Aston Martin Lagonda Results Presentation Deck

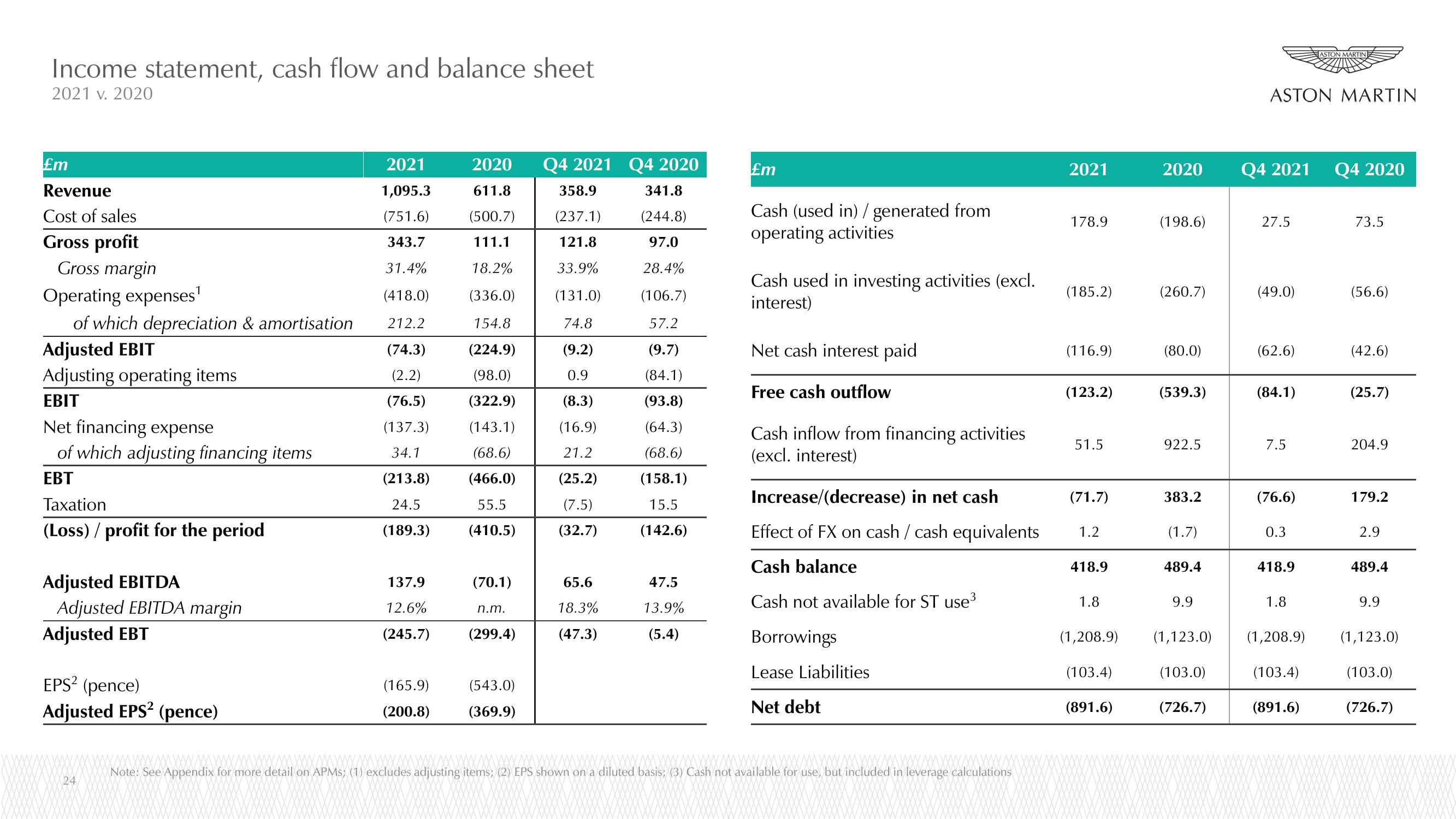

Income statement, cash flow and balance sheet

2021 v. 2020

£m

Revenue

Cost of sales

Gross profit

Gross margin

Operating expenses¹

(418.0)

of which depreciation & amortisation 212.2

Adjusted EBIT

Adjusting operating items

(74.3)

(2.2)

(76.5)

(137.3)

EBIT

Net financing expense

of which adjusting financing items

EBT

34.1

(213.8)

24.5

(189.3)

Taxation

(Loss) / profit for the period

Adjusted EBITDA

Adjusted EBITDA margin

Adjusted EBT

EPS² (pence)

Adjusted EPS² (pence)

2021

1,095.3

(751.6)

343.7

31.4%

24

137.9

12.6%

(245.7)

(165.9)

(200.8)

2020 Q4 2021

611.8

358.9

(500.7) (237.1)

111.1

121.8

18.2%

33.9%

(336.0)

154.8

(224.9)

(98.0)

(322.9)

(131.0)

74.8

(9.2)

0.9

(8.3)

(143.1)

(16.9)

21.2

(68.6)

(466.0)

55.5

(410.5)

(70.1)

n.m.

(299.4)

(543.0)

(369.9)

(25.2)

(7.5)

(32.7)

65.6

18.3%

(47.3)

Q4 2020

341.8

(244.8)

97.0

28.4%

(106.7)

57.2

(9.7)

(84.1)

(93.8)

(64.3)

(68.6)

(158.1)

15.5

(142.6)

47.5

13.9%

(5.4)

£m

Cash (used in) / generated from

operating activities

Cash used in investing activities (excl.

interest)

Net cash interest paid

Free cash outflow

Cash inflow from financing activities

(excl. interest)

Increase/(decrease) in net cash

Effect of FX on cash / cash equivalents

Cash balance

Cash not available for ST use³

Borrowings

Lease Liabilities

Net debt

Note: See Appendix for more detail on APMs; (1) excludes adjusting items; (2) EPS shown on a diluted basis; (3) Cash not available for use, but included in leverage calculations

2021

178.9

(185.2)

(116.9)

(123.2)

51.5

(71.7)

1.2

418.9

1.8

(1,208.9)

(103.4)

(891.6)

2020

(198.6)

(260.7)

(80.0)

(539.3)

922.5

383.2

(1.7)

489.4

9.9

ASTON MARTIN

Q4 2021

27.5

(49.0)

(62.6)

(84.1)

7.5

(76.6)

0.3

418.9

1.8

ASTON MARTIN

(1,123.0) (1,208.9)

(103.0) (103.4)

(726.7)

(891.6)

Q4 2020

73.5

(56.6)

(42.6)

(25.7)

204.9

179.2

2.9

489.4

9.9

(1,123.0)

(103.0)

(726.7)View entire presentation