Nikola Results Presentation Deck

1 3

PAGE

NIKOLA

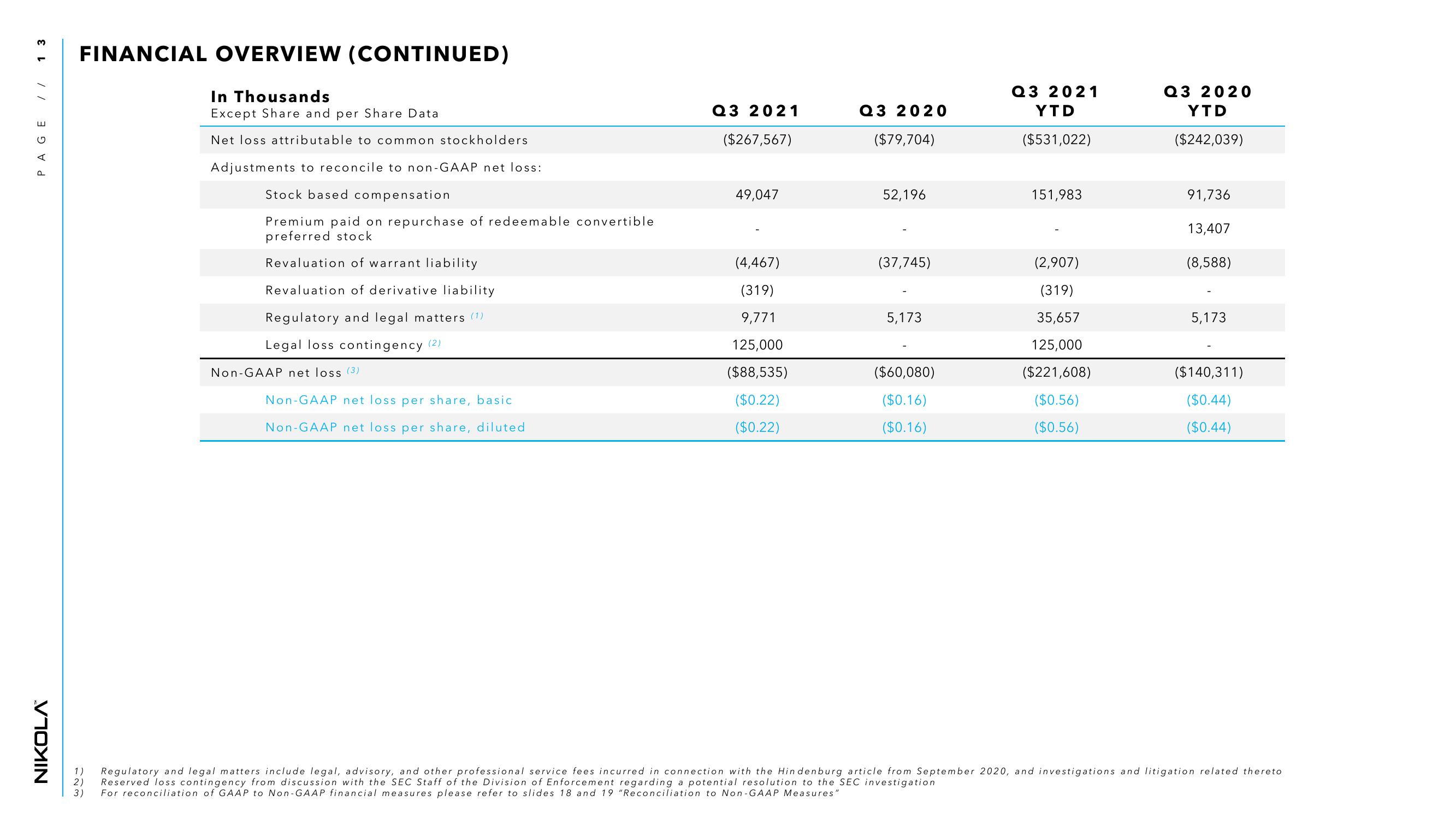

FINANCIAL OVERVIEW (CONTINUED)

1)

2)

123

3)

In Thousands

Except Share and per Share Data

Net loss attributable to common stockholders

Adjustments to reconcile to non-GAAP net loss:

Stock based compensation

Premium paid on repurchase of redeemable convertible

preferred stock

Revaluation of warrant liability

Revaluation of derivative liability

Regulatory and legal matters (1)

Legal loss contingency (2)

Non-GAAP net loss (3)

Non-GAAP net loss per share, basic

Non-GAAP net loss per share, diluted

Q3 2021

($267,567)

49,047

(4,467)

(319)

9,771

125,000

($88,535)

($0.22)

($0.22)

Q3 2020

($79,704)

52,196

(37,745)

5,173

($60,080)

($0.16)

($0.16)

Q3 2021

YTD

($531,022)

151,983

(2,907)

(319)

35,657

125,000

($221,608)

($0.56)

($0.56)

Q3 2020

YTD

($242,039)

91,736

13,407

(8,588)

5,173

($140,311)

($0.44)

($0.44)

Regulatory and legal matters include legal, advisory, and other professional service fees incurred in connection with the Hindenburg article from September 2020, and investigations and litigation related thereto

Reserved loss contingency from discussion with the SEC Staff of the Division of Enforcement regarding a potential resolution to the SEC investigation

For reconciliation of GAAP to Non-GAAP financial measures please refer to slides 18 and 19 "Reconciliation to Non-GAAP Measures"View entire presentation