Waldencast SPAC Presentation Deck

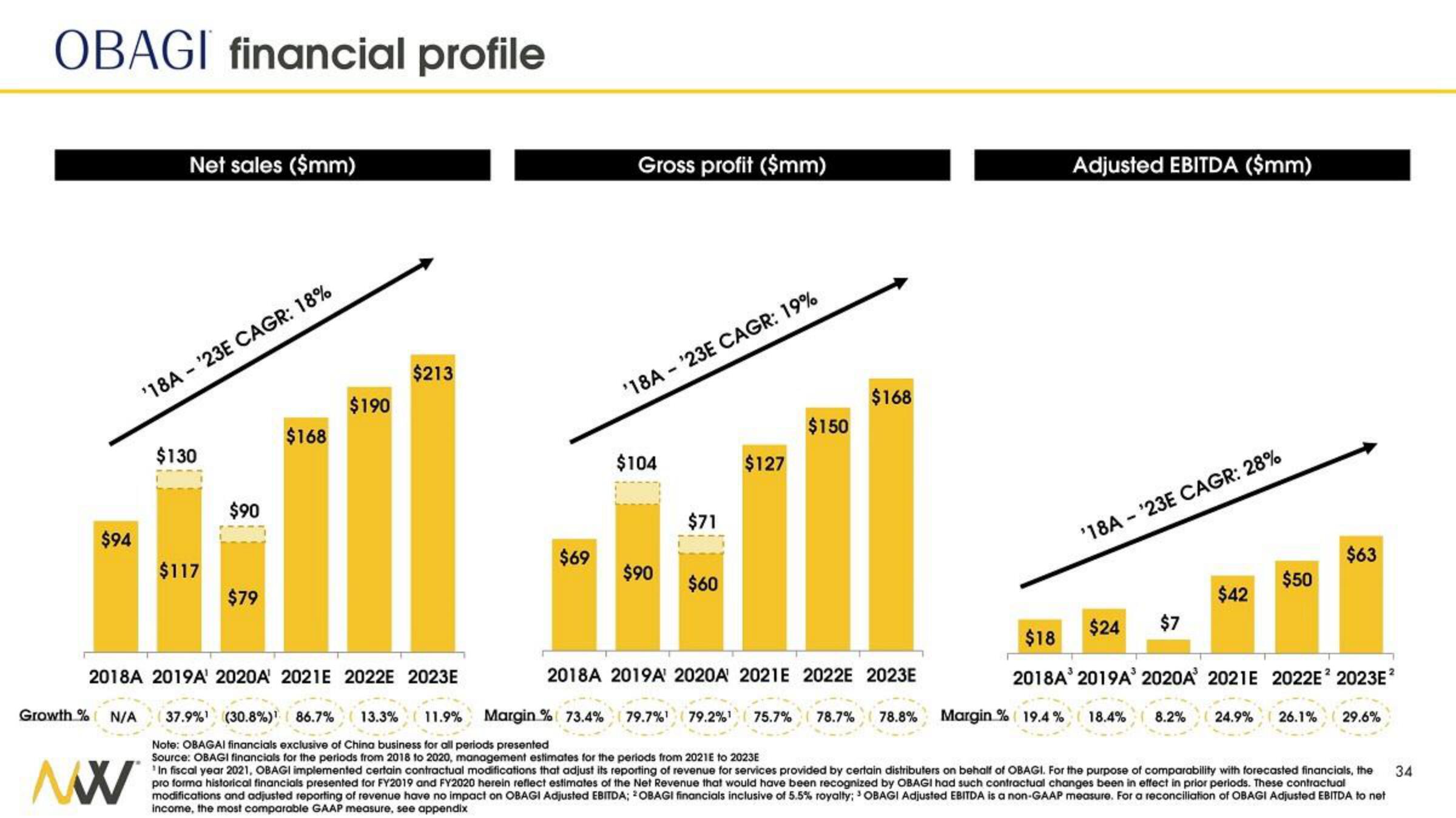

OBAGI financial profile

$94

Growth % N/A

Net sales ($mm)

MW

'18A-'23E CAGR: 18%

$130

$117

$90

$79

$168

$190

$213

2018A 2019A' 2020A' 2021E 2022E 2023E

$69

Gross profit ($mm)

'18A-'23E CAGR: 19%

$104

$90

$71

$60

$127

$150

$168

Adjusted EBITDA ($mm)

'18A-'23E CAGR: 28%

$24

$7

$42

$50

$63

$18

2018A³ 2019A³ 2020A 2021E 2022E² 2023E²

Margin % 19.4% 18.4% 8.2% 24.9% 26.1% 29.6%

2018A 2019A 2020A 2021E 2022E 2023E

37.9%¹ (30.8%) ¹ 86.7% 13.3% 11.9% Margin % 73.4% 79.7%¹ 79.2%¹ 75.7% 78.7% 78.8%

Note: OBAGAI financials exclusive of China business for all periods presented

Source: OBAGI financials for the periods from 2018 to 2020, management estimates for the periods from 2021E to 2023E

'In fiscal year 2021, OBAGI implemented certain contractual modifications that adjust its reporting of revenue for services provided by certain distributers on behalf of OBAGI. For the purpose of comparability with forecasted financials, the

pro forma historical financials presented for FY2019 and FY2020 herein reflect estimates of the Net Revenue that would have been recognized by OBAGI had such contractual changes been in effect in prior periods. These contractual

modifications and adjusted reporting of revenue have no impact on OBAGI Adjusted EBITDA; OBAGI financials inclusive of 5.5% royalty; OBAGI Adjusted EBITDA is a non-GAAP measure. For a reconciliation of OBAGI Adjusted EBITDA to net

income, the most comparable GAAP measure, see appendix

34View entire presentation