Endeavour Mining Investor Presentation Deck

DEBT STRUCTURE

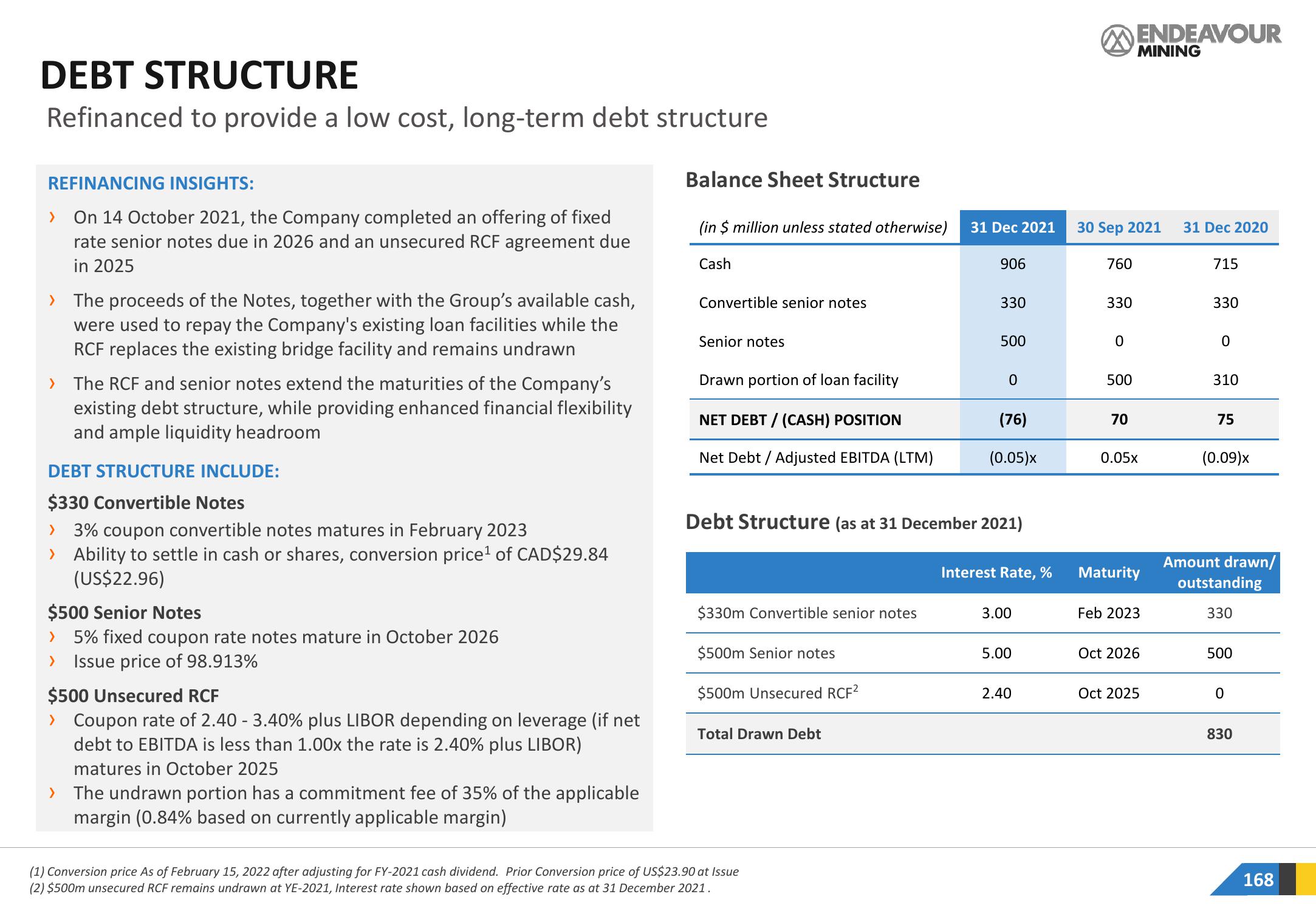

Refinanced to provide a low cost, long-term debt structure

REFINANCING INSIGHTS:

> On 14 October 2021, the Company completed an offering of fixed

rate senior notes due in 2026 and an unsecured RCF agreement due

in 2025

>

The proceeds of the Notes, together with the Group's available cash,

were used to repay the Company's existing loan facilities while the

RCF replaces the existing bridge facility and remains undrawn

> The RCF and senior notes extend the maturities of the Company's

existing debt structure, while providing enhanced financial flexibility

and ample liquidity headroom

DEBT STRUCTURE INCLUDE:

$330 Convertible Notes

>

3% coupon convertible notes matures in Februa 2023

> Ability to settle in cash or shares, conversion price¹ of CAD$29.84

(US$22.96)

$500 Senior Notes

> 5% fixed coupon rate notes mature in October 2026

> Issue price of 98.913%

$500 Unsecured RCF

> Coupon rate of 2.40 -3.40% plus LIBOR depending on leverage (if net

debt to EBITDA is less than 1.00x the rate is 2.40% plus LIBOR)

matures in October 2025

> The undrawn portion has a commitment fee of 35% of the applicable

margin (0.84% based on currently applicable margin)

Balance Sheet Structure

(in $ million unless stated otherwise)

Cash

Convertible senior notes

Senior notes

Drawn portion of loan facility

NET DEBT / (CASH) POSITION

Net Debt / Adjusted EBITDA (LTM)

$330m Convertible senior notes

$500m Senior notes

$500m Unsecured RCF²

Total Drawn Debt

31 Dec 2021

(1) Conversion price As of February 15, 2022 after adjusting for FY-2021 cash dividend. Prior Conversion price of US$23.90 at Issue

(2) $500m unsecured RCF remains undrawn at YE-2021, Interest rate shown based on effective rate as at 31 December 2021.

906

330

500

Debt Structure (as at 31 December 2021)

0

(76)

(0.05)x

Interest Rate, %

3.00

5.00

2.40

760

30 Sep 2021

330

0

500

ENDEAVOUR

70

MINING

0.05x

Maturity

Feb 2023

Oct 2026

Oct 2025

31 Dec 2020

715

330

0

310

75

(0.09)x

Amount drawn/

outstanding

330

500

0

830

168View entire presentation