BlackRock Global Long/Short Credit Absolute Return Credit

Case Study: Idiosyncratic Long Event Trade

Background

Unity Media is a German cable operator owned by

Liberty Global with solid fundamentals

●

●

●

We believe M&A activity in the German cable space will

increase this year and that the company could benefit

from a potential acquisition

Additionally, we believe an IG buyer could potentially

acquire the company

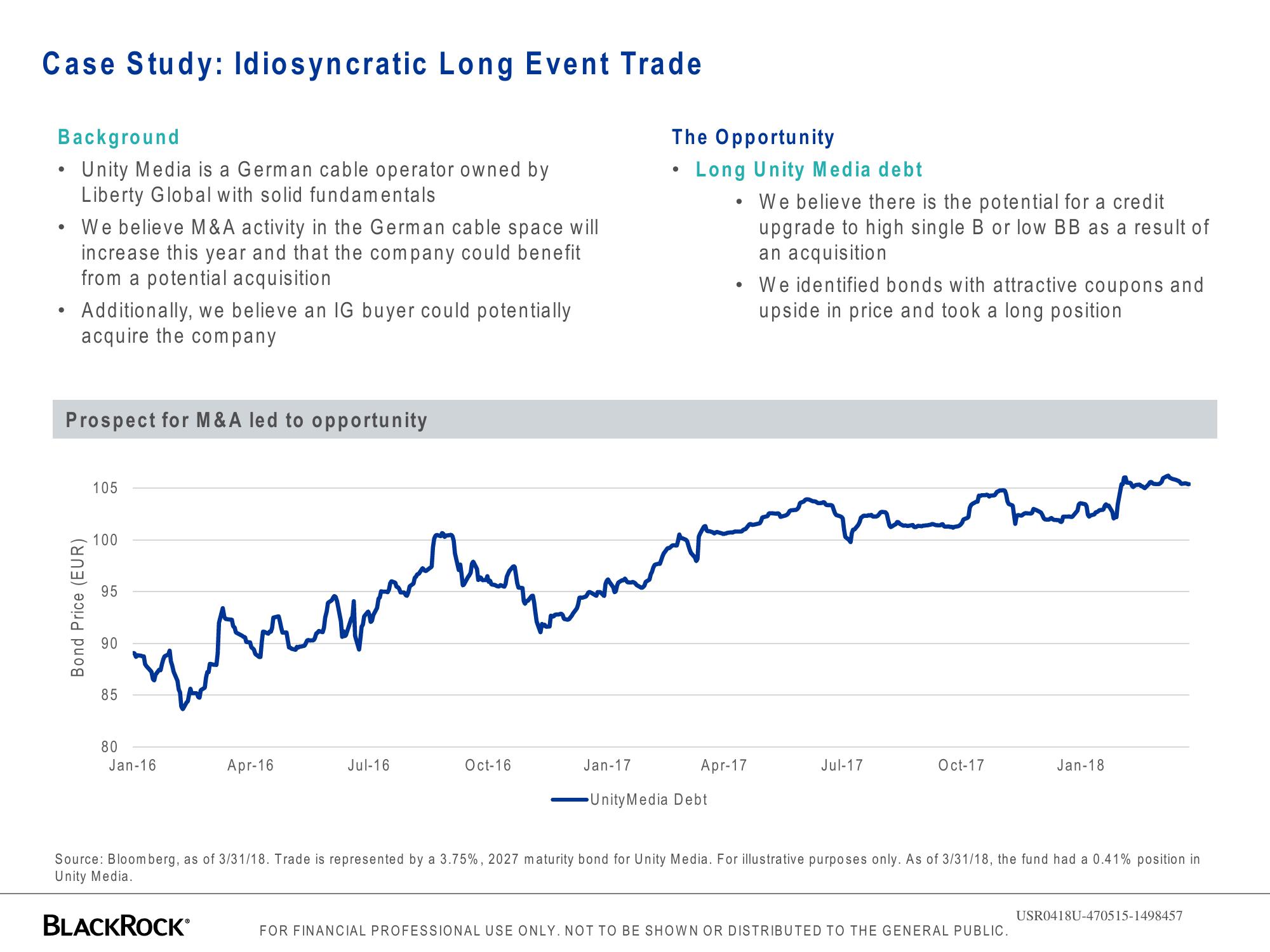

Prospect for M&A led to opportunity

Bond Price (EUR)

105

100

95

90

85

80

www.yo

Jan-16

مرا

Apr-16

Jul-16

mun

Oct-16

human

The Opportunity

●

Long Unity Media debt

Jan-17

Unity Media Debt

Apr-17

We believe there is the potential for a credit

upgrade to high single B or low BB as a result of

an acquisition

We identified bonds with attractive coupons and

upside in price and took a long position

Jul-17

لسا

Oct-17

mur

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

Jan-18

Source: Bloomberg, as of 3/31/18. Trade is represented by a 3.75%, 2027 maturity bond for Unity Media. For illustrative purposes only. As of 3/31/18, the fund had a 0.41% position in

Unity Media.

BLACKROCK*

USR0418U-470515-1498457View entire presentation