Apollo Global Management Investor Presentation Deck

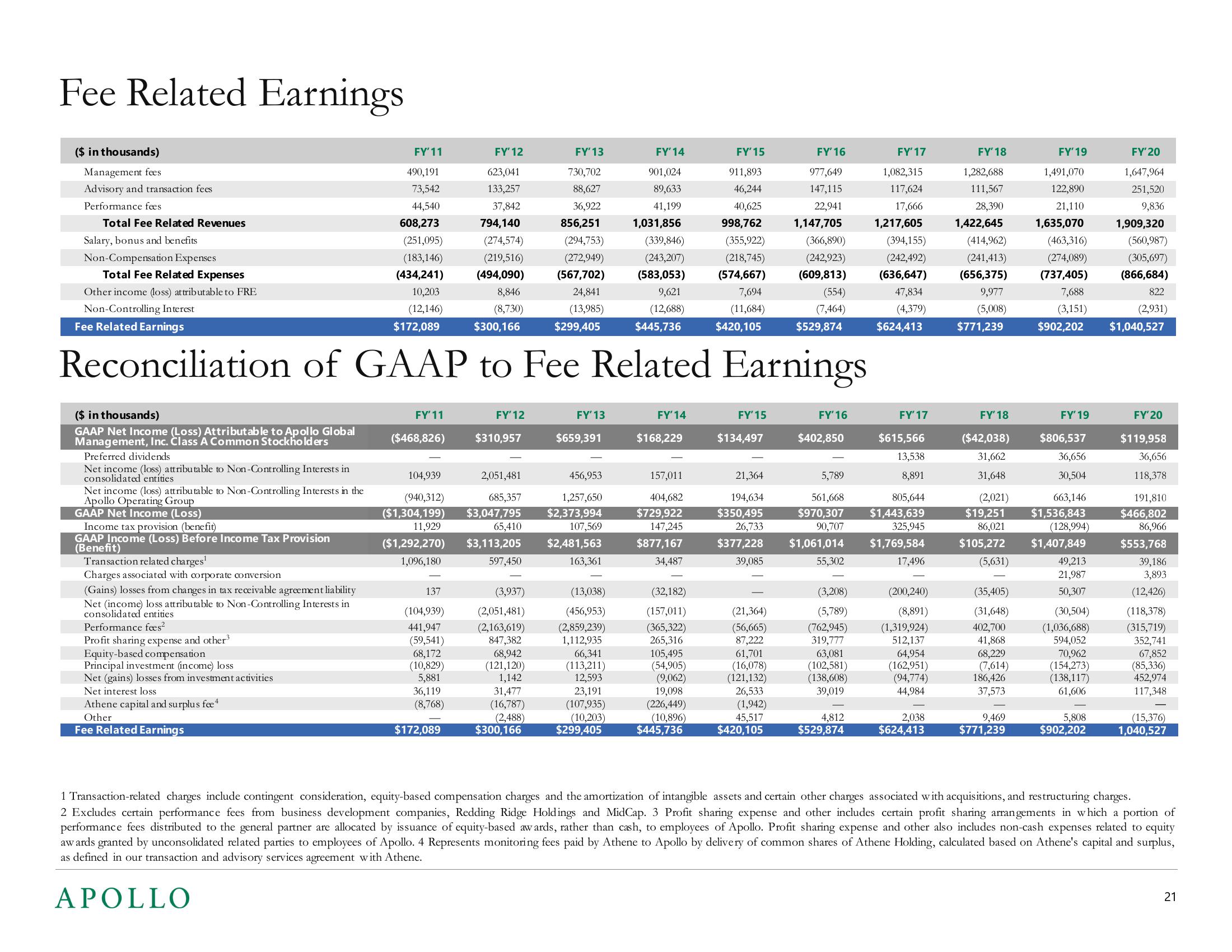

Fee Related Earnings

($ in thousands)

Management fees

Advisory and transaction fees

Performance fees

Total Fee Related Revenues

Salary, bonus and benefits

Non-Compensation Expenses

FY'11

490,191

73,542

44,540

608,273

(251,095)

(183,146)

(434,241)

10,203

(12,146)

8,846

Non-Controlling Interest

(8,730)

Fee Related Earnings

$172,089

$300,166

Reconciliation of GAAP to Fee Related Earnings

Total Fee Related Expenses

Other income (loss) attributable to FRE

($ in thousands)

GAAP Net Income (Loss) Attributable to Apollo Global

Management, Inc. Class A Common Stockholders

Preferred dividends

Net income (loss) attributable to Non-Controlling Interests in

consolidated entities

Net income (loss) attributable to Non-Controlling Interests in the

Apollo Operating Group

GAAP Net Income (Loss)

Income tax provision (benefit)

GAAP Income (Loss) Before Income Tax Provision

(Benefit)

