Paya SPAC Presentation Deck

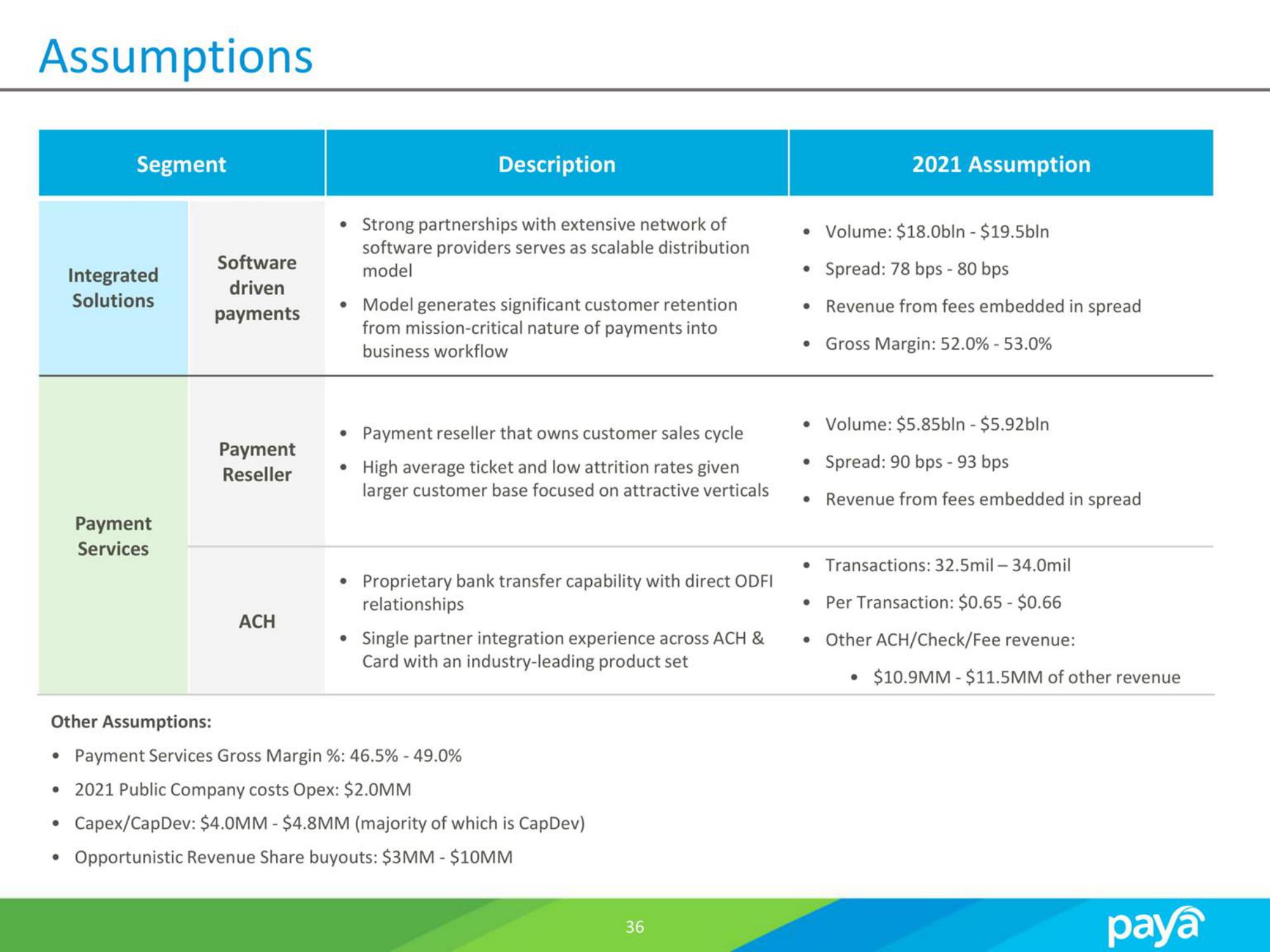

Assumptions

●

Segment

●

Integrated

Solutions

Payment

Services

Software

driven

payments

Payment

Reseller

ACH

Description

Strong partnerships with extensive network of

software providers serves as scalable distribution

model

Model generates significant customer retention

from mission-critical nature of payments into

business workflow

• Payment reseller that owns customer sales cycle

• High average ticket and low attrition rates given

larger customer base focused on attractive verticals

• Proprietary bank transfer capability with direct ODFI

relationships

Other Assumptions:

• Payment Services Gross Margin %: 46.5% - 49.0%

• 2021 Public Company costs Opex: $2.0MM

Capex/CapDev: $4.0MM - $4.8MM (majority of which is CapDev)

Opportunistic Revenue Share buyouts: $3MM - $10MM

• Single partner integration experience across ACH &

Card with an industry-leading product set

36

• Volume: $18.0bln - $19.5bln

• Spread: 78 bps - 80 bps

Revenue from fees embedded in spread

• Gross Margin: 52.0% - 53.0%

●

2021 Assumption

• Volume: $5.85bln - $5.92bln

• Spread: 90 bps - 93 bps

Revenue from fees embedded in spread

●

• Transactions: 32.5mil-34.0mil

• Per Transaction: $0.65 - $0.66

• Other ACH/Check/Fee revenue:

●

$10.9MM - $11.5MM of other revenue

payaView entire presentation