Apollo Global Management Investor Presentation Deck

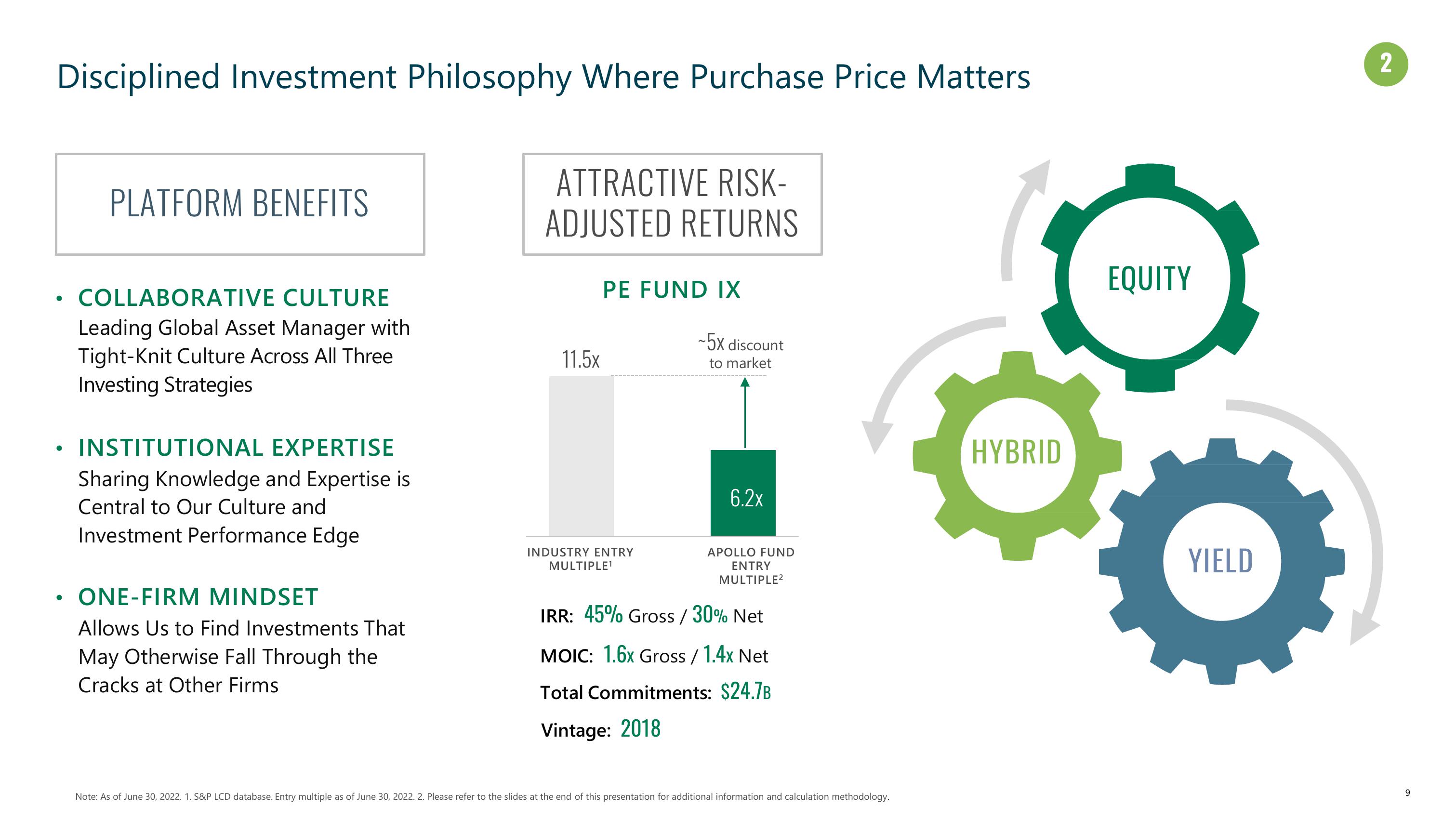

Disciplined Investment Philosophy Where Purchase Price Matters

●

PLATFORM BENEFITS

COLLABORATIVE CULTURE

Leading Global Asset Manager with

Tight-Knit Culture Across All Three

Investing Strategies

• INSTITUTIONAL EXPERTISE

Sharing Knowledge and Expertise is

Central to Our Culture and

Investment Performance Edge

• ONE-FIRM MINDSET

Allows Us to Find Investments That

May Otherwise Fall Through the

Cracks at Other Firms

ATTRACTIVE RISK-

ADJUSTED RETURNS

11.5x

PE FUND IX

INDUSTRY ENTRY

~5x discount

to market

MULTIPLE¹

6.2x

APOLLO FUND

ENTRY

MULTIPLE²

IRR: 45% Gross / 30% Net

MOIC: 1.6x Gross / 1.4x Net

Total Commitments: $24.7B

Vintage: 2018

Note: As of June 30, 2022. 1. S&P LCD database. Entry multiple as of June 30, 2022. 2. Please refer to the slides at the end of this presentation for additional information and calculation methodology.

HYBRID

EQUITY

YIELD

2

9View entire presentation