Allwyn Investor Update

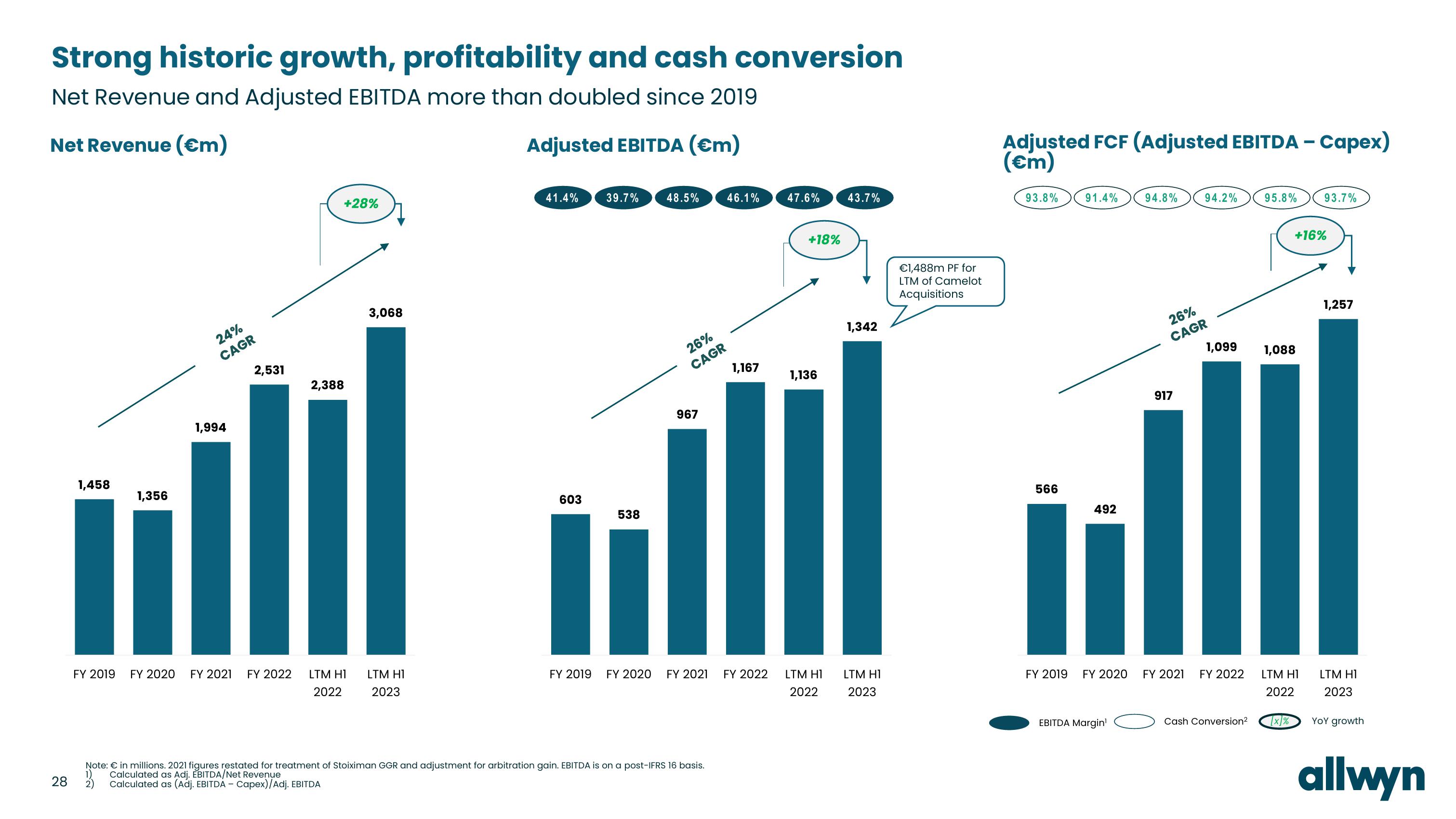

Strong historic growth, profitability and cash conversion

Net Revenue and Adjusted EBITDA more than doubled since 2019

Net Revenue (€m)

Adjusted EBITDA (€m)

28

1,458

FY 2019

1,356

24%

CAGR

1,994

2,531

2,388

+28%

3,068

FY 2020 FY 2021 FY 2022 LTM H1 LTM H1

2023

2022

41.4%

603

39.7% 48.5%

538

26%

CAGR

967

46.1%

Note: € in millions. 2021 figures restated for treatment of Stoiximan GGR and adjustment for arbitration gain. EBITDA is on a post-IFRS 16 basis.

1) Calculated as Adj. EBITDA/Net Revenue

2)

Calculated as (Adj. EBITDA - Capex)/Adj. EBITDA

1,167

FY 2019 FY 2020 FY 2021 FY 2022

47.6%

+18%

1,136

LTM H1

2022

43.7%

1,342

LTM H1

2023

€1,488m PF for

LTM of Camelot

Acquisitions

Adjusted FCF (Adjusted EBITDA - Capex)

(€m)

93.8%

91.4%

566

492

11

FY 2019

FY 2020

EBITDA Margin¹

94.8%

26%

CAGR

917

FY 2021

94.2%

FY 2022

95.8%

1,099 1,088

Cash Conversion²

+16%

93.7%

LTM H1

2022

[x]%

1,257

LTM H1

2023

YOY growth

allwynView entire presentation