Embracer Group Mergers and Acquisitions Presentation Deck

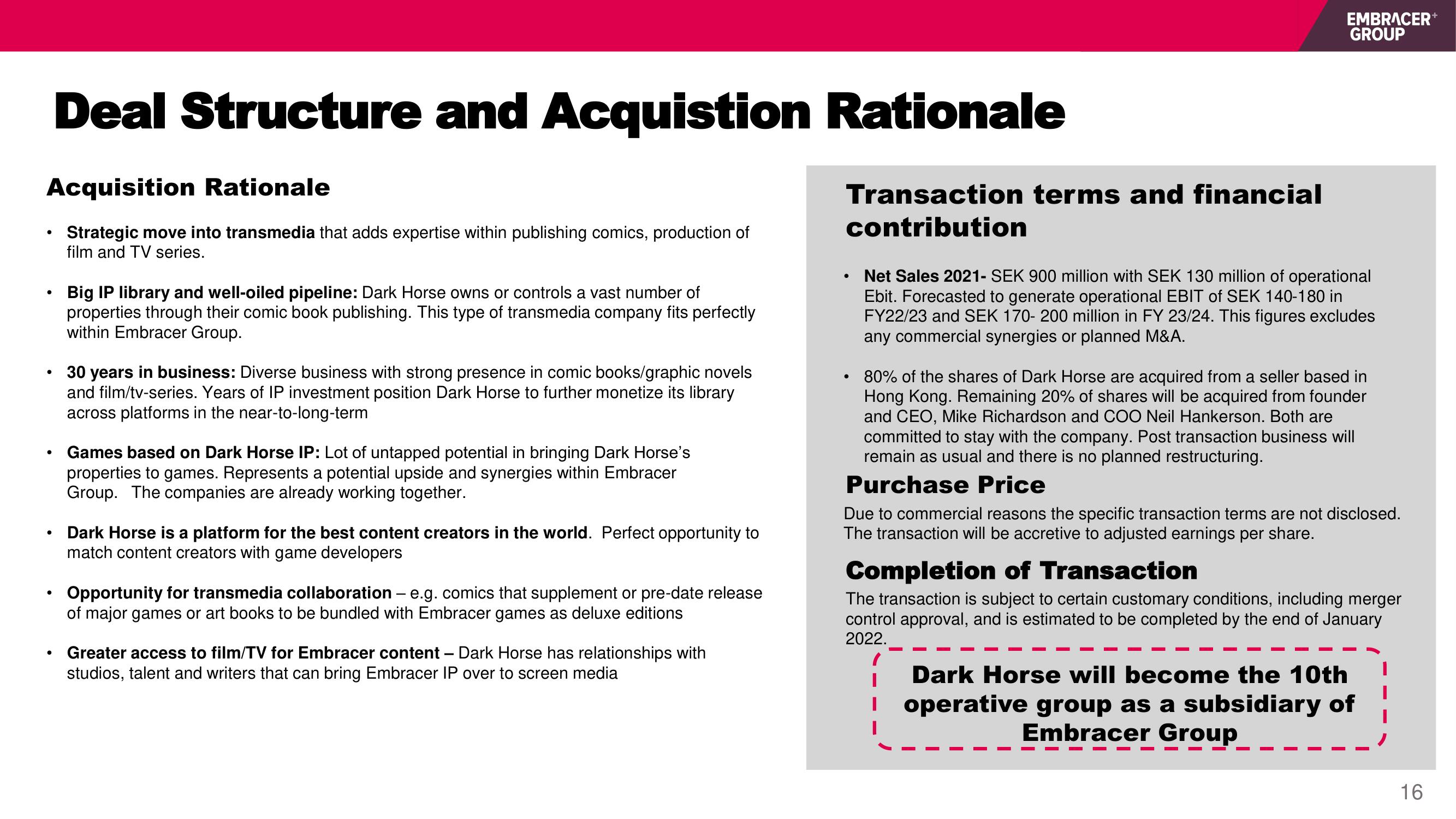

Acquisition Rationale

Strategic move into transmedia that adds expertise within publishing comics, production of

film and TV series.

●

●

●

Deal Structure and Acquistion Rationale

●

Big IP library and well-oiled pipeline: Dark Horse owns or controls a vast number of

properties through their comic book publishing. This type of transmedia company fits perfectly

within Embracer Group.

30 years in business: Diverse business with strong presence in comic books/graphic novels

and film/tv-series. Years of IP investment position Dark Horse to further monetize its library

across platforms in the near-to-long-term

Games based on Dark Horse IP: Lot of untapped potential in bringing Dark Horse's

properties to games. Represents a potential upside and synergies within Embracer

Group. The companies are already working together.

Dark Horse is a platform for the best content creators in the world. Perfect opportunity to

match content creators with game developers

Opportunity for transmedia collaboration - e.g. comics that supplement or pre-date release

of major games or art books to be bundled with Embracer games as deluxe editions

Greater access to film/TV for Embracer content - Dark Horse has relationships with

studios, talent and writers that can bring Embracer IP over to screen media

Transaction terms and financial

contribution

●

EMBRACER+

GROUP

●

Net Sales 2021- SEK 900 million with SEK 130 million of operational

Ebit. Forecasted to generate operational EBIT of SEK 140-180 in

FY22/23 and SEK 170- 200 million in FY 23/24. This figures excludes

any commercial synergies or planned M&A.

80% of the shares of Dark Horse are acquired from a seller based in

Hong Kong. Remaining 20% of shares will be acquired from founder

and CEO, Mike Richardson and COO Neil Hankerson. Both are

committed to stay with the company. Post transaction business will

remain as usual and there is no planned restructuring.

Purchase Price

Due to commercial reasons the specific transaction terms are not disclosed.

The transaction will be accretive to adjusted earnings per share.

Completion of Transaction

The transaction is subject to certain customary conditions, including merger

control approval, and is estimated to be completed by the end of January

2022.

Dark Horse will become the 10th

operative group as a subsidiary of

Embracer Group

16View entire presentation