Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

Company

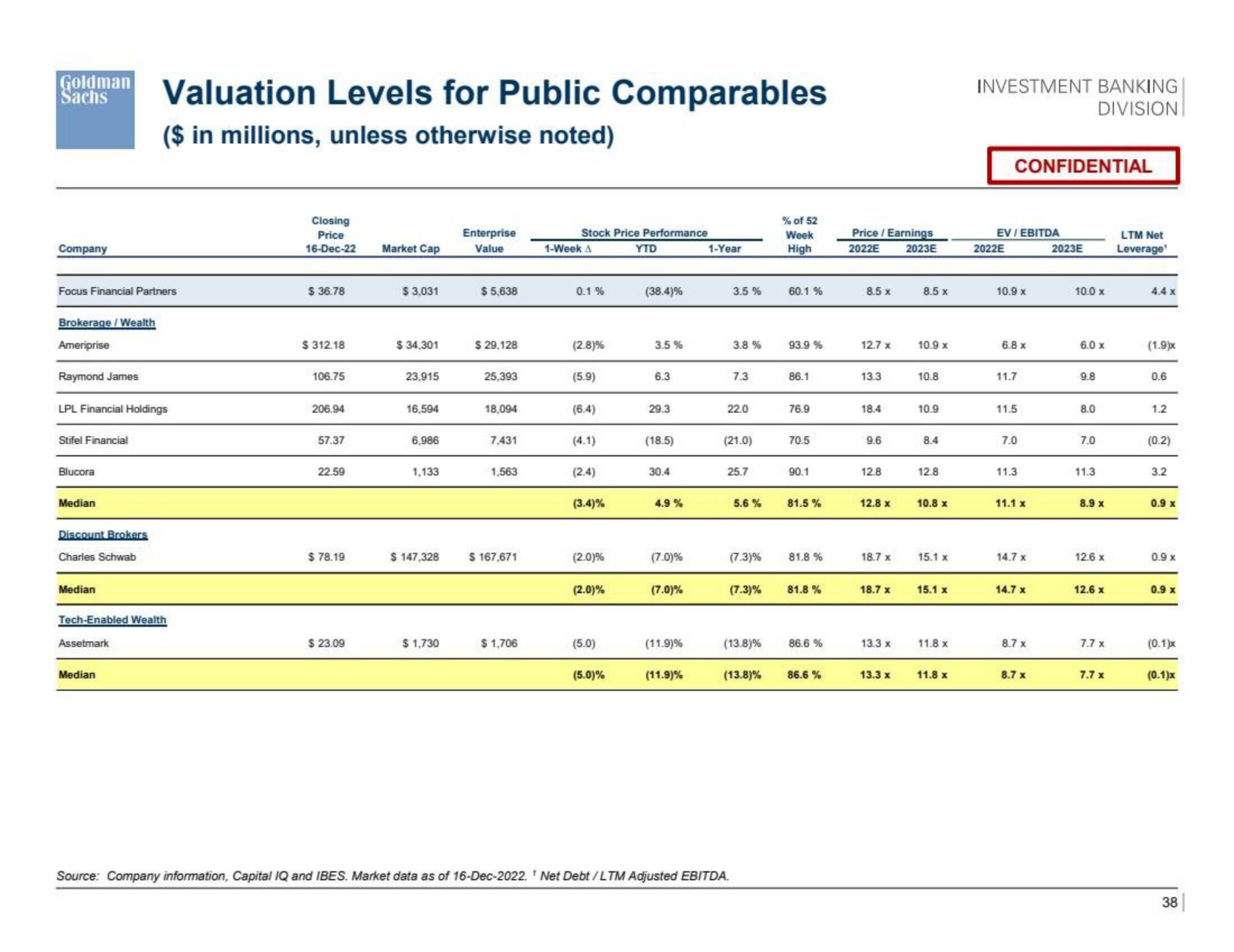

Focus Financial Partners

Brokerage / Wealth

Ameriprise

Raymond James

LPL Financial Holdings

Stifel Financial

Blucora

Median

Discount Brokers

Charles Schwab

Median

Valuation Levels for Public Comparables

($ in millions, unless otherwise noted)

Tech-Enabled Wealth

Assetmark

Median

Closing

Price

16-Dec-22 Market Cap

$36.78

$ 312.18

106.75

206.94

57.37

22.59

$78.19

$ 23.09

$ 3,031

$ 34,301

23,915

16,594

6,986

1,133

$ 147,328

$1,730

Enterprise

Value

$ 5,638

$ 29,128

25,393

18,094

7,431

1,563

$ 167,671

$ 1,706

Stock Price Performance

1-Week A

YTD

0.1%

(2.8)%

(5.9)

(6.4)

(4.1)

(2.4)

(3.4)%

(2.0)%

(2.0)%

(5.0)

(5.0)%

(38.4)%

3.5%

6.3

29.3

(18.5)

30.4

4.9%

(7.0)%

(7.0)%

(11.9)%

(11.9)%

1-Year

3.5 %

3.8 %

7.3

22.0

(21.0)

25.7

5.6 %

(7.3)%

Source: Company information, Capital IQ and IBES. Market data as of 16-Dec-2022.¹ Net Debt/LTM Adjusted EBITDA.

(7.3)%

(13.8)%

% of 52

Week

High

60.1 %

93.9 %

86.1

76.9

70.5

90.1

81.5%

81.8%

(13.8)% 86.6%

81.8%

86.6%

Price / Earnings

2022E 2023E

8.5 x

12.7 x

13.3

18.4

9.6

12.8

12.8 x

18.7 x

18.7 x

13.3 x

13.3 x

8.5 x

10.9 x

10.8

10.9

8.4

12.8

10.8 x

15.1 x

15.1 x

11.8 x

11.8 x

INVESTMENT BANKING

DIVISION

CONFIDENTIAL

EV/EBITDA

2022E

10.9 x

6.8 x

11.7

11.5

7.0

11.3

11.1 x

14.7 x

14.7 x

8.7 x

8.7 x

2023E

10.0 x

6.0 x

9.8

8.0

7.0

11.3

8.9 x

12.6 x

12.6 x

7.7 x

7.7 x

LTM Net

Leverage¹

4.4 x

(1.9)x

0.6

1.2

(0.2)

3.2

0.9 x

0.9 x

0.9 x

(0.1)x

(0.1)x

38View entire presentation