Evercore Investment Banking Pitch Book

Financial Analysis

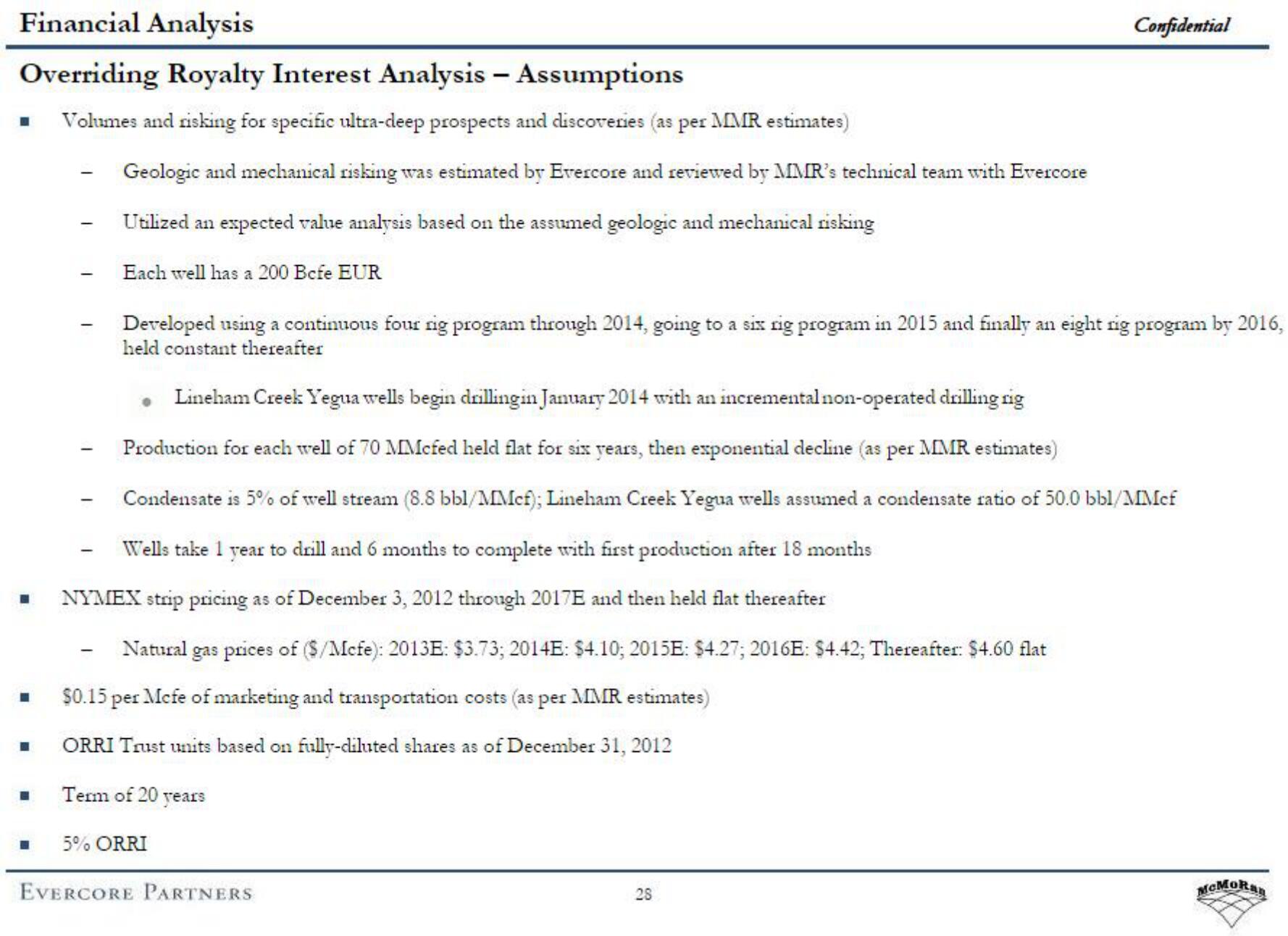

Overriding Royalty Interest Analysis - Assumptions

Volumes and risking for specific ultra-deep prospects and discoveries (as per MMR estimates)

Geologic and mechanical risking was estimated by Evercore and reviewed by MMR's technical team with Evercore

Utilized an expected value analysis based on the assumed geologic and mechanical risking

Each well has a 200 Bcfe EUR

■

■

■

■

-

1

Lineham Creek Yegua wells begin drillingin January 2014 with an incremental non-operated drilling rig

Production for each well of 70 MMcfed held flat for six years, then exponential decline (as per MMR estimates)

Condensate is 5% of well stream (8.8 bb1/MMcf); Lineham Creek Yegua wells assumed a condensate ratio of 50.0 bb1/MMcf

Wells take 1 year to drill and 6 months to complete with first production after 18 months

NYMEX strip pricing as of December 3, 2012 through 2017E and then held flat thereafter

Natural gas prices of ($/Mcfe): 2013E: $3.73; 2014E: $4.10; 2015E: $4.27; 2016E: $4.42; Thereafter: $4.60 flat

$0.15 per Mcfe of marketing and transportation costs (as per MMR estimates)

ORRI Trust units based on fully-diluted shares as of December 31, 2012

Term of 20 years

-

Developed using a continuous four rig program through 2014, going to a six rig program in 2015 and finally an eight rig program by 2016,

held constant thereafter

5% ORRI

Confidential

EVERCORE PARTNERS

28

MCMORanView entire presentation