Metals Company SPAC

BETTER METALS FOR EVs

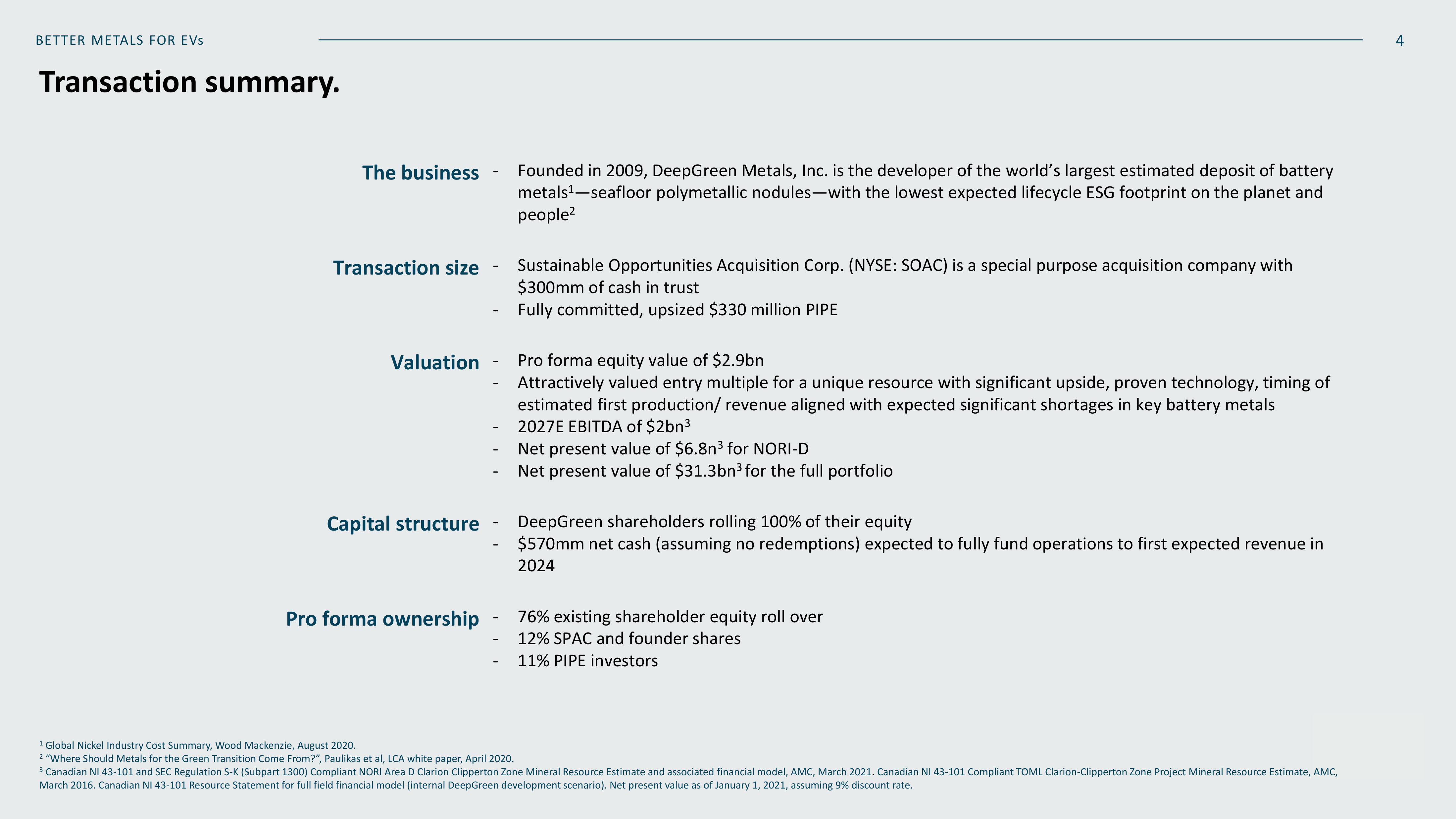

Transaction summary.

The business

Transaction size

Valuation

Capital structure

Pro forma ownership

-

Founded in 2009, DeepGreen Metals, Inc. is the developer of the world's largest estimated deposit of battery

metals ¹-seafloor polymetallic nodules-with the lowest expected lifecycle ESG footprint on the planet and

people²

Sustainable Opportunities Acquisition Corp. (NYSE: SOAC) is a special purpose acquisition company with

$300mm of cash in trust

Fully committed, upsized $330 million PIPE

Pro forma equity value of $2.9bn

Attractively valued entry multiple for a unique resource with significant upside, proven technology, timing of

estimated first production/ revenue aligned with expected significant shortages in key battery metals

2027E EBITDA of $2bn³

Net present value of $6.8n³ for NORI-D

Net present value of $31.3bn³ for the full portfolio

DeepGreen shareholders rolling 100% of their equity

$570mm net cash (assuming no redemptions) expected to fully fund operations to first expected revenue in

2024

76% existing shareholder equity roll over

12% SPAC and founder shares

11% PIPE investors

¹ Global Nickel Industry Cost Summary, Wood Mackenzie, August 2020.

2 "Where Should Metals for the Green Transition Come From?", Paulikas et al, LCA white paper, April 2020.

3 Canadian NI 43-101 and SEC Regulation S-K (Subpart 1300) Compliant NORI Area D Clarion Clipperton Zone Mineral Resource Estimate and associated financial model, AMC, March 2021. Canadian NI 43-101 Compliant TOML Clarion-Clipperton Zone Project Mineral Resource Estimate, AMC,

March 2016. Canadian NI 43-101 Resource Statement for full field financial model (internal DeepGreen development scenario). Net present value as of January 1, 2021, assuming 9% discount rate.

4View entire presentation