J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

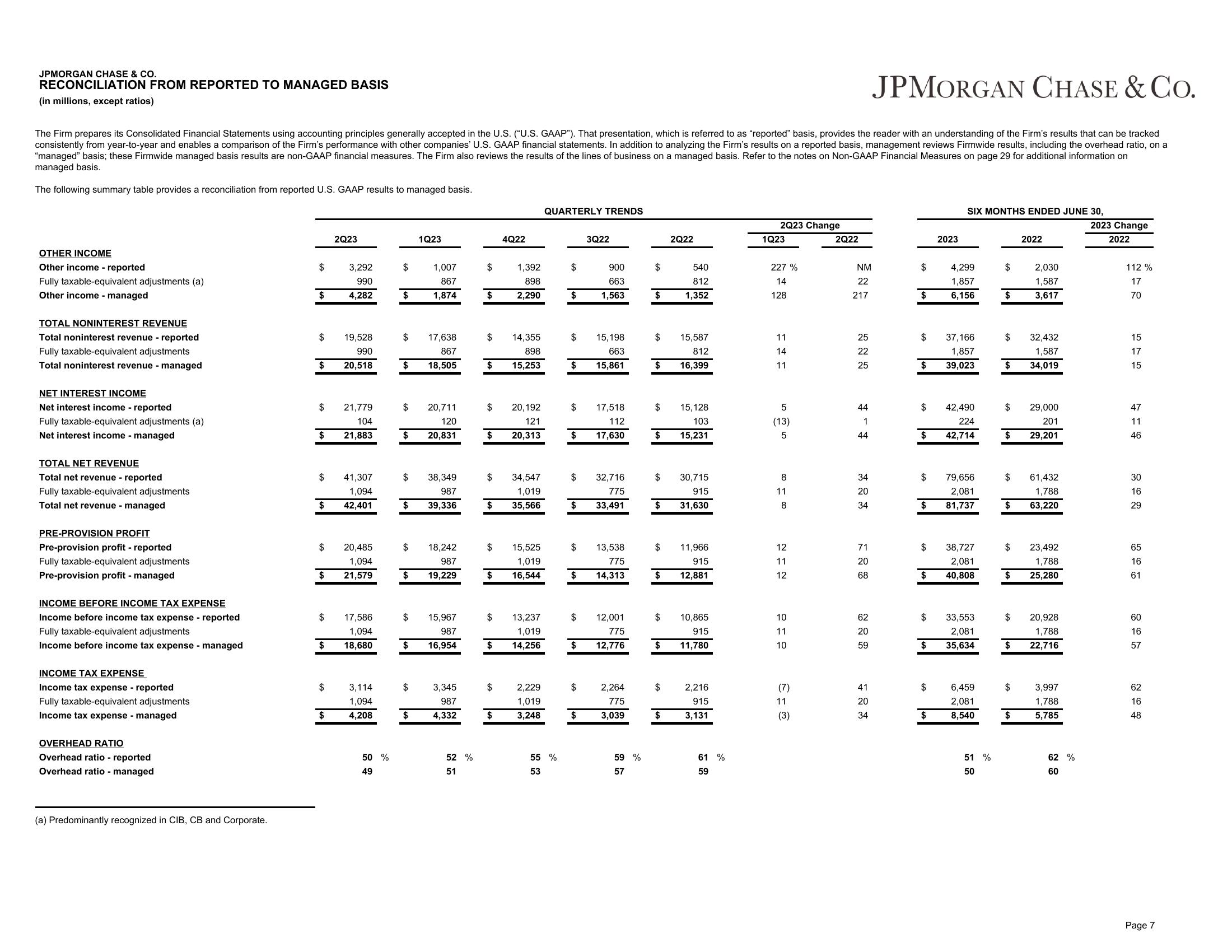

RECONCILIATION FROM REPORTED TO MANAGED BASIS

(in millions, except ratios)

JPMORGAN CHASE & CO.

