Granite Ridge Investor Presentation Deck

Overview

Strategy & Execution

Appendix

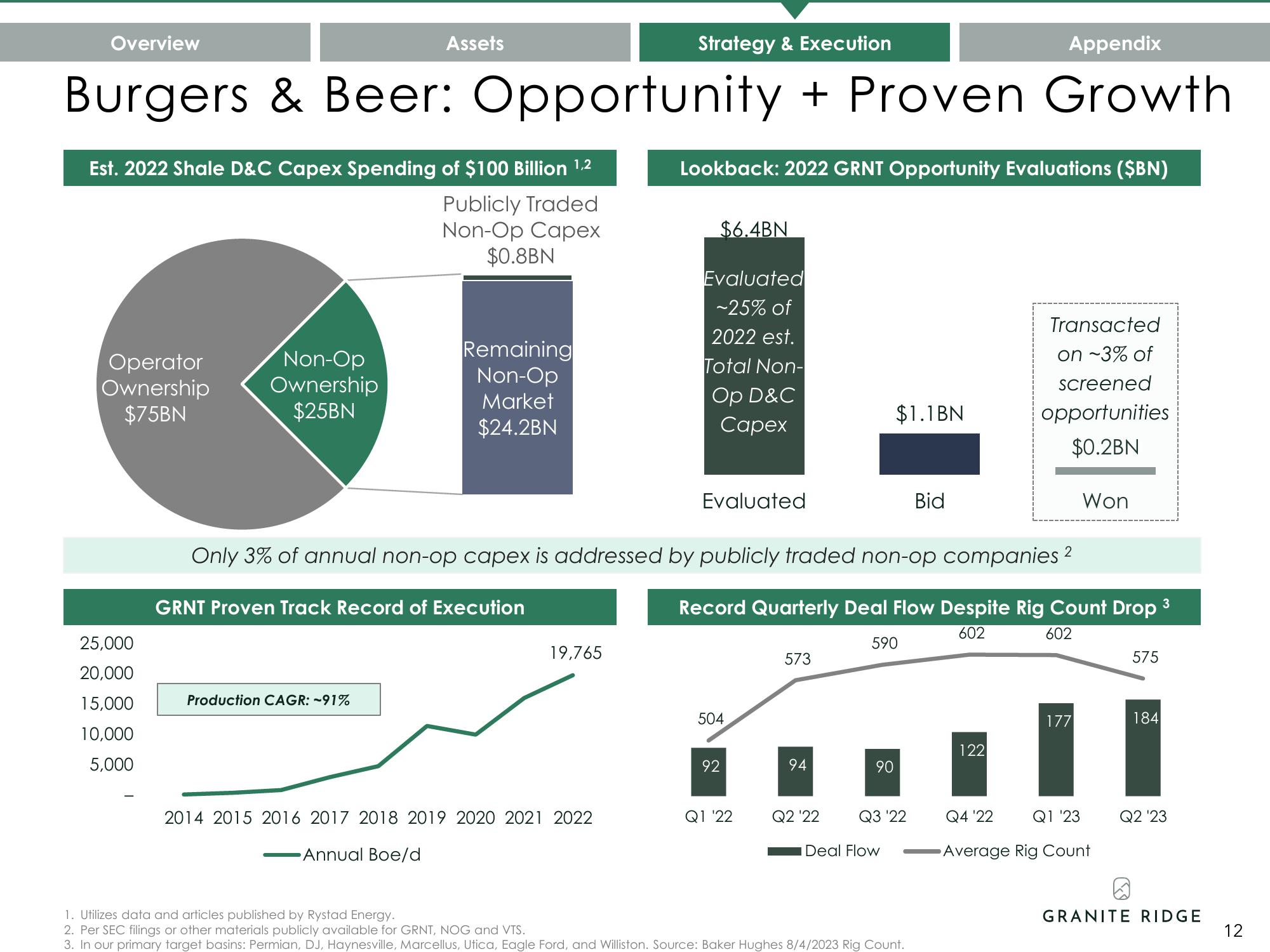

Burgers & Beer: Opportunity + Proven Growth

Lookback: 2022 GRNT Opportunity Evaluations ($BN)

Est. 2022 Shale D&C Capex Spending of $100 Billion ¹,2

Publicly Traded

Non-Op Capex

$0.8BN

Operator

Ownership

$75BN

25,000

20,000

15,000

10,000

5,000

Non-Op

Ownership

$25BN

Assets

Remaining

Non-Op

Market

$24.2BN

Production CAGR: -91%

GRNT Proven Track Record of Execution

19,765

$6.4BN

2014 2015 2016 2017 2018 2019 2020 2021 2022

Annual Boe/d

Evaluated

~25% of

2022 est.

Total Non-

Op D&C

Capex

Evaluated

Only 3% of annual non-op capex is addressed by publicly traded non-op companies 2

3

Record Quarterly Deal Flow Despite Rig Count Drop

602

602

504

92

Q1 '22

573

94

Q2 '22

$1.1BN

590

90

Q3 '22

Deal Flow

Bid

1. Utilizes data and articles published by Rystad Energy.

2. Per SEC filings or other materials publicly available for GRNT, NOG and VTS.

3. In our primary target basins: Permian, DJ, Haynesville, Marcellus, Utica, Eagle Ford, and Williston. Source: Baker Hughes 8/4/2023 Rig Count.

Transacted

on ~3% of

screened

opportunities

$0.2BN

122

Won

177

Q4 '22 Q1 '23

Average Rig Count

575

@

184

Q2 '23

GRANITE RIDGE

12View entire presentation