Zenvia IPO

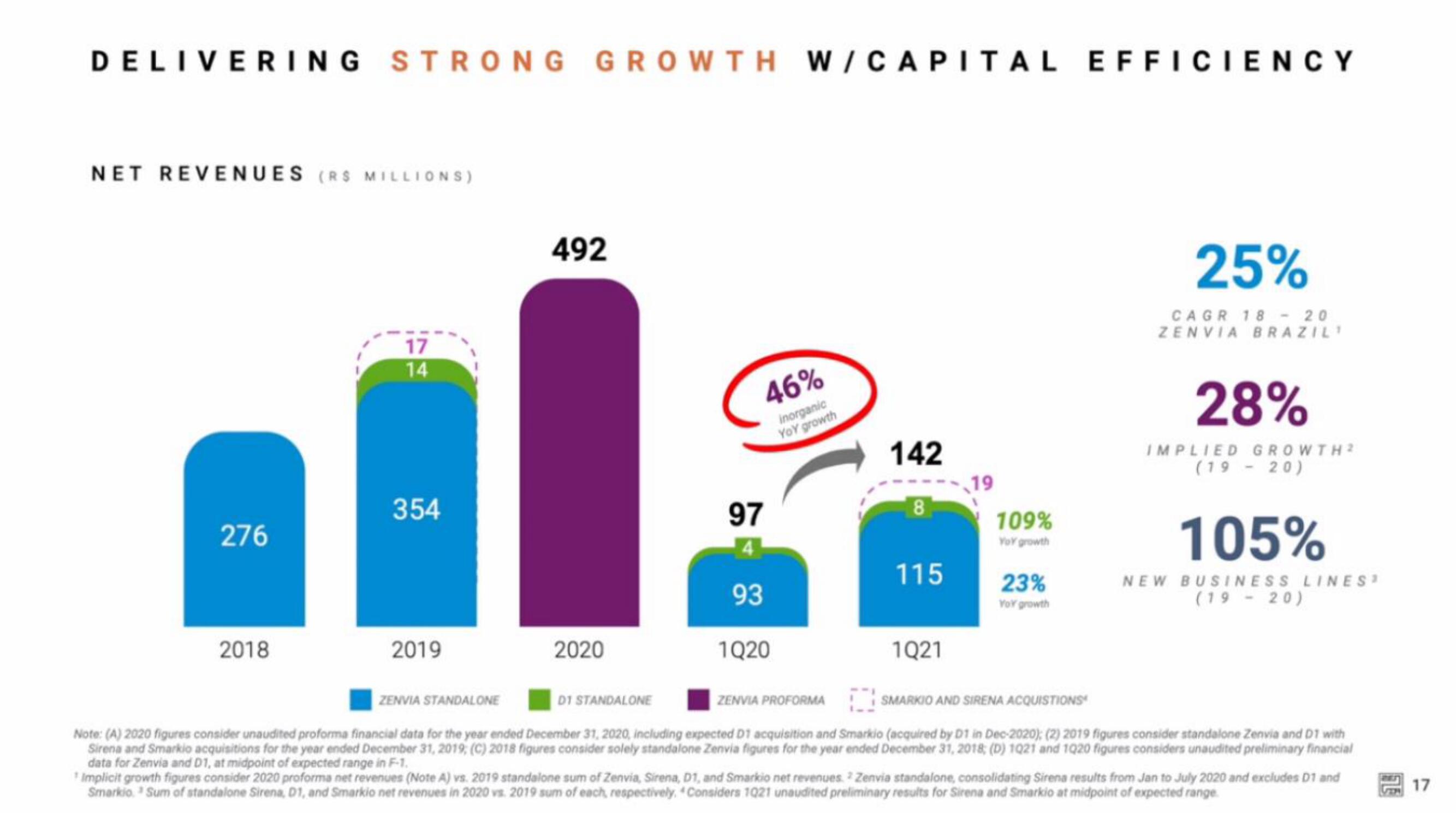

DELIVERING STRONG GROWTH W/CAPITAL EFFICIENCY

NET REVENUES (RS MILLIONS)

276

2018

17

14

354

2019

492

2020

46%

inorganic

YOY growth

97

4

93

1020

142

8

115

1Q21

19

109%

Yoy growth

23%

Voy growth

25%

CAGR 18 20

ZENVIA BRAZILI

28%

IMPLIED GROWTH 2

(19 - 20)

105%

NEW BUSINESS LINES

(19-20)

ZENVIA STANDALONE

D1 STANDALONE

ZENVIA PROFORMA

SMARKIO AND SIRENA ACQUISTIONS

Note: (A) 2020 figures consider unaudited proforma financial data for the year ended December 31, 2020, including expected D1 acquisition and Smarkio (acquired by D1 in Dec-2020); (2) 2019 figures consider standalone Zenvia and D1 with

Sirena and Smarkio acquisitions for the year ended December 31, 2019; (C) 2018 figures consider solely standalone Zenvia figures for the year ended December 31, 2018; (D) 1021 and 1020 figures considers unaudited preliminary financial

data for Zenvia and D1, at midpoint of expected range in F-1.

¹ Implicit growth figures consider 2020 proforma net revenues (Note A) vs. 2019 standalone sum of Zenvia, Sirena, D1, and Smarkio net revenues Zenvia standalone, consolidating Sirena results from Jan to July 2020 and excludes D1 and

Smarkio. Sum of standalone Sirena, D1, and Smarkio net revenues in 2020 vs. 2019 sum of each, respectively. Considers 1021 unaudited preliminary results for Sirena and Smarkio at midpoint of expected range.

17View entire presentation