Ares US Real Estate Opportunity Fund III

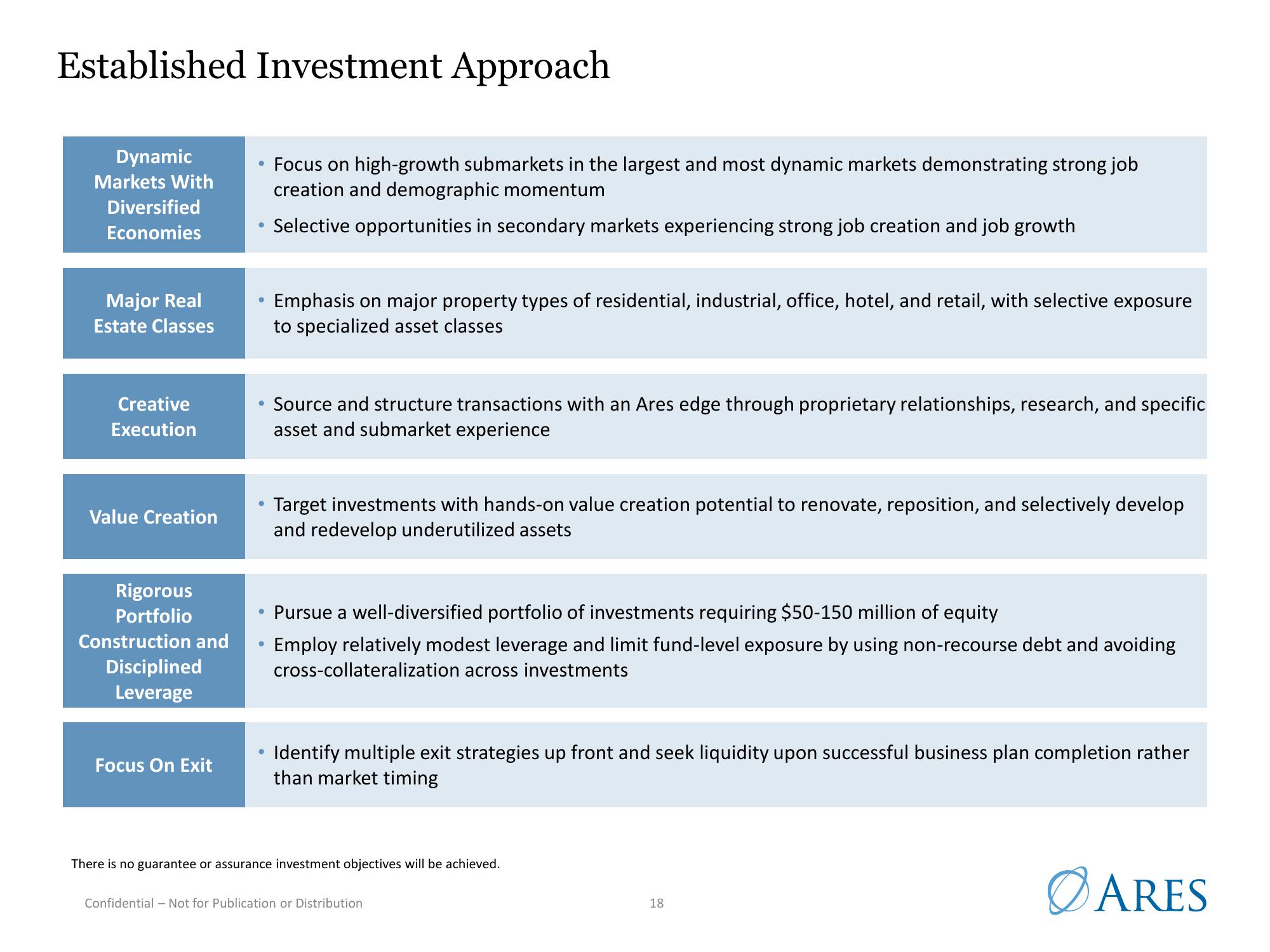

Established Investment Approach

Dynamic

Markets With

Diversified

Economies

Major Real

Estate Classes

Creative

Execution

Value Creation

Rigorous

Portfolio

Construction and

Disciplined

Leverage

Focus On Exit

e

●

●

●

●

●

●

●

Focus on high-growth submarkets in the largest and most dynamic markets demonstrating strong job

creation and demographic momentum

Selective opportunities in secondary markets experiencing strong job creation and job growth

Emphasis on major property types of residential, industrial, office, hotel, and retail, with selective exposure

to specialized asset classes

Source and structure transactions with an Ares edge through proprietary relationships, research, and specific

asset and submarket experience

Target investments with hands-on value creation potential to renovate, reposition, and selectively develop

and redevelop underutilized assets

Pursue a well-diversified portfolio of investments requiring $50-150 million of equity

Employ relatively modest leverage and limit fund-level exposure by using non-recourse debt and avoiding

cross-collateralization across investments

Identify multiple exit strategies up front and seek liquidity upon successful business plan completion rather

than market timing

There is no guarantee or assurance investment objectives will be achieved.

Confidential - Not for Publication or Distribution

18

ARESView entire presentation