SmileDirectClub Results Presentation Deck

●

Gross margin.

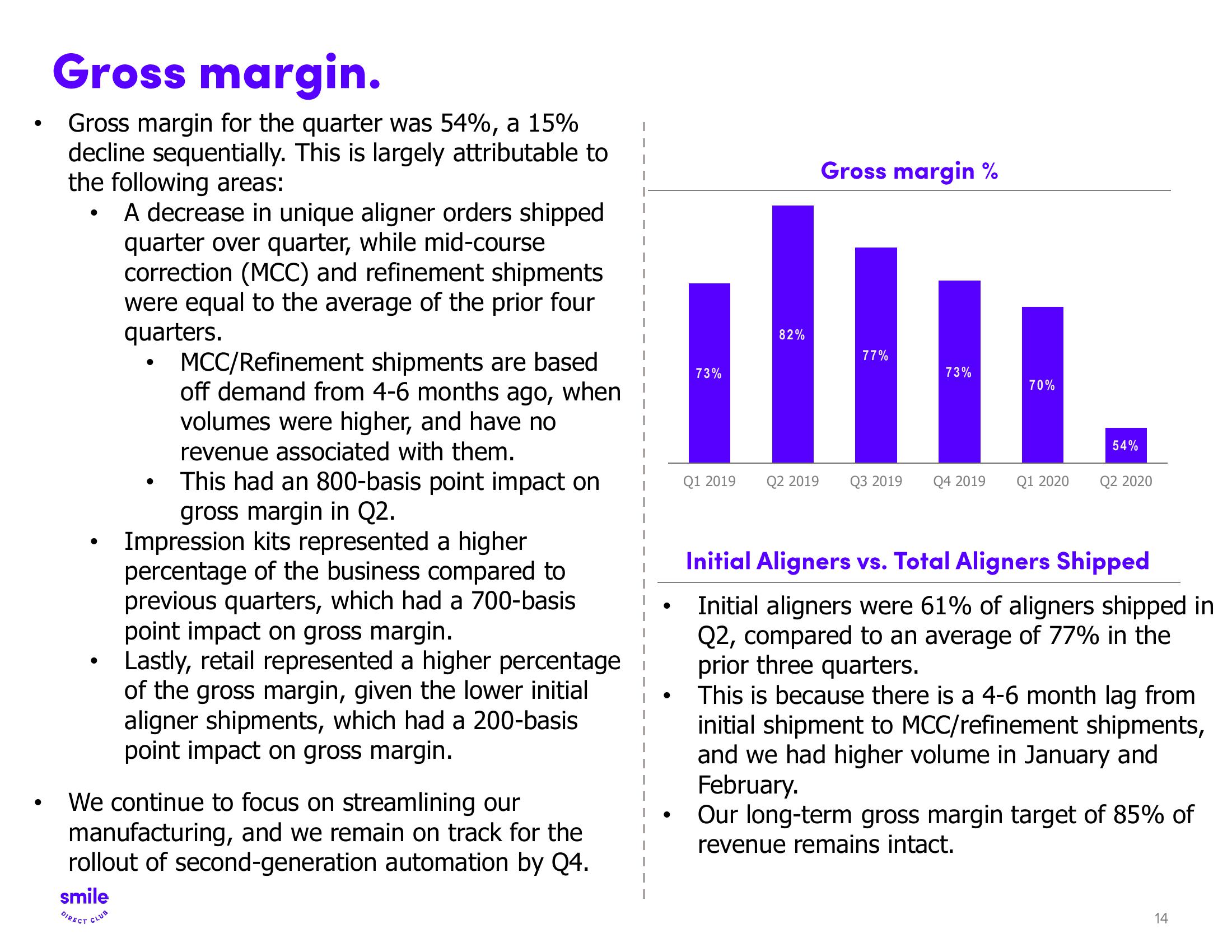

Gross margin for the quarter was 54%, a 15%

decline sequentially. This is largely attributable to

the following areas:

A decrease in unique aligner orders shipped

quarter over quarter, while mid-course

correction (MCC) and refinement shipments

were equal to the average of the prior four

quarters.

●

●

●

●

MCC/Refinement shipments are based

off demand from 4-6 months ago, when

volumes were higher, and have no

revenue associated with them.

This had an 800-basis point impact on

gross margin in Q2.

Impression kits represented a higher

percentage of the business compared to

previous quarters, which had a 700-basis

point impact on gross margin.

Lastly, retail represented a higher percentage

of the gross margin, given the lower initial

aligner shipments, which had a 200-basis

point impact on gross margin.

We continue to focus on streamlining our

manufacturing, and we remain on track for the

rollout of second-generation automation by Q4.

smile

DIRECT CLUB

73%

82%

Gross margin %

77%

73%

70%

Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020

54%

Q2 2020

Initial Aligners vs. Total Aligners Shipped

Initial aligners were 61% of aligners shipped in

Q2, compared to an average of 77% in the

prior three quarters.

This is because there is a 4-6 month lag from

initial shipment to MCC/refinement shipments,

and we had higher volume in January and

February.

Our long-term gross margin target of 85% of

revenue remains intact.

14View entire presentation