Perfect SPAC Presentation Deck

PERFECT

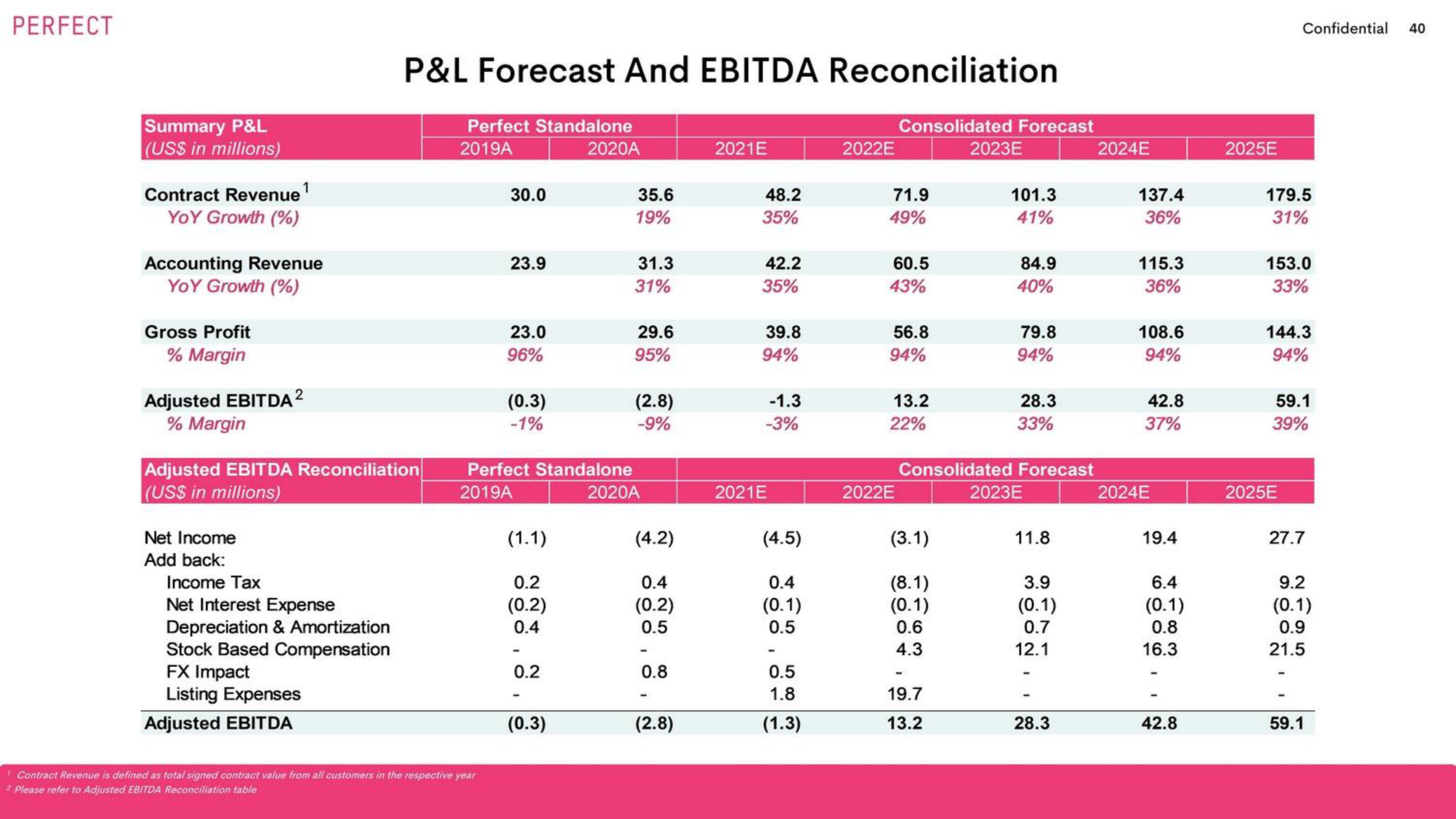

Summary P&L

(US$ in millions)

Contract Revenue ¹

YOY Growth (%)

Accounting Revenue

YOY Growth (%)

Gross Profit

% Margin

Adjusted EBITDA ²

% Margin

Adjusted EBITDA Reconciliation

(US$ in millions)

Net Income

Add back:

Income Tax

P&L Forecast And EBITDA Reconciliation

Net Interest Expense

Depreciation & Amortization

Stock Based Compensation

FX Impact

Listing Expenses

Adjusted EBITDA

Perfect Standalone

2019A

2020A

30.0

¹ Contract Revenue is defined as total signed contract value from all customers in the respective year

* Please refer to Adjusted EBITDA Reconciliation table

23.9

23.0

96%

(0.3)

-1%

(1.1)

0.2

(0.2)

0.4

Perfect Standalone

2019A

2020A

0.2

35.6

19%

(0.3)

31.3

31%

29.6

95%

(2.8)

-9%

(4.2)

0.4

(0.2)

0.5

0.8

(2.8)

2021E

48.2

35%

42.2

35%

39.8

94%

-1.3

-3%

2021E

(4.5)

0.4

(0.1)

0.5

0.5

1.8

(1.3)

2022E

Consolidated Forecast

71.9

49%

60.5

43%

56.8

94%

13.2

22%

2022E

(3.1)

(8.1)

(0.1)

0.6

4.3

2023E

19.7

13.2

101.3

41%

84.9

40%

79.8

94%

Consolidated Forecast

28.3

33%

2023E

11.8

3.9

(0.1)

0.7

12.1

28.3

2024E

137.4

36%

115.3

36%

108.6

94%

42.8

37%

2024E

19.4

6.4

(0.1)

0.8

16.3

42.8

2025E

Confidential 40

179.5

31%

153.0

33%

144.3

94%

59.1

39%

2025E

27.7

9.2

(0.1)

0.9

21.5

59.1View entire presentation