Pathward Financial Results Presentation Deck

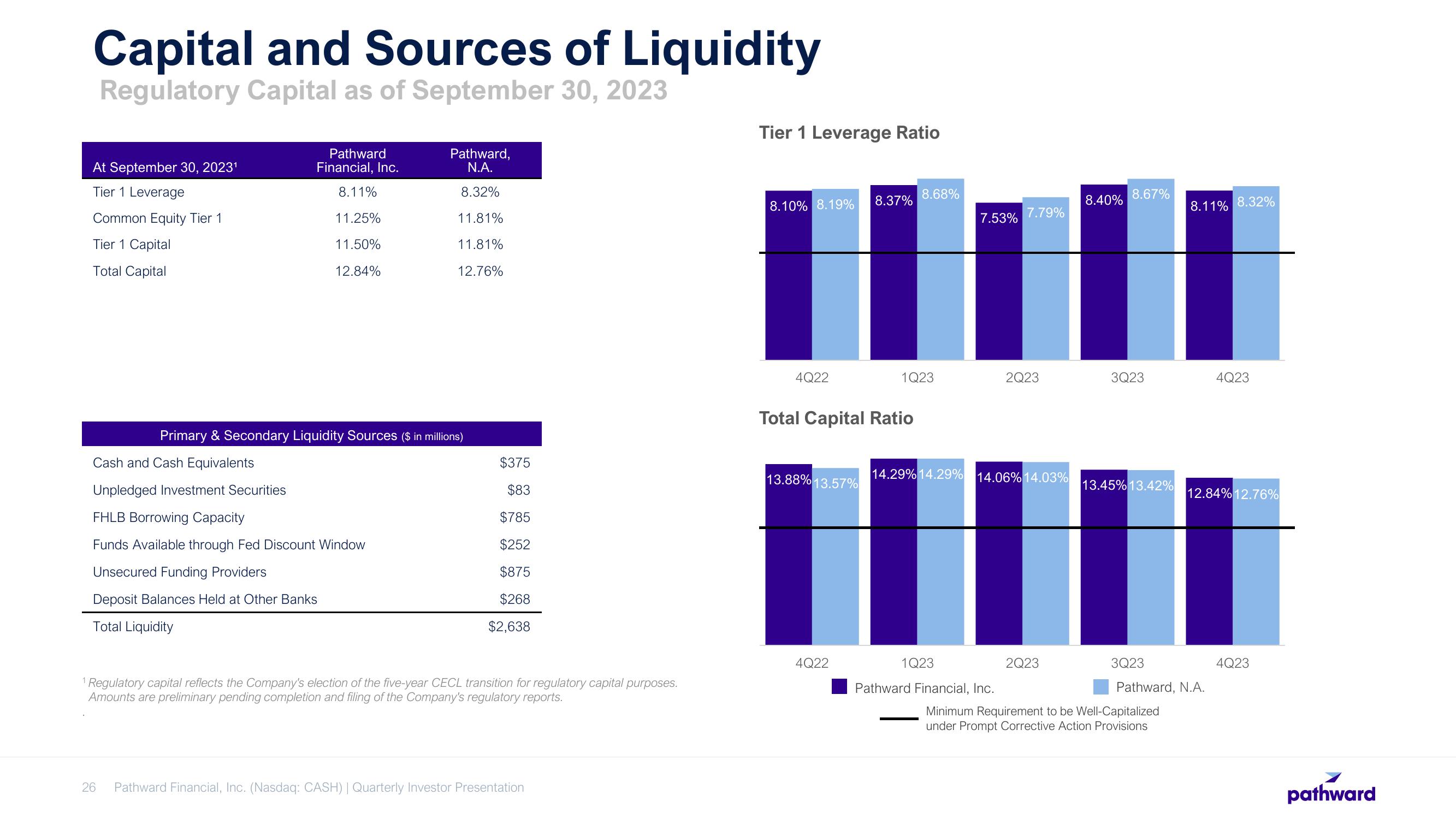

Capital and Sources of Liquidity

Regulatory Capital as of September 30, 2023

At September 30, 2023¹

Tier 1 Leverage

Common Equity Tier 1

Tier 1 Capital

Total Capital

Pathward

Financial, Inc.

8.11%

11.25%

11.50%

12.84%

Pathward,

N.A.

8.32%

11.81%

11.81%

12.76%

Primary & Secondary Liquidity Sources ($ in millions)

Cash and Cash Equivalents

Unpledged Investment Securities

FHLB Borrowing Capacity

Funds Available through Fed Discount Window

Unsecured Funding Providers

Deposit Balances Held at Other Banks

Total Liquidity

$375

$83

$785

$252

$875

$268

$2,638

¹ Regulatory capital reflects the Company's election of the five-year CECL transition for regulatory capital purposes.

Amounts are preliminary pending completion and filing of the Company's regulatory reports.

26 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

Tier 1 Leverage Ratio

8.10% 8.19%

8.37%

HI

4Q22

Total Capital Ratio

13.88% 13.57%

8.68%

4Q22

1Q23

7.53%

1Q23

7.79%

14.29% 14.29% 14.06% 1

Pathward Financial, Inc.

2Q23

2Q23

3%

8.40%

8.67%

3Q23

13.45% 13.42%

3Q23

8.11% 8.32%

Minimum Requirement to be Well-Capitalized

under Prompt Corrective Action Provisions

Pathward, N.A.

4Q23

12.84% 12.76%

4Q23

pathwardView entire presentation