Grove Investor Presentation Deck

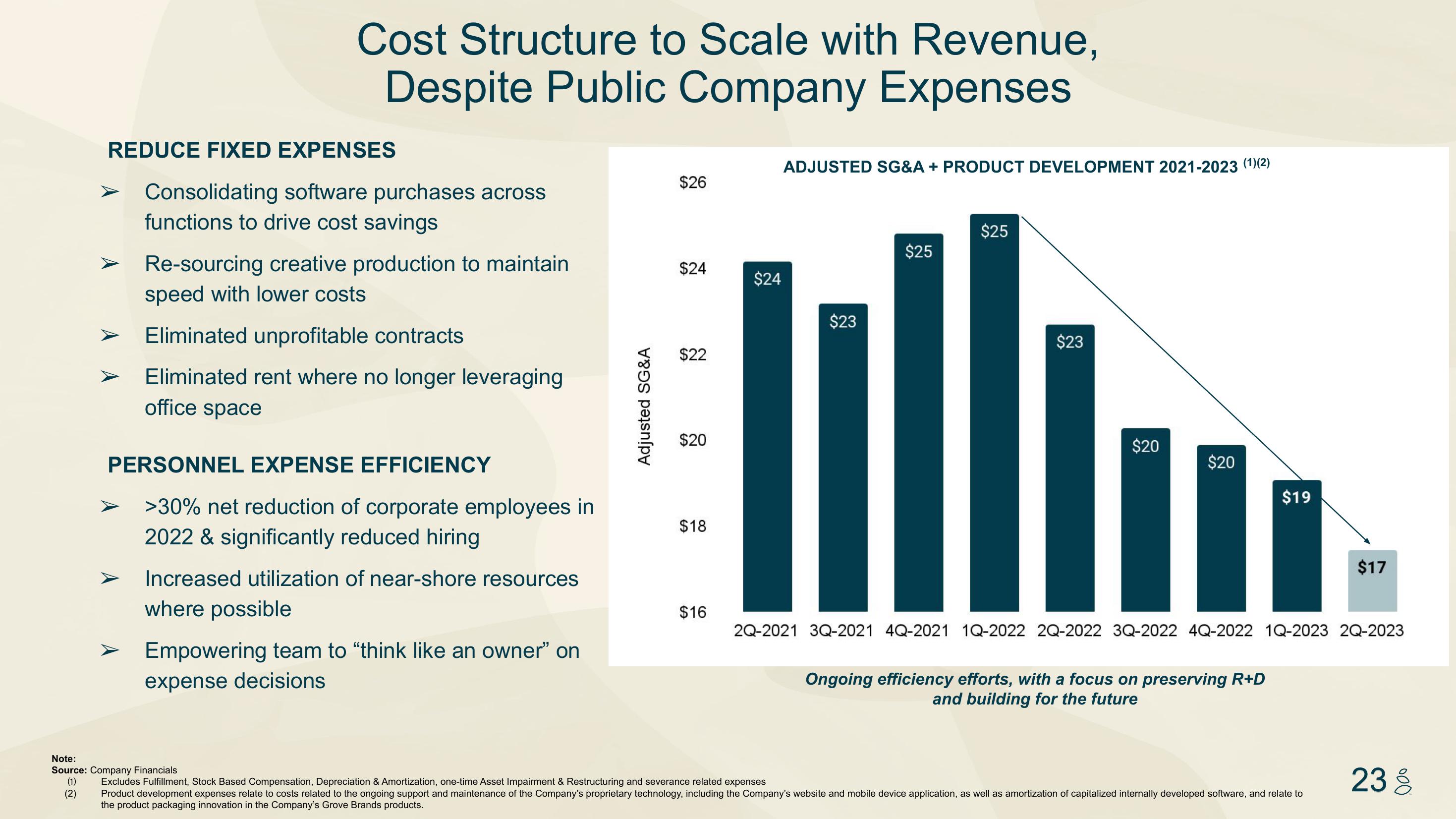

Cost Structure to Scale with Revenue,

Despite Public Company Expenses

REDUCE FIXED EXPENSES

Consolidating software purchases across

functions to drive cost savings

➤ Re-sourcing creative production to maintain

speed with lower costs

Eliminated unprofitable contracts

Eliminated rent where no longer leveraging

office space

PERSONNEL EXPENSE EFFICIENCY

>30% net reduction of corporate employees in

2022 & significantly reduced hiring

Increased utilization of near-shore resources.

where possible

Empowering team to "think like an owner" on

expense decisions

Note:

Source: Company Financials

(1)

(2)

Adjusted SG&A

$26

$24

$22

$20

$18

$16

ADJUSTED SG&A + PRODUCT DEVELOPMENT 2021-2023 (1)(2)

$24

$23

$25

$25

$23

$20

$20

$19

Ongoing efficiency efforts, with a focus on preserving R+D

and building for the future

2Q-2021 3Q-2021 4Q-2021 1Q-2022 2Q-2022 3Q-2022 4Q-2022 1Q-2023 2Q-2023

$17

Excludes Fulfillment, Stock Based Compensation, Depreciation & Amortization, one-time Asset Impairment & Restructuring and severance related expenses

Product development expenses relate to costs related to the ongoing support and maintenance of the Company's proprietary technology, including the Company's website and mobile device application, as well as amortization of capitalized internally developed software, and relate to

the product packaging innovation in the Company's Grove Brands products.

23 8View entire presentation