirements include the

FINMA Pillar 2 capital add-on related to the supply chain finance funds matter at Credit Suisse. Credit Suisse AG standalone is allowed to temporarily use capital buffers until the end of 2025, in line with

the CAO and regulatory guidance by FINMA. This allows the bank to have effective and efficient capital management during the strategic transformation

23View entire presentation