The Firm prepares its Consolidated Financial Statements using accounting principles generally accepted in the U.S. ("U.S. GAAP"). That presentation, which is referred to as "reported" basis, provides the reader with an understanding of the Firm's results that can be tracked

consistently from year-to-year and enables a comparison of the Firm's performance with other companies' U.S. GAAP financial statements. In addition to analyzing the Firm's results on a reported basis, management reviews Firmwide results, including the overhead ratio, on a

"managed" basis; these Firmwide managed basis results are non-GAAP financial measures. The Firm also reviews the results of the lines of business on a managed basis. Refer to the notes on Non-GAAP Financial Measures on page 29 for additional information on

managed basis.

The following summary table provides a reconciliation from reported U.S. GAAP results to managed basis.

OTHER INCOME

Other income - reported

Fully taxable-equivalent adjustments (a)

Other income - managed

TOTAL NONINTEREST REVENUE

Total noninterest revenue reported

Fully taxable-equivalent adjustments

Total noninterest revenue managed

NET INTEREST INCOME

Net interest income - reported

Fully taxable-equivalent adjustments (a)

Net interest income-managed

TOTAL NET REVENUE

Total net revenue - reported

Fully taxable-equivalent adjustments

Total net revenue - managed

PRE-PROVISION PROFIT

Pre-provision profit - reported

Fully taxable-equivalent adjustments

Pre-provision profit - managed

INCOME BEFORE INCOME TAX EXPENSE

Income before income tax expense reported

Fully taxable-equivalent adjustments

Income before income tax expense managed

INCOME TAX EXPENSE

Income tax expense - reported

Fully taxable-equivalent adjustments

Income tax expense - managed

OVERHEAD RATIO

Overhead ratio - reported

Overhead ratio - managed

(a) Predominantly recognized in CIB, CB and Corporate.

$

$

$

$

$

$ 21,779

104

$ 21,883

$

$ 41,307

1,094

42,401

$

$

$

2Q23

$

3,292

990

4,282

$

19,528

990

20,518

20,485

1,094

21,579

17,586

1,094

18,680

3,114

1,094

4,208

50 %

49

$

$

$

$

$

$

$

$

$

1Q23

$

1,007

867

1,874

$

17,638

867

18,505

20,711

120

20,831

18,242

987

$ 19,229

38,349

987

39,336

$ 15,967

987

16,954

3,345

987

$ 4,332

52 %

51

$ 1,392

898

2,290

$

$

14,355

898

$ 15,253

$

$

$

34,547

1,019

$ 35,566

$

$

4Q22

$

$

$

20,192

121

20,313

15,525

1,019

16,544

13,237

1,019

14,256

2,229

1,019

3,248

QUARTERLY TRENDS

55 %

53

$

$

$

$

$

$

$

$

$

$

$

$

3Q22

$ 13,538

775

14,313

$

900

663

1,563

15,198

663

15,861

17,518

112

17,630

32,716

775

33,491

12,001

775

12,776

2,264

775

3,039

59 %

57

$

$

$

$

$

$

$

$

$

$

$

$

$

$

2Q22

540

812

1,352

15,587

812

16,399

15,128

103

15,231

30,715

915

31,630

11,966

915

12,881

10,865

915

11,780

2,216

915

3,131

61 %

59

2Q23 Change

1Q23

227 %

14

128

11

14

11

5

(13)

5

8

11

8

12

11

12

10

11

10

(7)

11

(3)

2Q22

NM

22

217

25

22

25

44

1

44

34

20

34

71

20

68

62

20

59

41

20

34

$

$

$

$

$

$

$

$

$

$

$ 79,656

2,081

$ 81,737

$

2023

$

SIX MONTHS ENDED JUNE 30,

4,299

1,857

6,156

37,166

1,857

39,023

42,490

224

42,714

38,727

2,081

40,808

33,553

2,081

35,634

6,459

2,081

8,540

51 %

50

$

$

$

$

$

$

$

$

$

$

$

$

$

$

2022

2,030

1,587

3,617

32,432

1,587

34,019

29,000

201

29,201

61,432

1,788

63,220

23,492

1,788

25,280

20,928

1,788

22,716

3,997

1,788

5,785

62 %

60

2023 Change

2022

112 %

17

70

15

17

15

47

11

46

30

16

29

65

16

61

60

16

57

62

16

48

Page 7View entire presentation