1Q21 Investor Update

CAPITALIZATION

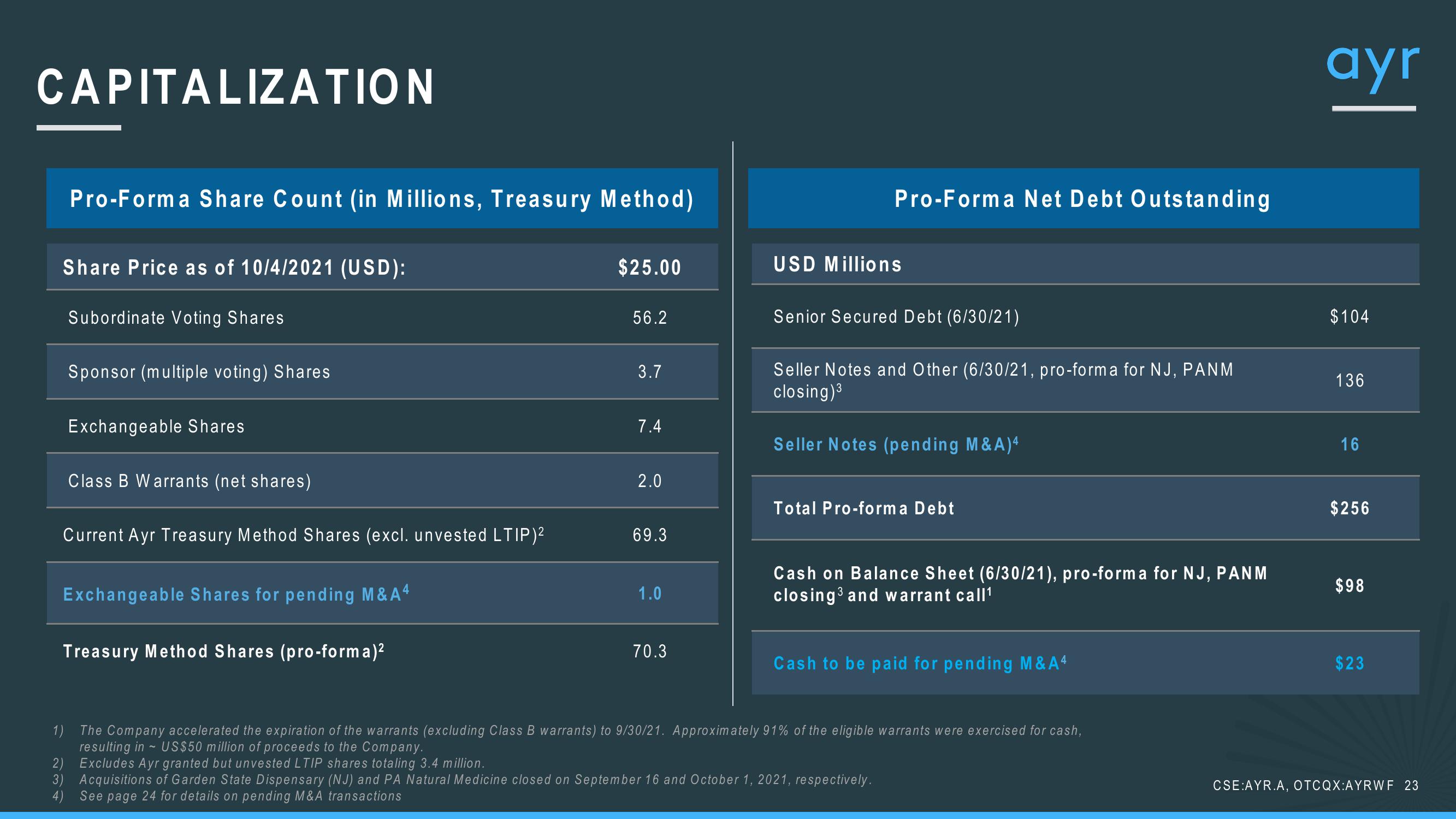

Pro-Forma Share Count (in Millions, Treasury Method)

Share Price as of 10/4/2021 (USD):

Subordinate Voting Shares

Sponsor (multiple voting) Shares

Exchangeable Shares

Class B Warrants (net shares)

Current Ayr Treasury Method Shares (excl. unvested LTIP) ²

Exchangeable Shares for pending M&A4

Treasury Method Shares (pro-forma)²

$25.00

56.2

3.7

7.4

2.0

69.3

1.0

70.3

Pro-Forma Net Debt Outstanding

USD Millions

Senior Secured Debt (6/30/21)

Seller Notes and Other (6/30/21, pro-forma for NJ, PANM

closing) ³

Seller Notes (pending M&A)4

Total Pro-forma Debt

Cash on Balance Sheet (6/30/21), pro-forma for NJ, PANM

closing³ and warrant call¹

Cash to be paid for pending M & A4

1)

The Company accelerated the expiration of the warrants (excluding Class B warrants) to 9/30/21. Approximately 91% of the eligible warrants were exercised for cash,

resulting in - US$50 million of proceeds to the Company.

2) Excludes Ayr granted but unvested LTIP shares totaling 3.4 million.

3)

Acquisitions of Garden State Dispensary (NJ) and PA Natural Medicine closed on September 16 and October 1, 2021, respectively.

4)

See page 24 for details on pending M&A transactions

ayr

$104

136

16

$256

$98

$23

CSE:AYR.A, OTCQX:AYRWF 23View entire presentation