Inovalon Results Presentation Deck

CAPEX Returning Towards Historical Levels

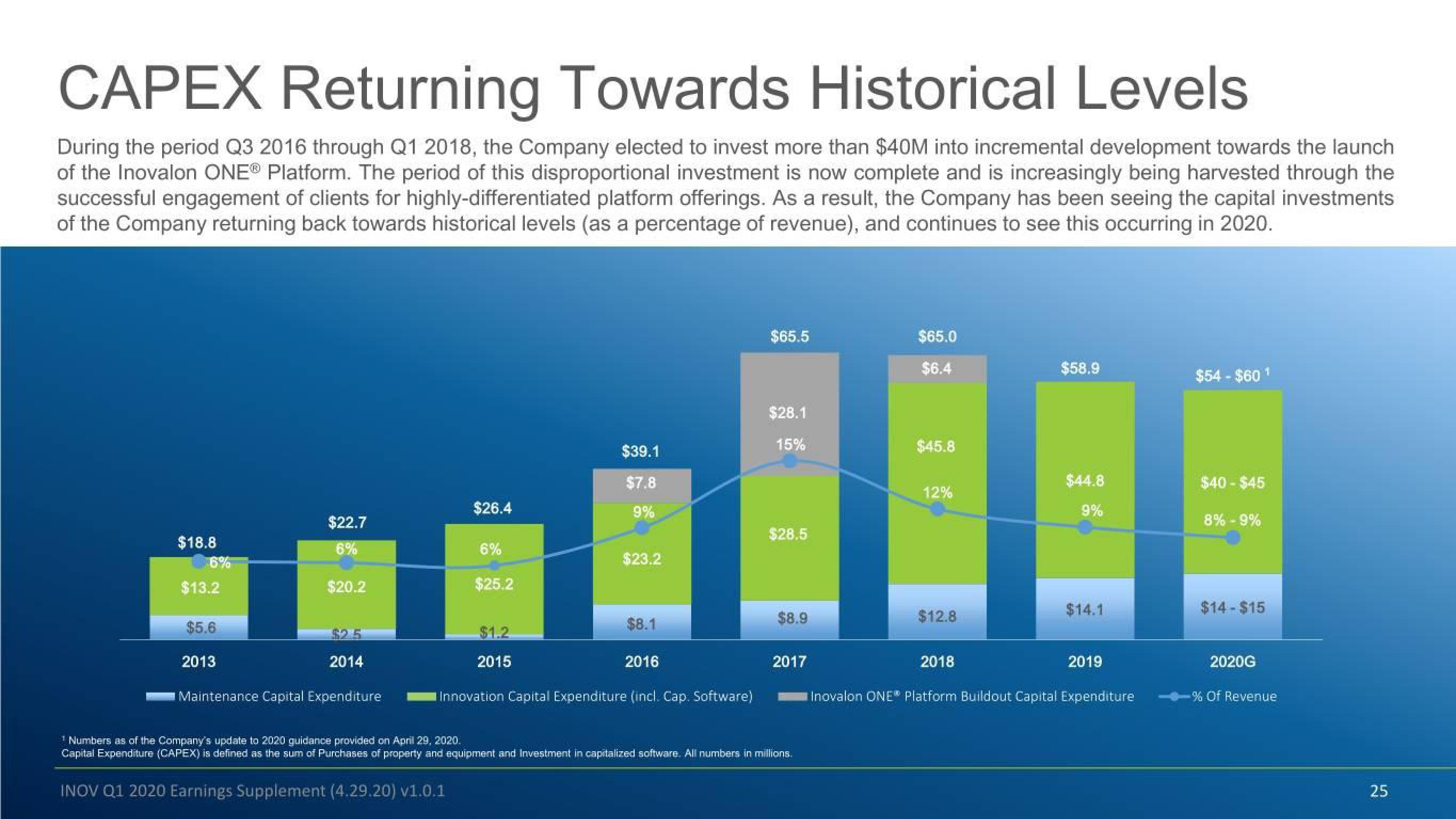

During the period Q3 2016 through Q1 2018, the Company elected to invest more than $40M into incremental development towards the launch

of the Inovalon ONE® Platform. The period of this disproportional investment is now complete and is increasingly being harvested through the

successful engagement of clients for highly-differentiated platform offerings. As a result, the Company has been seeing the capital investments

of the Company returning back towards historical levels (as a percentage of revenue), and continues to see this occurring in 2020.

$18.8

6%

$13.2

$5.6

2013

$22.7

6%

$20.2

2014

Maintenance Capital Expenditure

$26.4

6%

$25.2

$1.2

2015

$39.1

$7.8

9%

$23.2

$8.1

2016

I Innovation Capital Expenditure (incl. Cap. Software)

$65.5

$28.1

15%

$28.5

$8.9

2017

¹ Numbers as of the Company's update to 2020 guidance provided on April 29, 2020.

Capital Expenditure (CAPEX) is defined as the sum of Purchases of property and equipment and Investment in capitalized software. All numbers in millions.

INOV Q1 2020 Earnings Supplement (4.29.20) v1.0.1

$65.0

$6.4

$45.8

12%

$12.8

$58.9

$44.8

9%

$14.1

2018

Inovalon ONE® Platform Buildout Capital Expenditure

OFFER

2019

$54 - $60 ¹

1

$40 - $45

8% -9%

$14-$15

2020G

% Of Revenue

ING

25View entire presentation