Deutsche Bank Results Presentation Deck

Sustainability

Q3 2023 highlights

Recent achievements

St.

Sustainable

Finance

Policies &

Commitments

People &

Own

Operations

Thought

Leadership &

Stakeholder

Engagement

> Increased Sustainable Finance volumes by € 11bn to € 265bn¹ (cumulative since 2020)

> Launched new € 400m loan portfolio in cooperation with the European Investment Bank to support mid-sized companies with their

sustainable transformation ambitions; eligible companies in the European Union will be able to apply for long-term loans through

Deutsche Bank to finance their transition

> Acted as mandated lead arranger, underwriter, bookrunner and sustainability structuring agent on the Australian $4.6bn sustainability-

linked loan (SLL) for Air Trunk, a hyperscale date center specialist, to refinance its first SLL in 2021

> Participated in a € 3bn sustainability-linked financing for Energias de Portugal, supporting their decarbonization and renewables ramp

up (Corporate Bank)

> Joint bookrunner for Volkswagen Leasing's € 2bn triple-tranche inaugural Green Bond offering, intended use of proceeds relating to

leasing contracts for individual Battery Electric Vehicles; issuance occurred under their ICMA² Green Bond Principles-aligned

Framework, for which DB acted as joint ESG coordinator (Investment Bank O&A)

> Acted as lead arranger and sole bookrunner for a $ 125m senior secured committed warehouse facility to Redaptive to deploy Energy-

as-a-Service solutions for its sustainability programs (Investment Bank FIC)

> Published the Green Financing Instruments Report for 2022 including allocation reporting and impact reporting on Deutsche Bank's

Green Asset Pool and Liabilities

> Published DB's initial Transition Plan as well as net-zero pathways for three additional carbon-intensive industries in the bank's

corporate loan portfolio on October 19; the publication marks two further milestones in Deutsche Bank's Net-Zero Banking Alliance

(NZBA) commitments

> Developed regional sustainability governance concept as supplement to existing Deutsche Bank matrix structure and as accelerator for

sustainability transformation in regions globally - governance model successfully integrated in first major regions and countries; rolled

out in EMEA region and APAC in advanced stage

> Published global playbooks to all regional functions to standardize best in class processes and initiatives across energy, waste and water

> Hosted international leaders from business, government and civil society to showcase global climate action during Climate Week in New

York City, e.g. Net Zero Banking Alliance

> Set up a new Nature Advisory Panel in October, which aims to help the bank assess nature-related risks and identify new financial

product offerings tied to the challenge of reversing biodiversity loss

> Hosted an 'Environmental Sustainability Week' coinciding with this year's Earth Overshoot Day to explore a selection of efforts that can

contribute to a more sustainable society

> Disclosed ESG sector reports, i.e. Oil & Gas, Utilities, Metals & Mining, on Deutsche Bank Research website

Notes: for footnotes refer to slides 38 and 39

Deutsche Bank

Investor Relations

Q3 2023 Fixed Income Investor Call

October 27, 2023

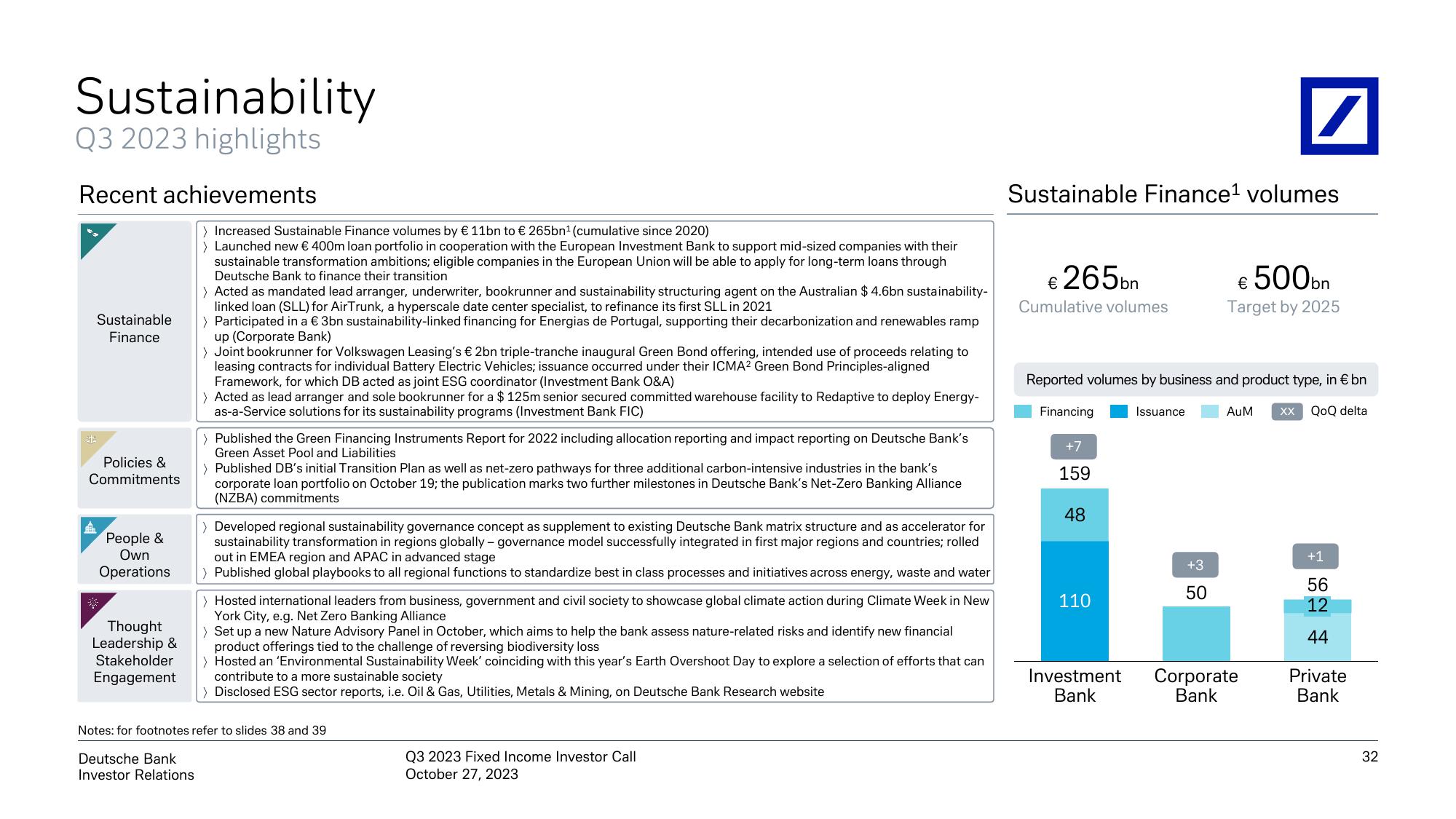

Sustainable Finance¹ volumes

€ 265bn

Cumulative volumes

Reported volumes by business and product type, in € bn

Financing

XX QoQ delta

+7

159

48

110

Investment

Bank

Issuance

€ 500bn

Target by 2025

+3

50

AuM

Corporate

Bank

+1

56

12

44

Private

Bank

32View entire presentation