Transaction related charges¹

Charges associated with corporate conversion

(Gains) losses from changes in tax receivable agreement liability

Net (income) loss attributable to Non-Controlling Interests in

consolidated entities

Performance fees²

Profit sharing expense and other³

Equity-based compensation

Principal investment (income) loss

Net (gains) losses from investment activities

Net interest loss

Athene capital and surplus fee*

Other

Fee Related Earnings

FY' 11

($468,826)

104,939

(940,312)

($1,304,199)

11,929

($1,292,270)

1,096,180

137

(104,939)

441,947

(59,541)

68,172

(10,829)

5,881

36,119

(8,768)

$172,089

FY' 12

623,041

133,257

37,842

794,140

(274,574)

(219,516)

(494,090)

FY' 12

$310,957

2,051,481

685,357

$3,047,795

65,410

$3,113,205

597,450

(3,937)

(2,051,481)

(2,163,619)

847,382

68,942

(121,120)

1,142

31,477

(16,787)

(2,488)

$300,166

FY' 13

730,702

88,627

36,922

856,251

(294,753)

(272,949)

(567,702)

24,841

(13,985)

$299,405

FY' 13

$659,391

456,953

1,257,650

$2,373,994

107,569

$2,481,563

163,361

(13,038)

(456,953)

(2,859,239)

1,112,935

66,341

(113,211)

12,593

23,191

(107,935)

(10,203)

$299,405

FY' 14

901,024

89,633

41,199

1,031,856

(339,846)

(243,207)

(583,053)

9,621

(12,688)

$445,736

FY' 14

$168,229

157,011

404,682

$729,922

147,245

$877,167

34,487

(32,182)

(157,011)

(365,322)

265,316

105,495

(54,905)

(9,062)

19,098

(226,449)

(10,896)

$445,736

FY'15

911,893

46,244

40,625

998,762

(355,922)

(218,745)

(574,667)

7,694

(11,684)

$420,105

FY'15

$134,497

FY' 16

977,649

147,115

22,941

1,147,705

(366,890)

(242,923)

(609,813)

(21,364)

(56,665)

87,222

61,701

(16,078)

(121,132)

26,533

(1,942)

45,517

$420,105

(554)

(7,464)

$529,874

FY' 16

$402,850

FY' 17

$615,566

5,789

13,538

21,364

8,891

194,634

561,668

805,644

$350,495 $970,307 $1,443,639

26,733

90,707

325,945

$377,228 $1,061,014 $1,769,584

39,085

55,302

17,496

(3,208)

(5,789)

(762,945)

319,777

63,081

(102,581)

(138,608)

39,019

FY' 17

1,082,315

117,624

17,666

1,217,605

(394,155)

(242,492)

(636,647)

47,834

(4,379)

$624,413

4,812

$529,874

(200,240)

(8,891)

(1,319,924)

512,137

64,954

(162,951)

(94,774)

44,984

2,038

$624,413

FY' 18

1,282,688

111,567

28,390

1,422,645

(414,962)

(241,413)

(656,375)

9,977

(5,008)

$771,239

FY' 18

($42,038)

31,662

FY' 19

$806,537

36,656

30,504

31,648

(2,021)

663,146

$19,251 $1,536,843

86,021

(128,994)

$105,272 $1,407,849

(5,631)

49,213

21,987

50,307

(30,504)

(1,036,688)

594,052

70,962

(154,273)

(138,117)

61,606

(35,405)

(31,648)

402,700

41,868

68,229

(7,614)

186,426

37,573

FY' 19

1,491,070

122,890

21,110

1,635,070

(463,316)

(274,089)

(737,405)

7,688

(3,151)

$902,202

9,469

$771,239

5,808

$902,202

FY'20

1,647,964

251,520

9,836

1,909,320

(560,987)

(305,697)

(866,684)

822

(2,931)

$1,040,527

FY'20

$119,958

36,656

118,378

191,810

$466,802

86,966

$553,768

39,186

3,893

(12,426)

(118,378)

(315,719)

352,741

67,852

(85,336)

452,974

117,348

(15,376)

1,040,527

1 Transaction-related charges include contingent consideration, equity-based compensation charges and the amortization of intangible assets and certain other charges associated with acquisitions, and restructuring charges.

2 Excludes certain performance fees from business development companies, Redding Ridge Holdings and MidCap. 3 Profit sharing expense and other includes certain profit sharing arrangements in which a portion of

performance fees distributed to the general partner are allocated by issuance of equity-based awards, rather than cash, to employees of Apollo. Profit sharing expense and other also includes non-cash expenses related to equity

awards granted by unconsolidated related parties to employees of Apollo. 4 Represents monitoring fees paid by Athene to Apollo by delivery of common shares of Athene Holding, calculated based on Athene's capital and surplus,

as defined in our transaction and advisory services agreement with Athene.

APOLLO

21View entire presentation